Occupational pension plans, which can be

defined benefit or defined contribution plans, were also mentioned by

witnesses. A number of concerns about defined benefit plans in particular were

shared with the Committee, especially regarding the solvency and funding of

such plans, ownership of any pension surplus, and protection for employees when

the employer that sponsors the plan becomes insolvent or experiences financial

difficulty.

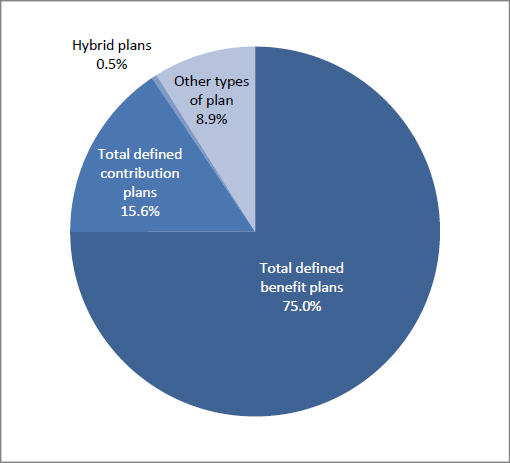

Figure 5: Registered Pension Plan Membership,

by Type of Plan, Canada, 2009 (%)

Source: Statistics Canada, CANSIM Table 280-0016.

Ms. Judy Cameron, of the Office of the

Superintendent of Financial Institutions (OSFI), commented that pension plan

assets of federally regulated occupational pension plans were eroded by stock

market declines in autumn 2008 while pension liabilities increased due to

extremely low and declining long-term interest rates that reduced the predicted

return on investment. She told the Committee that, due to stock market

improvements in 2009, the average solvency ratio increased from 0.85 at

December 2008 to 0.90 at December 2009, and 40% of federally regulated private

pension plans had a solvency ratio of less than 0.80 at the end of 2008, a

proportion which had fallen to 15% at the end of 2009.

Solvency issues were also addressed by Mr.

Rock Lefebvre, of the Certified General Accountants Association of Canada, who

shared preliminary analysis of the 2008 year-end results; these results

revealed a $300-billion funding deficit for all private-sector defined benefit

pension plans. He urged the creation of a target solvency margin related to the

risks associated with a pension plan’s assets and liabilities. Mr. John Farrell,

of Federally Regulated Employers—Transportation and Communications (FETCO),

stated that defined benefit plan sponsors are burdened with onerous and

volatile solvency funding requirements, and Mr. Serge Charbonneau, of the

Canadian Institute of Actuaries, pointed out that Crown corporations do not

have a bankruptcy risk and thus should not be required to adhere to solvency

rules.

The Public Service Alliance of Canada’s Ms.

Patty Ducharme told the Committee about the November 2009 actuarial report of

the Chief Actuary, which found that the pension plan for federal public service

employees had an actuarial surplus. She noted that employee contribution rates

are projected to increase by approximately 60% from 2005 to 2013 in order to

increase the ratio of employee-to-employer contributions.

Mr. Farrell noted that the majority of FETCO

members sponsor defined benefit pension plans, and urged modernization of

pension standards in order to support the viability of existing defined benefit

plans by enabling plan sponsors to continue to manage risks. He told the

Committee that FETCO generally supports the fall 2009 changes to the Pension

Benefits Standards Act, 1985, but indicated that permanent changes in

pension plan funding rules are needed, such as more frequent actuarial

valuations and more adequate reserves for lower future investment returns.

The Rotman International Centre for Pension

Management’s Mr. Keith Ambachtsheer, who appeared on his own behalf,

commented that—originally—defined benefit pension plans were seen by the

employer and employees as a gratuity; this gratuity is now seen as a financial

contract between the employer and plan members. Mr. Pierre St-Michel, who

appeared on his own behalf, reinforced the fact that a pension is a contract when

he said that pension deficits are really a subsidy from the employee to the

employer, since promised benefits are reduced. In highlighting the situation

that now exists in the Netherlands, Mr. Ambachtsheer proposed that defined

benefit pension plans should be regulated in a manner similar to banks and

insurance companies: risk on a balance sheet must have adequate buffers against

adverse outcomes. Ms. Cameron suggested that effective plan governance is

important in controlling risk, and suggested that regular “scenario testing” or

revaluation of current assets and future liabilities using various market

outcomes could help pension plan administrators understand, and prepare for,

future risk.

Mercer’s Mr. Malcolm Hamilton, who appeared

on his own behalf, told the Committee that one of the problems with defined

benefit pension plan rules is that employers that over-contribute in order to

create a reserve for lower future investment returns may not be fully entitled

to the surplus if the reserve is not eventually required. The Organisation for

Economic Co-operation and Development’s Mr. Edward Whitehouse, who appeared on

his own behalf, indicated that the current rules on over-contributions were

introduced when investment returns were high and tax authorities were concerned

about the sheltering of business income from taxation through contributions to

the pension plan. In the view of Mr. Lefebvre, clarification is needed about

the ownership and distribution of pension surpluses on plan termination.

Mr. Ambachtsheer noted that the issue of

pension surplus ownership is a property rights problem which could be resolved

through individual pension accounts that are owned by the employees. Mr.

Charbonneau advocated the creation of a pension security trust that would be

separate from, but complementary to, a defined benefit pension fund. In his

model, the employer would own the funds in the pension security trust, receive

a tax deduction for contributions and be taxed on withdrawals.

Regarding creditor status in relation to

pension plan actuarial deficits, Ms. Diane Urquhart, Ms. Diane

Contant Blanchard, Mr. Tony Wacheski, Ms. Gladys Comeau, Mr. Paul

Hanrieder and Mr. Pierre St-Michel, who appeared before the Committee on their

own behalf, as well as Mr. Donald Sproule of the Nortel Retirees’ and Former

Employees’ Protection Committee, Mr. Robert Farmer of the Bell Pensioners'

Group, Mr. Phil Benson of Teamsters Canada and Mr. Gaston Fréchette of the

Association des retraités d'Asbestos Inc., advocated higher priority for

pension deficits in the event of employer insolvency. Mr. Hanrieder suggested

that changes to the priority of pension deficits during bankruptcy should apply

to current bankruptcy proceedings of bankrupt employers. Mr. Sylvain de

Margerie and Ms. Josée Marin, both appearing on their own behalf, proposed that

unregulated pension plans for those on long-term disability should be granted

higher priority during bankruptcy proceedings.

Mr. Farrell was concerned that granting higher

priority to pension deficits would erode the savings of individuals without

defined benefit pension plans, since various types of private investments hold

corporate bonds that could be affected by the suggested priority change. He

also argued that higher priority for pension deficits would place companies

that offer defined benefit plans at a competitive disadvantage in relation to

Canadian companies that do not offer such plans and in relation to international

companies that are located in jurisdictions without such a super-priority

status. In addition, he argued that—with the suggested change—credit ratings

for companies that sponsor defined benefit plans could be reduced due to the

potential liability associated with a pension plan deficit; a lower credit

rating could increase the cost of capital.

Mr. Hamilton commented that higher priority for

pension deficits could result in conditional loans to corporations in the sense

that the terms of the loan could enable changes to be made if the company

introduced, or improved the benefits of, a defined benefit pension plan. Mr. Michel

Benoit, legal counsel to certain federally regulated private-sector employers,

stated that higher priority for pension deficits would increase the cost of

credit for employers; in his view, the best protection for pension plan members

is a financially sound employer. Ms. Melanie Johannink, who appeared on her own

behalf, told the Committee that, in Australia, the increased cost of credit for

employers was minimal after bankruptcy laws were changed to grant employer pension

plan contributions a priority status above unsecured creditors. Mr.

Ambachtsheer commented that most corporations have closed their defined benefit

pension plans to new employees and that changes to bankruptcy laws would only

have an effect during the winding up of existing plans and would not protect

future employees.

Mr. Charbonneau advocated changes that would

decrease the costs associated with annuities; in particular, during the winding

up of a pension plan, annuity purchases could be spread out over time rather

than purchased at the same time for all retirees. Ms. Norma Nielson, who

appeared on her own behalf, told the Committee that a possible solution for a

plan whose sponsor is bankrupt is to have the Canada Pension Plan Investment

Board assume administration of the plan’s investments. Mr. Donald Raymond, of

the Canada Pension Plan Investment Board, indicated that such a role is not

part of the Board’s current legislated mandate, and additional infrastructure

would be required to ensure that the funds associated with the plans sponsored

by insolvent employers would be segregated from the Canada Pension Plan’s

assets.

In addition to a change in priority status,

witnesses provided other suggestions in relation to pension protection in the

event of employer insolvency. For example, Mr. Serge Cadieux, of the

Canadian Office and Professional Employees Union, supported an insurance fund

for defined benefit pension plans; according to his proposal, such a fund

should be financed by premiums paid by all sponsors of defined benefit pension

plans as well as by a new tax on financial transactions cleared and settled by

a securities exchange.

Ms. Katherine Thompson, of the Canadian Union

of Public Employees, Mr. Réjean Bellemare, of the Fédération des

travailleurs et travailleuses du Québec, and Ms. Ducharme supported the

creation of a federally sponsored pension insurance program funded through

premiums paid by all defined benefit plan sponsors. Mr. Joel Harden,

of the Canadian Labour Congress, advocated an insurance premium of $2.50 per

plan member to a maximum of $12 million per year per pension plan, while Mr. Bellemare

supported a premium based on the investment risk of a particular pension plan.

The notion of an insurance scheme for

bankrupt pension plan sponsors was not supported by Mr. Whitehouse or by Mr. Ambachtsheer, who held the view that the schemes have not worked in other

countries. Mr. Ian Markham, of FETCO, also did not support a national insurance

fund since, in his view, well-run pension plans would be subsidizing plans with

more investment risk.