INDU Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

CHAPTER 4 -- CANADA'S CULTURAL SOVEREIGNTY DIMENSIONIn today’s world of technological convergence in the communications industry, the cultural dimension takes on an even larger importance in any discussions on foreign ownership rules. Technological and corporate convergence was by far the most frequently mentioned argument against the removal of foreign ownership rules at committee meetings. A. Foreign Ownership Restrictions for Telecommunications Common Carriers: Origin and Traditional Arguments in Favour of Maintaining Restrictions

An OECD representative pointed out that much has changed since the 1980s as most countries proceeded to liberalise ownership rules in their domestic market while maintaining their regulations on broadcasting content. According to the OECD, Canada now has the most severe restrictions amongst member-nations:[51] There are 30 OECD member countries, and only three countries have investment and ownership restrictions that apply to all public telecommunication operators. These countries are Canada, Mexico, and Korea. Of the three countries, Canada has the most severe restrictions. Some of the other OECD countries have restrictions in the sense that the state has to be a majority owner of the incumbent telecom carrier. For example, in Switzerland, the Swiss confederation must have majority ownership of Swisscom. France is required to have partial ownership of France Télécom, but not necessarily majority ownership. In the case of France, the state shares are down to about 23%. Canada is the most restrictive in terms of foreign investment in the telecom sector. The Friends of Canadian Broadcasting, the Writers Guild of Canada, and the Alliance of Canadian Cinema, Television and Radio Artists all indicated that any comparison with other OECD countries is flawed since none of these countries shares an official language and is immediately adjacent to the huge cultural and economic influence of the United States of America. The Canadian Conference of the Arts and the Society of Composers, Authors and Music Publishers of Canada also submitted an argument in favour of maintaining the status quo that is related to free trade agreements. They pointed out that the cultural exemption granted under the North American Free Trade Agreement (NAFTA) is valid only for the industries that existed at the time, which excludes the new media sector, such as web-based online media for example. They further suggested that opening up the telecommunications and broadcasting industries to foreign ownership could potentially expose the Government of Canada to a NAFTA Chapter 11 challenge by a foreign entity, if this entity feels that Canadian regulations put it at competitive disadvantage relative to a Canadian competitor. In their view, only the lack of foreign investment in the broadcasting sector has made the NAFTA question a non-issue up to now. B. Foreign Ownership Rules in the Era of Technological and Corporate ConvergenceParadoxically, the most often mentioned argument in favour of maintaining the status quo regarding foreign ownership restrictions - technological and corporate convergence- was not an issue when foreign ownership limitations for telecommunications common carriers were first announced in 1987. i) Background on Technological and Corporate ConvergenceChapter 3 explained in broad terms the concept of technological and

corporate convergence. Technological convergence refers to the fact that a

given hardware infrastructure can now be used to provide highly differentiated

services. For example, phone companies using traditional wireline connections

to provide Internet and television services (e.g., Internet protocol

television) and cable companies using cable connection to offer digital phone

services. Corporate convergence could refer to two things: “natural” corporate

convergence that results directly from technological convergence, or

“expansionary” convergence which is akin to more traditional vertical or

horizontal integration. Technological and corporate convergence have

dramatically changed the competitive landscape in the telecommunications and

broadcasting industries. Figure 3 presents some of the current “converged”

Canadian players and the typical competitive landscape they were in before the

advent of mobile phones and the Internet. Figure 4 presents today’s competitive

landscape. It would not be an exaggeration, even more so as a result of the

latest spectrum auction and latest corporate acquisitions (Shaw acquiring

Canwest, Cogeco acquiring Corus’ radio stations in Quebec), to say that

everyone is now going after everyone else’s market. Legislation does not reflect today’s converged environment as three separate statutes still govern the communications and information industries: the Radiocommunication Act, the Telecommunications Act and the Broadcasting Act. To take a concrete example, both Bell home phone and Bell Mobility are regulated under the Telecommunications Act, while Bell satellite television services (a BDU) are regulated under the Broadcasting Act. The CRTC suggested at the Committee hearings that legislators should contemplate merging the three acts. Some market players, such as Rogers and Shaw, showed little interest for such change. Figure 3—Competitive Landscape before the Advent of

Wireless Phones and the

Note: The period before the advent of mobile phones and the Internet should be interpreted here as the period ending in approximately the mid-1980s. Some of the companies shown on the diagram did not exist at the time under the name shown, but today’s names were used to allow direct comparisons between figures 3 and 4. (For example, Telus is the result of a number of mergers, so Telus on this figure should be interpreted as Telus “ancestor” companies. Similarly, Quebecor did not own Videotron at the time). Source: Parliamentary Information and Research Service, Library of Parliament. Figure 4—Competition Landscape in the Era of Convergence

Source: Parliamentary Information and Research Service, Library of Parliament. ii) The Domino Effect of Removing Foreign Ownership Restrictions on Canadian Culture

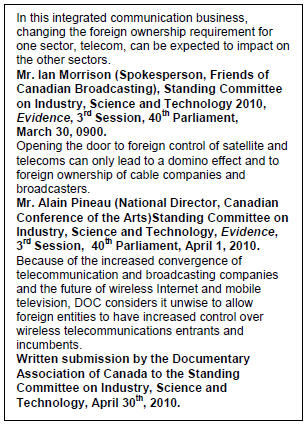

Opponents of the elimination of foreign ownership restrictions have used the above factor to say that, irremediably, removal of restrictions for telecommunications common carriers would eventually impact broadcasting content through a “domino effect.” If foreign ownership restrictions were to be removed only for telecommunications common carriers, converged players would considered this as unfair and would start applying tremendous pressure so that the removal of restrictions applies to BDUs as well. If the federal government were to allow any changes to apply to BDUs as well, then converged players involved in programming (i.e., dealing with content) could argue that changes are unfair to them and could apply pressure for the removal of foreign ownership restrictions for programming undertakings as well. Hence, a domino effect that would open the door to foreign ownership in broadcasting, and, according to some witnesses, would affect Canada’s cultural sovereignty. It should be noted that the claim from the artistic community and communications workers has been partially proven right in the sense that some converged players (e.g., Telus, Rogers, Shaw, MTS Allstream and Bell) have vigorously argued that changes to ownership rules should also apply to BDUs. This being said, no witnesses recommended the removal of foreign ownership restriction for Canadian programming undertakings. The above mentioned integrated players have indicated that it is possible to build a firewall from a legislative and regulatory standpoint between ownership of carriage (sometimes referred to as the “pipes” or “pipeline”) and content. This comment was also echoed by Dimitri Ypsilanti from the OECD. Conversely, Solange Drouin of l’Association québécoise de l’industrie du disque, du spectacle et de la vidéo, argued that the act of creation must not be dissociated from distribution. In order to promote creation, control of distribution is key. In her view, the fact that the federal government was able to exercise control over Canadian businesses was paramount in imposing Canadian content regulations. Furthermore, Astral Communications, which is involved in broadcasting only, has indicated that unless some safeguard measures are taken, such as forcing BDUs to completely divest from the broadcasting content sector, any “firewall” scenario between broadcasting distribution and broadcasting content is implausible[52]: Proposals for ownership liberalization over carriage, i.e., telecom and BDUs, must absolutely take into account the key role that BDUs have traditionally played in meeting the social and cultural objectives under the Broadcasting Act. Unlike a pure common carrier, a BDU does play an active and key role in influencing the content it offers consumers. BDUs are not just pipes; BDUs make programming decisions every day. They control and decide which programming services consumers will have access to. They make critical decisions about which services to market, promote, and offer, and how much they pay to these programming services and how much they charge consumers. This BDU influence over programming services may increase, given the recent CRTC decision regarding the value for signal of conventional television stations. Therefore, any liberalization of BDU ownership restrictions could easily result in an unacceptable level of influence by non-Canadians over the television broadcasting system. This could occur even if the ownership rules for programming services remain unchanged. Hence, the domino effect scenario presented by proponents of the status quo is one where the removal of foreign ownership restrictions in telecommunications would ultimately affect broadcasting content, and, in turn, Canada’s cultural sovereignty. For example, a foreign-owned BDU might aggressively promote foreign programming at the expense of Canadian programming, but still technically respect CRTC rules with respect to Canadian content. [51] Dimitri Ypsilanti (Head, Information, Communications and Consumer Policy Division, Directorate on Science, Technology and Industry (Paris), Organisation for Economic Co-operation and Development), Standing Committee on Industry, Science and Technology 2010, Evidence, 3rd Session, 40th Parliament, April 13, 2010, 0900. [52] Mr. André Bureau (Chairman of the Board, Astral Media Inc.), Standing Committee on Industry, Science and Technology 2010, Evidence, 3rd Session, 40th Parliament, April 13, 2010, 0900. |

As

related to the Committee by Industry Canada officials, Canada’s foreign

ownership restrictions in telecommunications were implemented relatively

recently. The policy framework was first announced in 1987 and formally enacted

in 1993. Importantly, a catalyst for the implementation of these restrictions

was the free trade negotiations with the United States. Canadian legislators at

the time wanted to mirror the prevailing restrictions in the United States and

make sure that they could be grandfathered under a free trade agreement. Also

mentioned at the time to justify restrictions on foreign ownership were

national sovereignty and security reasons, as well as economic, social and

cultural well-being. These reasons were mentioned to the Committee as still

being valid justifications to maintain foreign ownership restrictions. In

particular, witnesses opposing the removal of foreign ownership restrictions

stressed the geo-strategic nature of telecommunications infrastructure and

noted that surrendering control of telecommunications companies to foreign

shareholders would pose a national security issue.

As

related to the Committee by Industry Canada officials, Canada’s foreign

ownership restrictions in telecommunications were implemented relatively

recently. The policy framework was first announced in 1987 and formally enacted

in 1993. Importantly, a catalyst for the implementation of these restrictions

was the free trade negotiations with the United States. Canadian legislators at

the time wanted to mirror the prevailing restrictions in the United States and

make sure that they could be grandfathered under a free trade agreement. Also

mentioned at the time to justify restrictions on foreign ownership were

national sovereignty and security reasons, as well as economic, social and

cultural well-being. These reasons were mentioned to the Committee as still

being valid justifications to maintain foreign ownership restrictions. In

particular, witnesses opposing the removal of foreign ownership restrictions

stressed the geo-strategic nature of telecommunications infrastructure and

noted that surrendering control of telecommunications companies to foreign

shareholders would pose a national security issue.

Since

all three acts contain similar -but not completely identical- provisions

regarding foreign ownership restrictions, the current situation is not

considered by integrated players to be unfair. From the point of view of

integrated players, the fairness issue arises, as discussed in Chapter 3, when

a change is contemplated in one market segment and not in the other. This could

force converged companies to go through costly restructuring in order to be at

par with pure-play companies in terms of access to foreign capital, and in the

process, impact their capacity to “bundle” services and offer package deals to

consumers.

Since

all three acts contain similar -but not completely identical- provisions

regarding foreign ownership restrictions, the current situation is not

considered by integrated players to be unfair. From the point of view of

integrated players, the fairness issue arises, as discussed in Chapter 3, when

a change is contemplated in one market segment and not in the other. This could

force converged companies to go through costly restructuring in order to be at

par with pure-play companies in terms of access to foreign capital, and in the

process, impact their capacity to “bundle” services and offer package deals to

consumers.