PACP Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

“REPORT 1—VENTURE CAPITAL ACTION PLAN,” SPRING 2016 REPORTS OF THE AUDITOR GENERAL OF CANADAINTRODUCTION“Venture capital is a mechanism for financing new, innovative companies before and at the early stages of commercialization. A venture capital firm invests third-party funds in such companies in return for an equity share. When a company develops its ideas to the stage where its commercial potential is sufficiently proven, the venture capital firm is able to sell its equity in the company and then returns to third-party investors the funds received from them plus any profits.”[1] “For years, governments in Canada have been concerned about the lack of capital available for new and early-stage entrepreneurial ventures. Several governments have attempted a public response to what they perceived as a market failure: they have set up programs to channel funding to high-potential, young enterprises that are in need of capital.”[2] According to the Office of the Auditor General of Canada (OAG), the Business Development Bank of Canada (BDC) completed a review in 2010 in which it identified a number of issues faced by the national venture capital ecosystem beyond the simple lack of capital:

“[I]n Budget 2012, the Government of Canada announced $400 million to help increase private-sector investments in early-stage venture capital, and to support the creation of large-scale venture capital funds led by the private sector.”[4] After government-led consultations were held with various stakeholders, on 14 January 2013, the government announced that the Venture Capital Action Plan (VCAP) would make available:

At the same time, the government announced the following objectives for VCAP:

Table 1, below, provides a breakdown of the roles and responsibilities for VCAP among the Department of Finance Canada, Innovation, Science and Economic Development Canada (ISED), and BDC. Table 1 – Roles and Responsibilities for the Venture Capital Action Plan (VCAP), by Organization

Source: Table prepared by the Committee using information obtained from the Office of the Auditor General of Canada, “Report 1—Venture Capital Action Plan,” Spring 2016 Reports of the Auditor General of Canada, Ottawa, 2016, paragraphs 1.13, 1.14, and 1.15. In spring 2016, the OAG released a performance audit that examined whether the Department of Finance Canada, ISED, and BDC “properly assessed the policy need, and designed and implemented [VCAP] in order to meet its stated objectives.”[7] The OAG also examined whether the three organizations, “consistent with their roles and responsibilities, measured and monitored the performance of [VCAP] against the stated objectives and intended outcomes.”[8] On 29 September 2016, the House of Commons Standing Committee on Public Accounts (the Committee) held a hearing on this audit.[9] In attendance, from the OAG, were Michael Ferguson, Auditor General of Canada, and Richard Domingue, Principal.[10] The Department of Finance Canada was represented by Richard Botham, Assistant Deputy Minister, Economic Development and Corporate Finance Branch.[11] ISED was represented by Christopher Padfield, Director General, Small Business, Tourism and Marketplace Services.[12] Finally, Jérôme Nycz, Executive Vice President, BDC Capital, and Neal Hill, Vice President, Market Development, BDC Capital, appeared on behalf of BDC.[13] CREATION OF THE VENTURE CAPITAL ACTION PLANA. Analyzing the Market GapThe OAG examined whether the Department of Finance, ISED, and BDC “conducted sound analyses that led to a program designed to address Canadian venture capital market challenges in a manner complementary to existing venture capital programs.”[14] The OAG found that “BDC analyzed the venture capital funds that were raising capital by industry sector, geographic region of investments, and developmental stage of enterprises,” and “calculated the demand for venture capital over the following three years and the supply of money that was available.”[15] “This determined the size of the market gap and informed the decision to invest $400 million in venture capital at the time of Budget 2012.”[16] The OAG also found that, following consultations with stakeholders, “the government allowed flexibility in the investments that fund-of-funds managers could make” in order to meet the changing needs of the venture capital market.[17] The OAG made no recommendations in this area of examination.[18] Richard Botham, Assistant Deputy Minister, Economic Development and Corporate Finance Branch, Department of Finance Canada, provided the Committee with the following context for VCAP: In 2010 and 2011, McKinsey and Company, on behalf of the BDC, and the expert panel reviewing federal support to research and development, which was chaired by Mr. Tom Jenkins, examined the venture capital industry in Canada and found that there was a significant financing gap. It was largely attributable to key structural challenges facing the venture capital market, including a shortage of experienced managers, subscale fund sizes, and a lack of institutional investment in the asset class. These factors led to persistent low returns, decreased the attractiveness of this asset class, and subsequently limited firms' access to venture capital financing. The BDC also assessed the forecasted demand from Canadian fund managers looking to raise funds, as well as the forecasted supply of venture capital, and confirmed that there was a significant gap. While the BDC had been supporting the venture capital industry for some time, it was recognized that new approaches would be needed to address the structural challenges in the market.[19] Mr. Botham also explained that following an extensive consultation process, “consensus formed around some of the following overarching themes, which informed the design features” of VCAP: The new approach should be private sector-led and market-based, focused on demonstrating superior returns to investors. Although welcome, the funding announced in budget 2012 would be insufficient on its own to create a sustainable industry, and would need to lever significant resources from the private sector. Institutional investors left the venture capital asset class due to poor returns and the absence of large funds that fit their investment mandates, and they would likely only return if incented to do so in a different kind of structure. Venture capital in Canada was shifting away from early-stage investments towards later-stage companies where it was perceived that risk was lower. The funding in budget 2012 should be deployed to increase the number of private sector-led funding sources for venture capital funding managers. Investment should focus where Canada has existing strengths, such as information technology, life sciences, and clean technology. Finally, some funding should be deployed quickly into the market, given the immediate capital needs of innovative companies.[20] B. Attracting Private-Sector InvestorsThe OAG examined whether the Department of Finance, ISED, and BDC “properly implemented VCAP to attract and retain private‑sector capital.”[21] The OAG found “that in the early days of [VCAP], the government had encountered difficulties in convincing private-sector investors to participate as limited partners in the [funds-of-funds]. Among the reasons for the reluctance of the private sector to invest were the double layer of management fees payable in the case of [funds–of-funds], the historically low returns on venture capital investments, and international regulatory requirements.”[22] Regarding these difficulties, Richard Domigue, Principal, OAG, noted: [I]n the beginning, these people had a lot of work to do to convince private investors to join the project. As we indicated in the report, the fee structure and the tracking of performance, which was a hindrance for the entrepreneurs, were part of their concerns. Concerning achieving the full funding of these funds, we noted that for some of them, the funding period ended last March. So it was difficult to convince the businesses. The regulatory framework was also an issue. Under some Basel regulations, this type of asset was indeed not recognized in the calculation of admissible assets. Consequently, the financial sector, particularly the banks, were quite reluctant to join this initiative.[23] With respect to management fees, the OAG also noted that they “could amount to approximately $250 million of the total amount [$1.35 billion][24] committed to [funds-of-funds] over the expected 13-year lifetime of [VCAP].”[25] The OAG made no recommendations in this area of the examination.[26] When asked what percentage of the total capital committed will the management fees represent over the life of the program, Neal Hill, Vice President, Market Development, BDC Capital, BDC, responded: There are two levels of fees. The fund-to-funds managers collect approximately, on average, across the life of the program 0.56% of the committed capital that flows through their hands per year. That's the average across the life of the program for each of the fund-to-funds managers. Similarly, there is a second layer of fees. This is where the bulk of the fees actually go, the underlying Canadian venture capital funds, who are receiving the bulk of the financing, charge anywhere between a 2% and [2.5%] per year.[27] […] Over the life of the program, it is 19.6%—that's our calculation—of the total capital, and then the life of the program is 12 to 13 years, depending on how things turn out.[28] FUND MANAGER SELECTION PROCESSESThe OAG examined whether the Department of Finance Canada, ISED, and BDC adopted sound selection processes for funds-of-funds managers and high-performing fund managers.[29] Mr. Botham told the Committee that the selection processes “were designed to allow the government to leverage the knowledge, expertise, and capital of private- sector partners:” A private sector expert panel was named to lead a competitive selection process for the general partners to manage the [funds-of-funds], and for the general partners of the high-performing funds. The panel established the information requirements for applications, defined the selection criteria and evaluation methodology using industry benchmarks, and shortlisted candidates for in-person interviews prior to making final recommendations to the Minister of Finance. In the case of the selection process for the [funds-of-funds], recommended candidates made presentations to and were vetted by initial lead investors. Fund managers were selected by all lead investors, including governments.[30] The OAG found that the Department of Finance Canada, with the support of ISED and BDC, “met its short-term goals of establishing two large-scale national [funds-of-funds], recapitalizing two [funds-of-funds], and providing $50 million to four high-performing funds.”[31] However, the OAG found “some significant shortcomings in the selection process for fund managers.”[32] “For example, when the Department of Finance Canada posted the Call for Expressions of Interest, it indicated that it reserved the right to make changes to the selection process and to select any firm that it preferred. The government undertook limited outreach to advertise the Call for Expressions of Interest. The government also selected a candidate that did not initially submit an expression of interest.”[33] The OAG also “found that the weighting of the criteria changed during the review, affecting the ranking of applicants.”[34] The OAG believes that “these practices fell short of a sound process and were not in accordance with the government’s values of fairness, openness, and transparency.”[35] Mr. Ferguson told the Committee that the importance of these shortcomings should not solely be measured by their impact on VCAP : In the end, it looks like it perhaps has not caused a big problem, but it could have caused a problem. Whenever there's this type of an arrangement and you have in the expression of interest that you reserve the right to pick anybody, I think we identified that the scoring mechanism was changed. I think it wasn't even developed until after the bids were in, and then it was changed during the process. One of the companies that was picked wasn't even a company that had put in a bid in the first place. There was just a number of things that could have made somebody question whether the process was or was not fair. I think the warning here is less that there was necessarily a problem at the end of this one. I mean, they have companies in place. I think the warning is more that whenever a department decides that something is not a procurement process and therefore they can do some things that are outside a regular procurement process, it really raises the risk that at the end you could have people say, “Wait a minute, this process wasn't fair.”[36] In response to questions about the government’s rationale for indicating in its Call for Expressions of Interest that it reserved itself the right to make changes to the selection process and to select any firm that it preferred, Mr. Botham said: With the selection of the fund managers, the rationale for including that was twofold. This was a process that we were developing, in part, as we went. There were significant uncertainties with the reactions of investors. We were trying to make this a process that would meet a perception test in the market for the final outcome and who was selected, and that the fund managers would be seen to be credible. We wanted to build in flexibility for lead investors to have a role in the selection of the fund managers. If government alone selected fund managers, and then went out to private investors—pension funds, banks, corporations—and said, “Please commit $100 million to this fund manager that you have had no role in selecting or vetting”, then we would have had even more difficulty in raising funds than we did with the challenges we faced that have been highlighted. We did try to adhere to the normal standards of disclosure, openness, and transparency, which a standard government procurement would follow, knowing that this was not a standard government procurement. Governments were committing, in the end, a small proportion of the capital under management. For every $1 of government funding, the [private-sector] dollars were three times that. That was the reason for that.[37] The OAG recommended that when making investments that are similar to those of [VCAP], the Department of Finance Canada and ISED “should fully respect the values of fairness, openness, and transparency while meeting the purposes of the investment.”[38] The OAG believes that this would help “maintain the venture capital industry’s confidence in selection processes run by the Government of Canada.”[39] In response, the Department of Finance Canada and ISED agreed with the recommendation, and stated that VCAP “involved collaboration between private-sector and public-sector partners. In order to leverage the knowledge, expertise, and capital of private-sector partners, which are requirements for contributing to the success of [VCAP], selection processes were designed to balance the private-sector principles of confidentiality and flexibility in negotiations, with the public-sector principles of fairness, openness, and transparency for overall benefits of the public interest. Should the government decide to develop a new initiative that involves private-sector partnerships and formal selection processes to assist the government in making venture capital investments, as was the case under [VCAP], it will, in the context of the venture capital market at that time, design the selection processes to balance” these same principles.[40] The Committee is not satisfied with this response because the two departments agreed with the OAG’s recommendation about the shortcomings in the selection process for fund managers, but did not clearly explain how, should the government decide to develop an initiative that is similar to VCAP, they would design differently the selection processes to ensure that they fully respect the values of fairness, openness, and transparency while meeting the purposes of the investment. For this reason, the Committee recommends: Recommendation 1 That, by 31 May 2017, the Department of Finance Canada and Innovation, Science and Economic Development Canada clearly explain to the House of Commons Standing Committee on Public Accounts—should the Government of Canada decide to develop an initiative that is similar to the Venture Capital Action Plan—how they would design the selection processes differently to ensure that they fully respect the values of fairness, openness, and transparency while meeting the purposes of the investment. In their joint action plan, the two departments added that as “announced in Budget 2016, the Government is defining a new vision for Canada’s economy: to build Canada as a centre of global innovation. Through 2016 and 2017, the Government will define an Innovation Agenda to achieve this vision,”[41] an element of which includes “fostering capital markets that support commercialization and growth.”[42] PERFORMANCE MEASUREMENT AND REPORTINGA. Monitoring and Reporting on Venture Capital Action Plan ActivitiesThe OAG examined whether the Department of Finance Canada, ISED, and BDC, consistent with their roles and responsibilities, “measured and monitored the performance of VCAP against the stated objectives and intended outcomes.”[43] The OAG found that BDC “properly managed the monitoring and reporting of [VCAP] activities. [BDC] also effectively transmitted the information that it gathered to the Department of Finance Canada and [ISED],”[44] but the two departments “did not make public the information collected by BDC.”[45] The OAG also found that “the Performance Measurement Framework put in place by the two departments had a limited set of performance indicators and was not sufficient for assessing how [VCAP] fostered Canadian innovation and strengthened the economy.”[46] The OAG recommended that the Department of Finance Canada and ISED “expand [the VCAP’s] Performance Measurement Framework by considering the inclusion of performance metrics, such as” exit performance of recipient companies, recipient companies’ export growth and their financial performance, new patents and patent citations, and the number of new or additional key investment personnel and lead investors.[47] Furthermore, in order to increase transparency, “the two departments should report publicly relevant information about [VCAP] activities and performance.”[48] When asked to explain how the OAG developed its list of suggested additional performance metrics, Mr. Domingue said: [W]e looked at what other countries were doing. [Exhibit 1.4] refers to New Zealand, Finland and the United Kingdom. In their performance reports on their venture capital activities, they include this type of performance indicators. I would also like to add that the departments replied that when the data became available, they would include indicators such as expenditures on research and development and the number of jobs created. Patents are one of the key indicators of innovation, as mentioned in [E]xhibit 1.4. This idea of commercializing innovations is also an extremely relevant indicator to measure whether venture capital investments have led to technological innovations or not.[49] In response, the Department of Finance Canada and ISED said that, subject to the availability of robust data, “the government will update the Performance Measurement Framework to include additional metrics on exit performance, exports, financial performance, and key investment personnel. The framework will also cover innovation performance by including research and development spending and employment levels, as these are good indicators of innovation in venture capital-backed start-ups.”[50] In their joint action plan, the two departments added that ISED and BDC “will collaborate to publish, on an annual basis, aggregated performance information on the VCAP portfolio such as the amount committed, the amount called (i.e., paid into underlying companies), the amount distributed (i.e., paid back to investors in VCAP), and the fair value of the portfolio, respecting the confidentiality requirements in the agreements.”[51] “The first annual report will be published by 31 May 2017, covering the year 2016.”[52] Christopher Padfield, Director General, Small Business Branch, Small Business, Tourism and Marketplace Services, ISED, described this performance management framework in the following terms: The framework is really built around three key themes: how the VCAP is impacting the venture capital ecosystem; how it's supporting the underlying companies; and how it's building the next calibre of fund managers in Canada. We have a whole series of indicators. It's been complemented by some of the recommendations that the Auditor General made in his report really targeting down in terms of some of the performance of the actual underlying companies and those things. It gives you a bit of a flavour of how much follow-on investment we're seeing for funds after the VCAP and some of the performance of the actual firms within it.[53] […] I think the plan for us is that we want to make the performance measurement framework public, and then we're going to report out against it. We've identified some of the pieces in the action plan, and the goal is to take the data for this fiscal year and have them reported out in May of next year so people can do overall performance and some of the underlying indicators there too.[54] Mr. Botham drew the Committee’s attention to a news release published by ISED on 28 September 2016, which reported the following: Since the Government of Canada's launch of VCAP, the Government's initial investment of $390 million has been leveraged into a significant pool of venture capital. In particular, four funds-of-funds attracted over a billion in additional capital from a diverse set of investors that included pension funds, high-net-worth individuals, corporations, banks, and the governments of Ontario and Quebec. In total, the program has raised $1.356 billion in venture capital. The funds have been invested primarily in companies with early-stage innovations in sectors such as energy and clean technologies, information and communications technologies, and life sciences. To date, a total of 20 venture capital funds have benefited from the money raised through VCAP, translating into $453 million invested in 126 Canadian companies. Many more investments are expected in the coming years.[55] The Committee noted that this news release also included a document entitled Backgrounder: Venture Capital Action Plan Performance Metrics, which provides the following breakdown for the Government’s initial investment of $390 million:

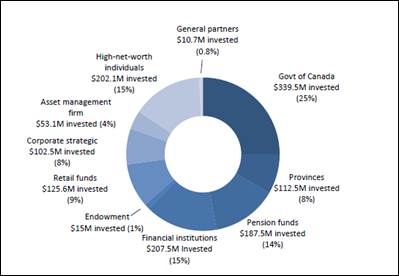

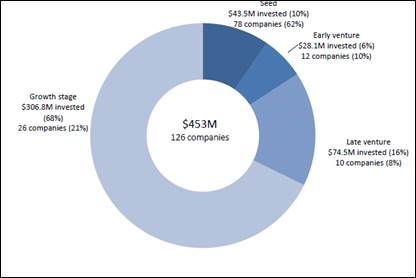

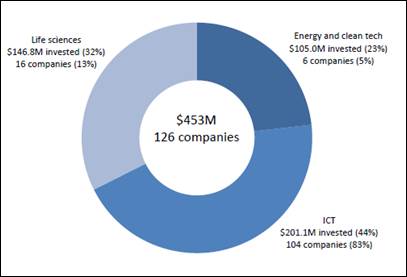

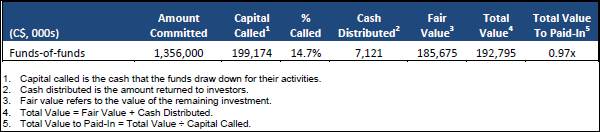

Moreover, this backgrounder provides various performance metrics, notably the type of investors participating in the VCAP funds-of-funds (see Figure 1), the primary stage focus (see Figure 2), and the primary sector focus (see Figure 3) as well as the performance of the VCAP funds-of-funds portfolio (see Table 2) and the performance of the VCAP high-performing funds Investment (see Table 3).[57] Figure 1 – Type of Investors Participating in the Four Funds-of-Funds of the Venture Capital Action Plan, as of 31 March 2016

Source: Innovation, Science and Economic Development Canada, Backgrounder: Venture Capital Action Plan Performance Metrics, 28 September 2016, p. 2. Figure 2 – Primary Stage Focus of Overall Venture Capital Action Plan Investments in Canadian Companies, as of 31 March 2016

Source: Innovation, Science and Economic Development Canada, Backgrounder: Venture Capital Action Plan Performance Metrics, 28 September 2016, p. 8. Figure 3 – Primary Sector Focus of Overall Venture Capital Action Plan Investments in Canadian Companies, as of 31 March 2016

Note: ICT refers to Information and Communications Technology. Source: Innovation, Science and Economic Development Canada, Backgrounder: Venture Capital Action Plan Performance Metrics, 28 September 2016, p. 9. When asked why most of the companies who received VCAP investments were from the Information and Communications Technology (ICT) sector, Jérôme Nycz, Executive Vice President of BDC Capital, BDC, said that in general, 70% of the venture capital industry’s investments are allocated in that sector.[58] As shown in Table 2, as of 31 March 2016, the VCAP funds-of-funds’ capital called—the cash that the funds draw down for their activities—represented 14.7% of the $1.356 billion committed.[59] Table 2 – Performance of the Venture Capital Action Plan Funds-of-Funds Portfolio, as of 31 March 2016

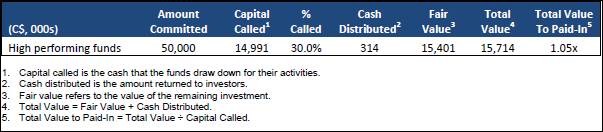

Source: Innovation, Science and Economic Development Canada, Backgrounder: Venture Capital Action Plan Performance Metrics, 28 September 2016, p. 5. As shown in Table 3, as of 31 March 2016, the VCAP high-performing funds’ capital called represented 30.0% of the $50.0 million committed.[60] Table 3 – Performance the Venture Capital Action Plan High-Performing Funds Investment, as of 31 March 2016

Source: Innovation, Science and Economic Development Canada, Backgrounder: Venture Capital Action Plan Performance Metrics, 28 September 2016, p. 6. When questioned about the reasons for which the government does not account for its borrowing cost when calculating the financial return of VCAP, Mr. Botham responded: [T]he Government of Canada does not track a dollar of debt that is raised against a specific dollar of expenditure. It is not possible to say x dollar in x program is related to x dollar of debt raised. That's a difficult impediment to get over, but that being said, clearly Canadians have an interest in the debt levels of their governments, and that is transparent. There are costs to carrying that debt, and there is no doubt about that.[61] When asked how better disclosure of VCAP’s performance could benefit the Canadian venture capital market, Mr. Ferguson said: [T]his is a program that's dealing with $400 million of federal investment into the program. There need to be ways of being able to determine whether the program is being successful. […] The problem with something like an investment in venture capital is that from a profitability point of view, you don't know whether it's going to be profitable until maybe 15 years from now. […] We talk about how much money the government, the provinces, and private sector have committed, and how much money has gotten into the hands of fund-of-funds managers, and how much into the hands of funds managers and again, there was a number about the amount of money that has been committed to companies. What's interesting is understanding how much money has actually gotten to the companies. What are they doing with it? What are the indicators that […] their ideas seem to be leading to commercialization and leading to something that is going to be profitable? I think it's trying to get down a little bit more into that level of detail which is the information that people really need to be able to understand that, okay, yes, this program seems to be on the road not just to creating that ecosystem of venture capitalists, but also creating successful companies.[62] When questioned about the delicate balance that needs to be reached between commercial confidentiality and greater transparency, Mr. Padfield responded: [W]e're going to start reporting on an annual basis in May. It really is the last [fund-of-funds]. It closed its fundraising not that long ago, so we're still very early days. Some of the metrics the guy went through in terms of our performance framework aren't going to be that meaningful because companies are only just beginning, and investments are going forward. We were looking at it for the period for when those performance metrics would make the most sense and look the most real. If you look at the release we made just yesterday, I've highlighted where some of the investments have gone to date. I'm not sure we have any kind of concern in terms of confidentiality. We know what pieces are covered under confidentiality agreements with the fund managers. Otherwise, we're making as much information available as possible, because again, we're happy to let everyone know the performance of the funds and the activities underneath.[63] Mr. Ferguson shared with the Committee his concerns about the little amount of information that has been provided to Parliament and the public on VCAP: I think our concern mostly is about what information you have as a parliamentarian. This is $400 million that the government has put into these [funds-of-funds]. As has been described, that $400 million is not an expense, so it did not affect the government's deficit one cent at the time it was made because it's considered to be an asset. So BDC has to track very carefully to make sure that the asset continues to be worth $400 million, and it tracks a lot of information. I get a bit concerned, as I said earlier, that a lot of what we keep hearing about is $1.35 billion committed and all of that. This is for you as parliamentarians to decide, but I don't think there's really a lot of information about how much of this money has actually gotten into the hands of the companies, and I think that information was part of the report released yesterday, how much has actually gotten into the hands of the companies. But we still don't really know, sort of, who those companies are. We don't really know what progress they're making. There's some categorization between whether they're a seed company or various different levels. What we were trying to point out is that it's not an issue of the information doesn't exist; in fact, the information does exist. It's more an issue of, okay it's $400 million that the federal government has put into this investment, and it's being monitored and it's being watched by BDC and the other departments, but is there a certain amount of information at the public level that you as parliamentarians should be receiving so that you understand exactly where this money is going and what it's being used for?[64] With regard to the information that BDC shared with VCAP investors, Mr. Nycz told the Committee: In terms of funds-of-funds investment funds, investors participate at the annual meeting of all investors in the funds. At those meetings, the fund goes through each one of their invested companies and reports progress against the original intention or their original strategy. BDC and other investors go through all of the companies under the fund portfolio and all of the fund performance under the VCAP. We get a full report on the progress of these companies.[65] When asked whether BDC shared this information will all private-sector investors, Mr. Nycz said: Exactly. Each investor in the [fund-of-funds], that [fund-of-funds] would invest in funds; if that investor is, for example, invested in Teralys investment funds, that investor would have a line of sight on all of the underlying portfolios.[66] When questioned about the reasons for which the government and the private-sector investors were getting more information on VCAP than Parliament and the public, Mr. Hill responded: We are reporting on the financial performance of the funds, and that will certainly be part of the annual report to the performance management framework that Innovation, Science and Economic Development is responsible for compiling and providing. I'm assuming that will get to Parliament as it gets to everyone else. Within that, though, the list of companies actually is a bit of a touchy matter because, if any of you have dealt with early-stage entrepreneurs, you know they are often very jealous of the quality and sensitivity of their idea. The investment funds that invest in these companies often have a confidentiality agreement with those companies that they cannot even disclose that they have invested in those companies.[67] […] There are some exceptions even for the [private-sector] investors. Anything the private investors get, we can get access to through the program, and we will provide that. I'm just saying that there are instances where the list of companies might not be complete because of a confidentiality situation.[68] In light of the testimony it heard and the documents it reviewed, the Committee recommends: Recommendation 2 That, by 31 May 2017, the Department of Finance Canada and Innovation, Science and Economic Development Canada provide the House of Commons Standing Committee on Public Accounts with a table clearly outlining the type of information, including all performance indicators, about the Venture Capital Action Plan that is available to the Government of Canada, the private-sector investors, and Parliament, respectively. This table should also provide the rationale for any differences and/or non-disclosure of information. Recommendation 3 That, by 31 May 2017, the Department of Finance Canada and Innovation, Science and Economic Development Canada provide the House of Commons Standing Committee on Public Accounts, and report publicly, a table that includes a breakdown of the investments by the primary, secondary and tertiary sectors of the economy (for example, natural resources extraction, manufacturing and services). B. Exit Strategy for the Public SectorThe “main objective of [VCAP] Plan is to create a self-sustaining, privately led venture capital ecosystem.”[69] However, the OAG found that this plan “does not provide for an exit of the public-sector partners during the lifetime of the funds.”[70] According to the OAG, “this could send a message that the public sector’s participation is intended to be permanent.”[71] For example, “[a]nother incentivized model, used in jurisdictions such as New Zealand and Israel, involves allowing (but not requiring) private-sector partners to purchase the government’s position after a certain time, at a price that would generate a predetermined rate of return to the government.”[72] The OAG recommended that in formulating future interventions such as VCAP, the Department of Finance Canada and ISED “should allow for an early exit of the public-sector partners.”[73] In response, the Department of Finance Canada and ISED stated that, should “the government pursue future venture capital interventions whereby government capital is treated differently than private-sector capital, similar to [VCAP], the government will consider a broad range of design parameters governing the participation of investors, which could include early-exit options. Parameters would be contemplated in the context of the maturity, sustainability, and nature of the venture capital market, and the objectives of the initiative.”[74] Mr. Domingue suggested that an exit strategy should be viewed as the ultimate performance indicator: When the government decides that the system is sustainable enough and the ecosystem is led by the private sector, and it's time for it to divest itself of the investment made by the taxpayers, that's the ultimate performance indicator. It's in that context that we suggest that next time, if there is ever a follow-up to this VC initiative, maybe you'd want to consider an exit strategy. The way the VCAP was designed did not allow for that, but next time, if there is a follow-up to more public funding in the VC world, maybe you'll want to consider that ultimate performance indicator, which is the exit strategy.[75] Regarding the absence of an exit strategy in VCAP, Mr. Botham explained: [T]he investment made into the [funds-of-funds] is not an ongoing investment. If there is a sense that there is an ongoing commitment that further funds are being made available, that is not the case. It is a single, one-time investment into funds, and for making that investment, there is a return. There isn't an option for the government capital to be withdrawn from the funds early. That is absolutely true. It was designed so that the investment would actually be deployed and that returns would be provided back to the government. So it's not ongoing forever; it is within the life of those funds.[76] CONCLUSIONIn this audit, the OAG concluded that the Department of Finance Canada, ISED, and BDC “assessed the policy need for [VCAP] prior to the Budget 2012 announcement and subsequently held extensive consultations with stakeholders to determine how to allocate the money. However, the selection of fund managers did not always adhere to sound practices because the process had important shortcomings with regard to fairness, openness, and transparency.”[77] The OAG also concluded that VCAP activities “were properly monitored. However, better performance indicators would help to measure the policy outcomes of the initiative and inform future policy decisions. Also, better public disclosure of [VCAP’s] performance could benefit the Canadian venture capital market. Finally, [VCAP] did not include an exit strategy to foster the transition to a self-sustaining, privately led ecosystem.”[78] In this report, the Committee made three recommendations which seek to ensure that the Department of Finance Canada and ISED, in collaboration with BDC, properly address the issues identified in the OAG’s audit. SUMMARY OF RECOMMENDED ACTIONS AND ASSOCIATED DEADLINESTable 4 – Summary of Recommended Actions and Associated Deadlines

[1] Office of the Auditor General of Canada (OAG), “Report 1—Venture Capital Action Plan,” Spring 2016 Reports of the Auditor General of Canada, Ottawa, 2016, paragraph 1.1. [2] Ibid., paragraph 1.6. [3] Ibid., paragraph 1.7. [4] Ibid., paragraph 1.9. [5] Ibid. [6] Ibid., paragraph 1.10. [7] Ibid., paragraph 1.16. [8] Ibid. [9] House of Commons Standing Committee on Public Accounts, Evidence, 1st Session, 42nd Parliament, 29 September 2016, Meeting 25. [10] Ibid. [11] Ibid. [12] Ibid. [13] Ibid. [14] OAG, “Report 1—Venture Capital Action Plan,” Spring 2016 Reports of the Auditor General of Canada, Ottawa, 2016, paragraph 1.37. [15] Ibid., paragraph 1.38. [16] Ibid. [17] Ibid., paragraph 1.44. [18] Ibid., paragraph 1.36. [19] House of Commons Standing Committee on Public Accounts, Evidence, 1st Session, 42nd Parliament, 29 September 2016, Meeting 25, 1540. [20] Ibid. [21] OAG, “Report 1—Venture Capital Action Plan,” Spring 2016 Reports of the Auditor General of Canada, Ottawa, 2016, paragraph 1.50. [22] Ibid., paragraph 1.45. [23] House of Commons Standing Committee on Public Accounts, Evidence, 1st Session, 42nd Parliament, 29 September 2016, Meeting 25, 1550. [24] OAG, “Report 1—Venture Capital Action Plan,” Spring 2016 Reports of the Auditor General of Canada, Ottawa, 2016, paragraph 1.21. [25] Ibid., paragraph 1.55. [26] Ibid., paragraph 1.49. [27] House of Commons Standing Committee on Public Accounts, Evidence, 1st Session, 42nd Parliament, 29 September 2016, Meeting 25, 1555. [28] Ibid., 1600. [29] Ibid., paragraph 1.66. [30] House of Commons Standing Committee on Public Accounts, Evidence, 1st Session, 42nd Parliament, 29 September 2016, Meeting 25, 1545. [31] OAG, “Report 1—Venture Capital Action Plan,” Spring 2016 Reports of the Auditor General of Canada, Ottawa, 2016, paragraph 1.60. [32] Ibid. [33] Ibid., paragraph 1.61. [34] Ibid., paragraph 1.74. [35] Ibid., paragraph 1.61. [36] House of Commons Standing Committee on Public Accounts, Evidence, 1st Session, 42nd Parliament, 29 September 2016, Meeting 25, 1650. [37] Ibid., 1610. [38] OAG, “Report 1—Venture Capital Action Plan,” Spring 2016 Reports of the Auditor General of Canada, Ottawa, 2016, paragraph 1.81. [39] Ibid. [40] Ibid. [41] Jointly Submitted Action Plan from the Business Development Bank of Canada (BDC), the Department of Finance and the Department of Industry, 3 May 2016, p. 1. [42] Ibid. [43] OAG, “Report 1—Venture Capital Action Plan,” Spring 2016 Reports of the Auditor General of Canada, Ottawa, 2016, paragraph 1.89. [44] Ibid., paragraph 1.82. [45] Ibid., paragraph 1.97. [46] Ibid., paragraph 1.82. [47] Ibid., paragraph 1.99. [48] Ibid. [49] House of Commons Standing Committee on Public Accounts, Evidence, 1st Session, 42nd Parliament, 29 September 2016, Meeting 25, 1620. [50] OAG, “Report 1—Venture Capital Action Plan,” Spring 2016 Reports of the Auditor General of Canada, Ottawa, 2016, paragraph 1.99 [51] Jointly Submitted Action Plan from the Business Development Bank of Canada (BDC), the Department of Finance and the Department of Industry, 3 May 2016, p. 2. [52] Ibid., pp. 1-2. [53] House of Commons Standing Committee on Public Accounts, Evidence, 1st Session, 42nd Parliament, 29 September 2016, Meeting 25, 1620. [54] Ibid., 1630. [55] Government of Canada, “Government Investments in Venture capital translate to more than $1.35 billion for Canadian companies.” News release, Ottawa, 28 September 2016. [56] Innovation, Science and Economic Development Canada, Backgrounder: Venture Capital Action Plan Performance Metrics, 28 September 2016, p. 1. [57] Ibid., pp. 2, 5, 6, 8 and 9. [58] House of Commons Standing Committee on Public Accounts, Evidence, 1st Session, 42nd Parliament, 29 September 2016, Meeting 25, 1710. [59] Innovation, Science and Economic Development Canada, Backgrounder: Venture Capital Action Plan Performance Metrics, 28 September 2016, p. 5. [60] Ibid., p. 6. [61] House of Commons Standing Committee on Public Accounts, Evidence, 1st Session, 42nd Parliament, 29 September 2016, Meeting 25, 1700. [62] Ibid., 1555. [63] Ibid., 1630. [64] Ibid., 1635. [65] Ibid. [66] Ibid. [67] Ibid., 1715. [68] Ibid., 1720. [69] OAG, “Report 1—Venture Capital Action Plan,” Spring 2016 Reports of the Auditor General of Canada, Ottawa, 2016, paragraph 1.100. [70] Ibid. [71] Ibid. [72] Ibid., paragraph 1.102. [73] Ibid., paragraph 1.103. [74] Ibid. [75] House of Commons Standing Committee on Public Accounts, Evidence, 1st Session, 42nd Parliament, 29 September 2016, Meeting 25, 1615. [76] Ibid. [77] OAG, “Report 1—Venture Capital Action Plan,” Spring 2016 Reports of the Auditor General of Canada, Ottawa, 2016, paragraph 1.104. [78] Ibid., paragraph 1.105. |