HUMA Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

TAKING ACTION: IMPROVING THE LIVES OF CANADIANS LIVING WITH EPISODIC DISABILITIES

Introduction

Episodic disabilities[1] are the result of medical conditions or diseases that are prolonged and often lifelong but have unpredictable episodes of illness and disability. These episodes of disability can vary in severity and duration and are often followed by periods of wellness. Examples of conditions and diseases that are episodically disabling are arthritis, Crohn’s and colitis, HIV/AIDS, mental illness, multiple sclerosis (MS), as well as some forms of cancer and rare diseases.[2]

All too often, these conditions have a negative impact on workforce participation and income security. However, there is an increasing body of research that suggests that many negative impacts are avoidable or can be mitigated through changes to public policy and workplace accommodations.[3]

Private members’ motion M-192 asked the Standing Committee on Human Resources, Skills and Social Development and the Status of Persons with Disabilities (the Committee) to provide recommendations for legislative and policy changes necessary to ensure that the needs of people with episodic disabilities caused, among other things, by MS, be adequately protected to ensure equity in government policy to support Canadians across all types of disability. It asks that the Committee report its findings to the House by 16 May 2019.

The Committee held three meetings, hearing from a total of 19 witnesses, and received four briefs. Witnesses included departmental officials, expert researchers, representatives of national non-government organizations and individuals with lived experience of episodic disabilities.

Overview

Statistical overview

The concept of disability has evolved significantly. Thirty years ago, when Statistics Canada started to collect data on disability, the concept of disability was grounded in the medical model. The medical model understands disability narrowly as a function of physical and sensory impairments as well as the health conditions of individuals. Early surveys collected information to identify and measure the prevalence of disability in the general population.

Since that time, there has been a profound paradigm shift, which is best described by the United Nations Convention on the Rights of Persons with Disabilities (UNCRPD).[4] The UNCRPD does not define disability solely according to an underlying medical condition or impairment. It also focuses upon the environment and how it contributes to people with disabilities being excluded from fully participating in society. Persons with disabilities include those who have long-term physical, mental, intellectual or sensory impairments which in interaction with various barriers may hinder their full and effective participation in society on an equal basis with others.[5] While physical, mental, intellectual or sensory impairments are important, it is the interaction between these impairments and the environment that is the crux of what has become known as the social model of disability.

Thus, emerging as a counterpoint to the dominant medical model, the social model identifies systemic barriers, negative attitudes and exclusion by society (whether intentional or inadvertent). The social model has expanded how disability is understood and acknowledges that barriers posed by the environment need to be addressed to give everyone an equal chance to participate more fully in society.[6]

The recent release of data from the Canada Survey on Disability (CSD) employs updated methodology firmly grounded in the social model of disability.[7] The results of the CSD serve as a benchmark against which to measure future progress. The survey employs for the first time a dedicated module that captures data on episodic disability in the working age population.[8] The recently released data provide a high‑level overview of three distinct groups or categories:

- Periodic: Person has at least one month or more without experiencing a limitation in daily activities. These people are “more likely” to have an episodic disability.

- Not Periodic: Person never goes one month without experiencing a limitation. These people are “less likely” to have an episodic disability.

- Not Periodic but does fluctuate: Person never goes one month without experiencing a limitation but it can go up and down (e.g., good days and bad days). These people are in the grey area but are “more likely” to be episodic because of the fluctuation.

While previously there was an inclination to view episodic disabilities as binary (episodic or not episodic), the new data release underscores that disability is often complex and multidimensional, varying in terms of the length of time between episodes of limitations as well as how these limitations progress over time (i.e., same, worsening, improving).

In 2017, over 3.7 million individuals between the ages of 25 and 64 reported that they had a disability. Of this group, over 1.6 million reported that their experience of disability was either periodic or fluctuating (i.e. episodic). More broadly, women represented over 55% of the working age population with disabilities. This gender difference is even greater among the sub‑population who reported periodic or fluctuating experiences of disability: of these, more than 58% were women.[9]

Figure 1 illustrates the employment rates of men and women according to their experience of disability. The employment rates for men and women with no disability are significantly higher than for persons with disabilities. Employment rates for those who experience disability as periodic or fluctuating fall in between. They are higher than those who report continuous experiences of disability but are lower than the population that reports no disability.

Figure 1—Employment Rates by Experience of Disability and Sex (age 25-64)

Source: Figure prepared by authors using data from Statistics Canada, Canadian Survey on Disability, 2017. Custom Tables.

Perhaps just as important is the data on persons with disabilities who are either unemployed or not in the labour force who report that they have work potential.[10] Figure 2 illustrates that over 55 % of men and 50 % of women who report periodic disability, and are not working, have the potential to be. This is significantly different from the work potential (36.6% of men, 31% of women) of those who report that their experience of disability is continuous or not periodic. This translates into approximately 350,000 people across Canada who are presently not employed and who want to work, but are marginalized often because of inadequate workplace accommodations.[11]

Figure 2—Work Potential of Persons with Disabilities: Periodic, Fluctuating and Not Periodic

Source: Figure prepared by authors using data from the Statistics Canada, Canadian Survey on Disability, 2017. Custom Tables.

Programs and services supporting people with episodic disabilities

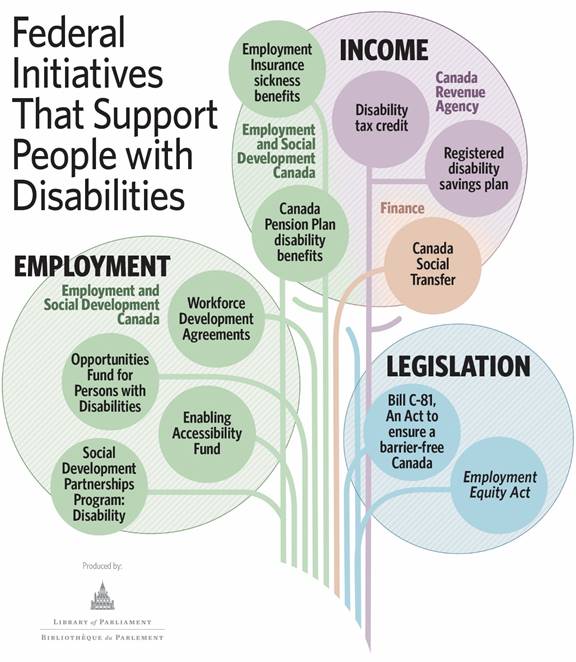

Employment and Social Development Canada (ESDC) is the main federal department responsible for disability programs. Many of these programs and activities assist persons with disabilities in securing income and in obtaining and maintaining employment.

Additional supports for persons with disabilities are offered through the income taxation system, with credits and/or deductions available to some persons with disabilities; Finance Canada is responsible for the policy underlying such benefits, and responsibility for their administration rests with the Canada Revenue Agency (CRA).

Figure 3 provides a snapshot of federal initiatives identified during the course of the study. Witnesses specifically proposed changes that could be made to Employment Insurance (EI) sickness benefits, the Disability tax credit (DTC), Canada Pension Plan (CPP) disability benefits and the Registered disability savings plan (RDSP) that will be explained in greater detail below.[12] Witnesses were also supportive of Bill C-81 an Act to ensure a barrier-free Canada that was adopted by the House of Commons and received first reading in the Senate on 29 November 2018.[13] Moreover, Appendix B provides detailed descriptions of all the initiatives contained in this snapshot.

Figure 3

Employment Insurance Program

The EI sickness program offers temporary sickness benefits to people unable to work because of sickness, injury, or quarantine. At present the maximum benefit is 15 weeks at 55% of insurable earnings. A person is normally entitled to receive EI sickness benefits if they have accumulated at least 600 hours of insurable employment during the qualifying period (normally the last 52 weeks)[14] and if weekly earnings have been reduced by more than 40% because of sickness, injury, or quarantine. A medical certificate signed by a doctor or approved medical practitioner is also required.

Working While on Claim is an initiative under the EI program that allows claimants to receive part of their EI benefits and all earnings from a job. It was originally introduced for those on regular benefits to encourage them to take up part-time or temporary work until a full-time job is found. In this way, the worker is more likely to remain attached to the labour force and is able to earn some extra income. Recent legislative changes amended the EI Act so that Working While on Claim is now a permanent fixture of the EI program and those receiving sickness and maternity benefits are eligible to participate.[15]

Canada Pension Plan Disability Benefits

The CPP disability benefits offer income protection for CPP contributors who are unable to work because of a severe and prolonged mental or physical disability. Table 1 describes CPP disability beneficiaries by diagnosis for the last three years. The most common diagnosis of CPP disability beneficiaries is mental disorder followed by disabilities related to musculoskeletal and connective tissue disorders.[16]

Recent reforms have allowed beneficiaries to have up to $5,200 in earnings each year (pre-tax) without potentially affecting the benefit. Active job supports and rapid reinstatement provisions are also available for those who try to return to work.

Table 1—Canada Pension Plan Disability Benefits by Class of Diagnosis

Principal Diagnosis |

2016 |

2017 |

2018 |

Infectious and Parasitic Diseases |

3,637 |

3,838 |

4,031 |

Neoplasms |

22,840 |

22,727 |

22,230 |

Endocrine, Nutritional and Metabolic Diseases, and Immunity Disorders |

8,880 |

9,073 |

9,073 |

Diseases of the Blood and Blood-Forming Organs |

569 |

579 |

578 |

Mental Disorders |

107,126 |

105,456 |

104,032 |

Diseases of the Nervous System and Sense Organs |

39,994 |

40,177 |

40,028 |

Diseases of the Circulatory System |

23,174 |

23,767 |

23,882 |

Diseases of the Respiratory System |

5,663 |

5,714 |

5,721 |

Diseases of the Digestive System |

7,672 |

7,600 |

7,525 |

Diseases of the Genitourinary System |

4,989 |

4,800 |

4,719 |

Complications of Pregnancy, Childbirth and Puerperium |

212 |

186 |

168 |

Diseases of the Skin and Subcutaneous Tissue |

1,917 |

1,896 |

1,854 |

Diseases of the Musculoskeletal System and Connective Tissue |

76,792 |

76,642 |

76,263 |

Congenital Anomalies |

2,388 |

2,370 |

2,363 |

Certain Conditions Originating in the Perinatal Period |

358 |

337 |

328 |

Symptoms, Signs and Ill-Defined Conditions |

10,429 |

10,348 |

10,312 |

Injury and Poisoning |

20,513 |

20,739 |

20,910 |

Unknown diagnosis |

171 |

200 |

220 |

Total |

337,324 |

336,449 |

334,237 |

Source: Table prepared by authors using data from: Canada Pension Plan (CPP) Disability Benefits by Class of Diagnosis, Open Government, Data accessed 12 February 2019.

Disability Tax Credit

The DTC is a non-refundable tax credit that helps persons with disabilities or their supporting persons reduce the amount of income tax they may have to pay. An individual may claim the disability amount after the CRA certifies their application for the credit. The purpose of the DTC is to provide for greater tax equity by allowing some relief for disability costs, since these are unavoidable additional expenses that other taxpayers do not have to face.[17]

To be eligible for the DTC, an individual must have a severe and prolonged impairment as defined in the Income Tax Act and as certified by a medical practitioner.[18] The effects of the impairment must be such that an individual is markedly restricted in performing basic activities of daily living all or substantially all of the time. Thus, eligibility is based not only on a medical diagnosis but also on the effects of the impairment on one’s ability to perform basic activities.

The DTC is one of the principal federal supports for individuals in Canada with severe and prolonged impairments. In addition, eligibility for the DTC provides a gateway to accessing other important benefits such as the Child Disability Benefit and the Canada Disability Savings Program. Table 1 displays the available data on DTC application approval rates by activity limitation. In 2016-2017 the approval rate for new applications was 89%.

Table 2—Disability Tax Credit Approval Rates (by fiscal year)

Basic Activities of Daily Living |

New Application Approval Rate 2014-2015 |

New Application Approval Rate 2015-2016 |

New Application Approval Rate 2016-2017 |

Vision |

89.1% |

88.1% |

85.1% |

Walking |

93.8% |

95.0% |

92.9% |

Speaking |

95.5% |

94.7% |

91.4% |

Mental Functions |

88.2% |

87.7% |

81.4% |

Hearing |

89.3% |

88.1% |

82.7% |

Feeding |

96.2% |

96.4% |

93.9% |

Dressing |

96.3% |

96.5% |

94.6% |

Eliminating |

94.8% |

95.0% |

91.6% |

Life-sustaining therapy |

89.0% |

89.0% |

86.6% |

Cumulative |

91.6% |

91.3% |

89.3% |

Average Approval Rate |

92.3% |

92.4% |

88.7% |

Source: Table prepared by the authors using data obtained from the Canada Revenue Agency, 2018 Disability Tax Credit at a glance, last updated March 2018.[19]

Canada Disability Savings Program

The Canada Disability Savings Program comprises the Registered Disability Savings Plan or RDSP, the Canada Disability Savings Grant and the Canada Disability Savings Bond. The Canada Disability Savings Program enables people with severe disabilities and their families to save for the future. In turn, this helps to provide some long-term financial security of persons with disabilities. Under an RDSP, a beneficiary of the plan may be eligible for the Canada Disability Savings Grant and the Disability Savings Bond, both of which are based on federal government contributions to the tax-free savings. Unlike the RDSP, where contributions are made after tax has been paid on the income, the grant and bond are both taxable when the beneficiary makes withdrawals. The eligibility requirements for an RDSP include Canadian residency, a valid Social Insurance Number and eligibility to claim the DTC.[20] Of those eligible for the DTC fewer than one third have a RDSP.[21]

Bill C-81, An Act to ensure a barrier-free Canada

Greater accessibility of federally regulated businesses and government services could potentially positively impact employment opportunities for persons with disabilities.

On 20 June 2018, the government tabled Bill C‑81, An act to ensure a barrier-free Canada. If enacted, Bill C‑81 would establish a general framework for identifying, removing and preventing barriers in areas under federal jurisdiction (such as employment; the built environment; information and communication technologies; the procurement of goods, services and facilities; the design and delivery of programs and services; and transportation). Greater accessibility of federally regulated businesses and government services could potentially positively impact employment opportunities for persons with disabilities. The proposed legislation also contains a definition of disability that includes the concept of episodic.

[D]isability means any impairment, including a physical, mental, intellectual, cognitive, learning, communication or sensory impairment — or a functional limitation — whether permanent, temporary or episodic in nature, or evident or not, that, in interaction with a barrier, hinders a person’s full and equal participation in society. (Emphasis added)

Bill C-81, An Act to ensure a barrier-free Canada

This bill was adopted by the House of Commons and received first reading in the Senate on 29 November 2018.

What the committee learned

Witnesses told the Committee that there is great variation across episodic disabilities and within each one as well. Tammy Yates, of the organization Realize, suggested that episodic disabilities take one of three forms:

Episodic stable conditions are characterized by periods of relative wellness, interspersed with unpredictable and fluctuating periods, like severe migraines and HIV—now that HIV is a chronic condition. Episodic degenerating conditions are similar to episodic stable conditions early on, but over time are progressive in their decline, such as Parkinson's or even, unfortunately, MS at times. Episodic remissive conditions may start as episodic stable, but in some instances the person may have a full recovery or remission, as in some forms of cancer or mental health illnesses.[22]

Witnesses who have been diagnosed with MS explained that various forms of the disease carry different prognoses and expected levels, frequency and duration of impairments. Thus, an individual with MS may maintain full mobility and capacity for an unpredictable amount of time, may experience symptoms of varying severity and duration at varying frequencies, and may or may not recover from the symptoms.

Similarly, a representative of Epilepsy Ontario explained that seizures associated with epilepsy are unpredictable and generally brief, but frequency and recovery time may limit an individual’s capacity to work on a full-time basis.

[P]eople with episodic disabilities want to remain productive and active participants in the labour market and people with episodic disabilities need more flexible income supports to avoid income insecurity.

Two main themes were identified by witnesses over the course of the Committee’s three meetings and in briefs submitted to the Committee: people with episodic disabilities want to remain productive and active participants in the labour market and people with episodic disabilities need more flexible income supports to avoid income insecurity.[23] Connecting these themes was an overarching sense that the understanding of disability embedded in the federal government’s programs, policies, services and lawsnamely of a severe and prolonged condition—needs to be expanded to include episodic experiences.[24] At the time of her diagnosis, one witness told the Committee, she researched possible financial supports in the event she became unable to work: “What I learned then, which is still relevant today, is that the current disability income and employment support programs in Canada were not designed with episodic disability in mind.”[25] These themes are addressed in greater detail in the next sections of this report.

People with episodic disabilities want to work

“What I learned then, which is still relevant today, is that the current disability income and employment support programs in Canada were not designed with episodic disability in mind.”

Julie Kelndorfer

Witnesses described two primary challenges with remaining employed when an episodic disability may force intermittent absences of varying lengths of time. First, they told the Committee, employers are often not informed about the nature of episodic disabilities and how they can support employees with such conditions to stay employed and productive. Second, accessing employment-related programs is at least challenging and sometimes impossible for people with episodic disabilities. These challenges can significantly affect mental health. One witness explained the impact of being denied employment opportunities for which one is otherwise qualified because of an unpredictable disease with unpredictable impairments:

It is detrimental to anyone’s quality of life and mental health to want to be productive and contribute to society, to want to use their skills, education and talents, but not be allowed to do so — not because of anything they did, not because of anything they can control, but because there is a chance that they might be temporarily disabled for a short period of time.[26]

At the same time, stresses about the unpredictability of the disability, future labour force participation and possible challenges associated with qualifying for income support programs can exacerbate the effects of the disability.[27]

Employers have an important role

Many employees and those seeking employment are reluctant to divulge their condition for fear of both stigma and loss of employment security.

Witnesses told the Committee of the valuable role a supportive employer can play in assisting people with episodic disabilities to maintain their employment and earnings.[28] Their supports, however, must be sufficiently flexible to meet the varying needs of employees with episodic disabilities.[29]

However, witnesses also advised the Committee that few employers are informed about episodic disabilities, partly because of stigma related to disability, particularly for those with mental health challenges.[30] As a result, many employees and those seeking employment are reluctant to divulge their condition for fear of both stigma and loss of employment security.[31]

Information for employers about episodic disabilities was identified as an important step to gaining their support for current or potential employees with episodic disabilities.[32] While non-government organizations play that role when their capacity and resources allow, such outreach is often on an individual and as-needed basis rather than more systemically.[33]

The Committee also heard that those with episodic disabilities may require more leave time than other employees, which may in turn trigger absenteeism and related disciplinary issues with employers.[34]

Accessible employment-related programs are needed

“[M]y biggest fear is not that I will lose the ability to walk or see. What I fear most is that I will not have the ability to continue to work and contribute financially to my own welfare.”

Shauna MacKinnon

Many witnesses identified inflexibilities in current support programs that create barriers for people with episodic disabilities: they are based on the assumption that one can either work or cannot work. Although full-time, ongoing employment may not be possible for many with episodic disabilities, as described by witnesses, the desire to remain employed with an earned income is a very high priority for most. One witness said:

Where the alternative is the added anxiety of not necessarily being able to stay in the job, which exacerbates a neurological condition like epilepsy or like MS to the point where they can't work, I think the positive alternative is, in any scenario, people being able to work. That is the best solution.[35]

Yet, as the proponent of this study, Member of Parliament David Yurdiga, told the Committee, “In Canada, support for persons with disabilities is built on a binary switch, either you can work or you cannot. However, life with episodic disabilities is not that black and white. Special requirements must be considered for people with episodic disabilities.”[36]

Income supports for people with episodic disabilities

Witnesses with lived experience of episodic disability all described the uncertainty of their futures. Most, like Shauna MacKinnon, told the Committee that their biggest fear was not a future with impairment, but rather, a future without an adequate income: “[M]y biggest fear is not that I will lose the ability to walk or see. What I fear most is that I will not have the ability to continue to work and contribute financially to my own welfare.”[37]

Employment Insurance sickness benefits

Testimony before the Committee identified characteristics of EI sickness benefits that can leave people with episodic disabilities without adequate protection. As Professor Michael Prince told committee members, the 15-week entitlement period has been unchanged since 1971, making it “one of the shortest periods of sickness protection among industrialized countries.”[38]

For those who do qualify for sickness benefits, the design of the program, until the recent reform to Working While on Claim, discouraged return to work on a part-time basis. As explained by Professor Prince, benefits above a certain threshold are reduced by the same amount than the amount earned.[39]

Further, because both qualifying and benefit periods are measured in weeks, someone with an episodic disability may face barriers to accessing these benefits. For example, someone may not qualify for benefits despite having worked an equivalent number of days, but not the required weeks. Someone else may face reduced benefits because working one day per week means that the benefit period is reduced by a full week.[40]

The Disability Tax Credit

The Committee heard that being eligible for provincial disability benefits through the social assistance system and/or for CPP disability does not qualify recipients for the DTC. This results in applicants having to acquire further medical certification with respect to impairments caused by the episodic disability, to prove eligibility for the DTC. Witnesses also reported that changes in interpretation of laws and regulations makes continued eligibility for the DTC uncertain upon reapplication.[41] Even if a person with an episodic disability does qualify for the DTC, they may be required to reapply every five years.

Registered Disability Savings Plans

[T]hat loss of DTC eligibility “means not only that the RDSP must be terminated, but also that all grants and contributions made by the government in the previous 10 years must be repaid.”

Lembi Buchanan

Issues with the DTC spill over into the RDSP. The RDSP was envisioned to help provide long‑term income security for persons with disabilities, allowing persons with disabilities and their families to save for periods of time when they are unable to work. The Committee learned that that loss of DTC eligibility “means not only that the RDSP must be terminated, but also that all grants and contributions made by the government in the previous 10 years must be repaid.”[42] Those repayments since 2010 have been substantial.[43]

Canada Pension Plan Disability

For people with episodic disabilities, by definition, the impairment is intermittent, which sometimes leaves the individual ineligible for any of the most common income programs supporting persons with disabilities. Particularly CPP disability is not an option, because the condition may not be severe and may or may not be expected to be of long duration. In some cases, the disability, including epilepsy as an example,[44] may not in and of itself result in eligibility for benefits.[45] One witness told the Committee, “current programs such as the Canada Pension Plan disability and the disability tax credit are not flexible enough to assist most individuals who have episodic conditions that worsen.” However, the “severe and prolonged” criteria leave many people with severe mental health disabilities no realistic alternative other than to resign themselves to being classified as unemployable and leave the workforce.

As described by Professor Prince,

The concept of probable duration, where a physician or other medical practitioner has to give their best professional opinion as to what the probable duration is of the incapacity to work due to illness or injury, needs a review if we're truly going to incorporate the concept of episodic disabilities into the medical assessment and certification.[46]

Navigating a complicated system that does not understand episodic disability

“Accounting for the ever-changing nature of episodic disabilities is important when designing income support programs as well as return-to-work or vocational rehabilitation programs, to ensure that people are encouraged to remain engaged in the workforce, thus creating a win-win situation benefiting everyone.”

Maureen Haan

Because many employment-related and income-support programs and services fall within provincial and territorial jurisdiction, witnesses told the Committee, people with episodic disabilities often face an “arduous” task to determine what is available and how to access these programs and services.[47] These programs fail to match the unpredictability of the impact of episodic disability with a corresponding flexibility.[48] To encourage continued labour force participation and support greater income security for people with episodic disabilities, one witness described what is required:

Accounting for the ever-changing nature of episodic disabilities is important when designing income support programs as well as return-to-work or vocational rehabilitation programs, to ensure that people are encouraged to remain engaged in the workforce, thus creating a win-win situation benefiting everyone.[49]

Finally, it was noted that an important obstacle facing people with episodic disabilities is that non-cash benefits that are often associated with income support programs, such as drug plans, subsidized housing, dental or vision care, may be lost upon return to work or earning income above a certain threshold.[50] This effectively discourages a person with episodic disability to return to work during periods of wellness. The loss of important non-cash supports coupled with a future unpredictable episode of disability could result in significant financial hardship.[51]

Conclusions and recommendations

Witnesses and briefs focussed on challenges to labour market participation and access to income security programs, while adding the need to include episodic disability among considerations when designing and implementing programs intended to support the broader disability community.

Supporting labour force attachment

Community organizations are uniquely positioned to provide technical assistance and outreach to employers about the business case and accommodation practices for workers with episodic disabilities.

While continuing participation in the labour market is a high priority upon diagnosis for persons with disabilities, the Committee heard that even with the best of intentions, employers often lack the knowledge, expertise and resources to accommodate workers, particularly those with episodic disabilities. Yet, the federal government as an employer, because of its size and its commitments to equity and representing the rich diversity of Canadian society, is in a unique position to lead the way in becoming a model employer.[52] The Committee, recognizing that there is an important opportunity to model best practices as it relates to accommodations for people with episodic disabilities, recommends:

Recommendation 1

That Employment and Social Development Canada work with other federal government departments and agencies to develop and include an episodic disability awareness and accommodation module as part of the accessibility strategy for the public service.

The Committee also heard that it is important to recognize the expertise of existing non‑government disability organizations. Witnesses underscored that these disability community organizations are well positioned to provide technical assistance and outreach to employers about the business case and accommodation practices for workers with episodic disabilities.[53] In order to better support these community-based disability organizations, the Committee recommends:

Recommendation 2

That Employment and Social Development Canada establish a dedicated funding stream through programs such as Social Development Partnerships and the Opportunities Fund for organizations representing and serving people with episodic disabilities in order to develop targeted employment supports for both employers and workers.

Some witnesses told the Committee that people with episodic disabilities may be absent from work more frequently, sometimes for periods of short duration, but almost always unpredictably. In addition, some workplace accommodations (e.g. ergonomic assessments, disability management training for supervisors and awareness training for co-workers) may involve additional costs. These realities may create challenges for employers and could make them less willing to hire someone with an episodic disability. In turn, employees and potential employees may be reluctant to disclose their episodic disabilities.[54] To incentivize both employers and employees with episodic disabilities to work together to create inclusive and productive workplaces, the Committee recommends:

Recommendation 3

That Employment and Social Development Canada, along with people with lived experience of episodic disabilities and the organizations that represent them, and representatives from the employer community, study a range of incentives for employers that could offset costs associated with accommodating employees with episodic disabilities.

Improving income security

[M]any of these negative impacts are avoidable or can be mitigated through reforms to public policy and programs.

The Committee heard that, all too often, episodic disabilities can have a negative impact on income security. For instance, people with episodic disabilities need to take more medical leave than people without disabilities, often unpaid.[55] Moreover, the current disability income support programs were not designed with an understanding of disability as episodic. Fortunately, the Committee also heard that many of these negative impacts are avoidable or can be mitigated through reforms to public policy and programs.[56]

Employment Insurance sickness benefits

The Committee heard clearly that workers with episodic disabilities may need to be absent from work more often and that reforms to EI sickness benefits that make it easier to qualify and allow for more flexibility would improve their income security.[57] The Committee acknowledges that recent reforms that allow Working While on Claim for EI sickness beneficiaries is a step in the right direction, but more needs to be done.

Furthermore, the Committee believes that while there would be costs to reforming EI sickness benefits, there would also be benefits such as increased labour force participation and productivity gains, which could offset these costs.[58] Reforms “would also be an investment in early interventions and job retention, so that these people would not be opting out of the labour force. They would be continuing to work and making some premium contributions.”[59] To improve income security and support people with episodic disabilities to remain active and productive, the Committee recommends:

Recommendation 4

That Employment and Social Development Canada review and reform Employment Insurance sickness benefits to better support people with disabilities, including episodic disabilities. To this end, reforms must consider:

- allowing workers to claim benefits in smaller units (hours or days) rather than weeks;

- reducing the number of hours worked required to qualify;

- extending the duration of benefits beyond 15 weeks; and

- international best practices.

Canada Pension Plan disability benefits and the Disability Tax Credit

Income support programs with rigid definitions and requirements for eligibility can complicate accessibility. Medical adjudicators do consider factors such as: the impact of the medical condition and treatment on work capacity; age; education; work history; performance, productivity and earnings. Yet, witnesses noted that income security programs that require a disability to be both ‘’severe’’ and ‘’prolonged’’ prevent people with episodic disabilities from being eligible even if they are unable to perform work that is both productive and profitable. They recommended that these criteria be reviewed and modified.[60] The Committee heard clearly that changes are needed that “enable people with episodic disabilities to exit and re-enter the labour force as their work capacity fluctuates.”[61] To this end, the Committee recommends:

Recommendation 5

That Employment and Social Development Canada work with Finance Canada to review the eligibility criteria of the Canada Pension Plan disability benefit with a view to:

- shifting the emphasis from the medical model concepts of "severe" and "prolonged" towards the social model concept of being able to work productively and gainfully on a regular basis; and

- encouraging re-entering employment by promoting vocational rehabilitation programs and rapid requalification for benefits as needed.

Recommendation 6

That Employment and Social Development Canada work closely with Canada Pension Plan disabiity to review appeal mechanisms to ensure openness and transparency and that appellants can be accompanied by an advocate in their appeal process.

The Committee learned that when someone is denied the DTC, often after having been deemed eligible for several years, this decision triggers the requirement that RDSPs be closed out, and that any contributions by the federal government be repaid. Witnesses told the Committee that these regulations can make a difficult financial situation much worse and disproportionately impact people with episodic disabilities. To address this issue, the Committee recommends:

Recommendation 7

That Employment and Social Development Canada work with Finance Canada and the Canada Revenue Agency to ensure that individuals can keep all Canada Disability Savings Grant and Canada Disability Savings Bond contributions made to their Registered Disability Savings Plans for periods in which they qualified for the Disability Tax Credit.

Finally, witnesses also explained that the administrative burden of applying for the DTC can fall disproportionately upon people with episodic disabilities. For example, one witness told the Committee that she is required to submit a doctor’s note each year to inform the government that she still has MS.[62] To address this situation the Committee recommends:

Recommendation 8

That Employment and Social Development Canada work with the Canada Revenue Agency to review administrative requirements imposed on recipients of disability benefits with a view to streamlining reporting requirements.

Recommendation 9

That the federal government consider amending the Income Tax Act to ensure that recipients of the Canada Pension Plan disability benefits are eligible for the Disability Tax Credit.

Recommendation 10

That the Canada Revenue Agency consider making changes to how it assesses reapplications for the Disability Tax Credit from individuals who were eligible for the Disability Tax Credit in the previous tax year, in order to ensure that they are not denied if they have not experienced a marked reduction in the impairment they experience as a result of their disability since they were last approved.

Expanding our understanding of disability to include episodic experiences

“disability means any impairment, including a physical, mental, intellectual, cognitive, learning, communication or sensory impairment — or a functional limitation — whether permanent, temporary or episodic in nature, or evident or not, that, in interaction with a barrier, hinders a person’s full and equal participation in society.”

Bill C-81

The Committee heard that it needs to address both work supports and income security for people with episodic disabilities. Moreover, enabling this approach requires a more dynamic and inclusive understanding of disability that incorporates episodic disabilities.

Building upon this testimony, it was recommended that coordinated application processes would help people with episodic disabilities access the range of programs that would help them to stay active in the labour force and provide income replacement during periods when they are unable to work. Witnesses suggested that the government explore a “single window” or “Service Canada” approach to disability supports.[63] It was also suggested that developing an “individualized funding model for income and social supports”[64] holds promise. A related challenge is the risk of losing non-cash benefits, like medical services or subsidized housing, when earning income. The cancellation of important non-cash supports create powerful disincentives for people with episodic disabilities to remain active in the labour force.

The Committee recognizes that the government has, in Bill C-81, An act to ensure a barrier-free Canada, made a significant step forward by proposing a legal framework that includes the concept of episodic disability.

Notwithstanding the legislation, the Committee also understands that there is still considerable work to be done by all orders of government to operationalize this new concept. Therefore, to address these issues and advance the concept of disability that includes those which are episodic in nature, the Committee recommends:

Recommendation 11

That Employment and Social Development Canada work with Finance Canada, the Canada Revenue Agency and provincial/territorial governments to review the system of disability income supports and employment services programs recognizing the following:

- that people with episodic disabilities need access to employment supports;

- that people with episodic disabilities need access to income support during periods when they are unable to work;

- the benefits of a single window approach that delivers accessible, flexible and portable employment and income supports;

- associated non-income benefits (e.g. prescription drugs, housing subsidies, vison care) should continue when earned income replaces income supports; and

- that people applying for programs need to be able to communicate with governments both orally and in writing.

[1] In the French version of this report the term disability, when used in the general sense, is rendered as “incapacité”. In specific instances that relate to an official federal government programs such as Canada Pension Plan disability the term disability is rendered as “invalidité”.

[2] Please see Appendix A, Table A1 for a list of conditions that are known to result in episodic disability. For more information please see: Episodic Disabilities Employment Network and the Episodic Disabilities Network.

[4] Adele Furrie, The evolution of disability data in Canada: Keeping in step with a more inclusive Canada, 28 November 2018.

[5] United Nations Convention on the Rights of Persons with Disabilities, Article 1—Purpose.

[6] The evolution of the concept of disability its impact on data collection is explored further in ANNEX: B.

[7] Adele Furrie, The evolution of disability data in Canada: Keeping in step with a more inclusive Canada, 28 November 2018.

[8] Research is currently underway between Statistics Canada and Employment Social Development Canada (ESDC) on episodic disabilities using new questions on the Canadian Survey on Disability, 2017 (CSD).

[9] Statistics Canada, Canadian Survey on Disability, 2017.

[10] Anyone who was officially unemployed or who was not in the labour force but stated they would be looking for work in the next 12 months, was classified as having work potential. Those who stated they were “completely retired,” those who said their condition completely prevented them from working and that no workplace accommodation existed that would enable them to work, and those who were housebound, were classified as not being potential workers. Students who did not fall into any of the above categories (unemployed, looking for work, housebound, etc.) were excluded from the analysis entirely. While many or even most of them may become future workers, their current work potential status is considered undetermined. Therefore, these students were not classified as either potential workers or non-potential workers. Finally, anyone not falling into any of the categories above was classified as having work potential.

[11] See Stuart Morris et. al. A demographic, employment and income profile of Canadians with disabilities aged 15 years and over, 2017, 28 November 2018.

[12] See, for example, House of Commons, Standing Committee on Human Resources, Skills and Social Development and the Status of Persons with Disabilities (HUMA), Evidence, 42nd Parliament, 1st Session, 4 December 2018 (Deanna Groetzinger, Manager, Neurological Health Charities Canada); and HUMA, Evidence, 42nd Parliament, 1st Session, 6 December 2018 (Emile Tompa, Senior Scientist, Institute for Work and Health and Tammy Yates, Executive Director, Realize).

[13] See for example, HUMA, Evidence, 42nd Parliament, 1st Session, 4 December 2018 (Michael Prince, professor of Social Policy, Faculty of Human and Social Development, University of Victoria, as an individual).

[14] Self-employed workers with sufficient insurable earnings from self-employment may also qualify.

[15] Bill C-86: A second Act to implement certain provisions of the budget tabled in Parliament on February 27, 2018 and other measures, S.C. 2018, c. 27.

[16] Canada Pension Plan (CPP) Disability Benefits by Class of Diagnosis, Open Government, Data accessed 12 February 2019.

[17] S. Mitra et. al. “Extra Costs of Living with a Disability: A Systematized Review and Agenda for Research.” Disability and Health Journal 10 (4):475-484, 2017. Also see: The Disability Tax Credit, The Government of Canada, Canada Revenue Agency.

[18] For more information please see: Income Tax Folio S1-F1-C2, Disability Tax Credit, Canada Revenue Agency, 2016.

[19] Notes: Many individuals make claims in multiple categories depending on the effects of the impairments. The number of incomplete claims where a decision has not been made within a fiscal year are not included, as the decision is pending and is usually completed in the next fiscal year. Thus, any estimate is only point in time.

[20] Since the DTC is a non-refundable credit it can only be used by people to claim a reduction in tax that is owed. Thus, it not financially beneficial to those individuals in low income who have no tax owing and no relative with tax owing to which it can be transferred.

[21] ESDC, “Planned Results: What we want to achieve this year and beyond,” ESDC 2018-2019 Departmental plan.

[22] HUMA, Evidence, 42nd Parliament, 1st Session, 6 December 2018 (Tammy Yates, Executive Director, Realize).

[23] Cite HUMA, Evidence, 42nd Parliament, 1st Session, 6 December 2018 (Monique Gignac, Associate Scientific Director and Senior Scientist, Institute for Work and Health), and HUMA, Submission (Wendy Porch for the Disabled Women’s Network of Canada), published 17 December 2018, p. 6.

[24] Cite HUMA, Submission (Guillermo Boccagni), published 17 December 2018.

[25] HUMA, Evidence, 42nd Parliament, 1st Session, 29 November 2018 (Julie Kelndorfer, Director, Government and Community Relations, Multiple Sclerosis Society of Canada). HUMA, Submission (Margaret Parlor, President of National ME/FM Network), published 10 December 2018.

[26] HUMA, Evidence, 42nd Parliament, 1st Session, 4 December 2018 (Patrycia Rzechowka, Ambassador and Spokesperson, Multiple Sclerosis Society of Canada).

[27] HUMA, Evidence, 42nd Parliament, 1st Session, 6 December 2018 (Maureen Haan, President and Chief Executive Officer, Canadian Council on Rehabilitation and Work).

[28] See, for example, HUMA, Evidence, 42nd Parliament, 1st Session, 4 December 2018 (Deanna Groetzinger), and Evidence, 42nd Parliament, 1st Session, 6 December 2018 (Adele Furrie, President and Chief Executive Officer, Adele Furrie Consulting Inc., as an individual).

[30] Ibid.

[31] Ibid. (Monique Gignac).

[33] See, for example, HUMA, Evidence, 42nd Parliament, 1st Session, 4 December 2018 (Patrycia Rzechowka), and HUMA, Evidence, 42nd Parliament, 1st Session, 29 November 2018 (Drew Woodley, Director, Government Relations, Epilepsy Ontario).

[34] HUMA, Evidence, 42nd Parliament, 1st Session, 6 December 2018 (Monique Gignac), and HUMA, Submission (Wendy Porch), published 17 December 2018, p. 6.

[36] Ibid. (David Yurdiga, MP, Fort McMurray—Cold Lake, CPC).

[37] Ibid. (Shauna MacKinnon, as an individual).

[39] Ibid.

[41] HUMA, Evidence, 42nd Parliament, 1st Session, 4 December 2018 (Deborah Lovagi, Representative, Neurological Health Charities Canada).

[42] Ibid. (Lembi Buchanan, founding member, Disability Tax Fairness Alliance).

[43] Ibid.

[45] HUMA, Submission (Margaret Parlor) published 10 December 2018.

[48] See, for example, HUMA, Evidence, 42nd Parliament, 1st Session, 4 December 2018 (Deanna Groetzinger), HUMA, Evidence, 42nd Parliament, 1st Session, 6 December 2018 (Maureen Haan) and HUMA, Submission (Guillermo Boccagni), published 17 December 2018.

[50] Ibid.

[53] See, for example, HUMA, Evidence, 42nd Parliament, 1st Session, 4 December 2018 (Deanna Groetzinger) and Evidence, 42nd Parliament, 1st Session, 6 December 2018 (Tammy Yates).

[54] Ibid. See also Condition Chronic: How improving workplace wellness helps Canadians and the Economy, Public Policy Forum, September 2017.

[55] For more information please see: Episodic Disabilities Employment Network and the Episodic Disabilities Network.

[56] Tyler Meredith et al. Leaving Some Behind: What Happens When Workers Get Sick, Institute for Research on Public Policy, 3 September 2015; Centre for Research on Work Disability Policy, Episodic Disabilities in Canada: People with episodic disabilities in Canada: Who are they and what supports do they need to obtain and retain employment?, October 2016; Rosemary Lysaght et al. Employers’ Perspectives on Intermittent Work Capacity—What Can Qualitative Research Tell Us?, Queens University, 18 April 2011.

[57] HUMA, Evidence, 42nd Parliament, 1st Session, 6 December 2018 (Tammy Yates). See also: Tyler Meredith et al. Leaving Some Behind: What Happens When Workers Get Sick, Institute for Research on Public Policy, 3 September 2015.

[58] It should be noted that the Committee heard extending benefits in this way could cost between $50 million and $100 million annually, an incremental cost of 4% to 5% of the cost of current sickness benefits. HUMA, Evidence, 42nd Parliament, 1st Session, 4 December 2018 (Michael Prince),. See also, Alexandry Dobrescu, Thy Dinh and Carole Stonebridge. Multiple Sclerosis in the Workplace: Making the Case for Enhancing Employment and Income Supports. Ottawa: The Conference Board of Canada, 2018.

[59] Ibid.

[60] See, for example, HUMA, Evidence, 42nd Parliament, 1st Session, 4 December 2018 (Deanna Groetzinger).

[62] Ibid.