FINA Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

Considering the Path Forward

Chapter 1: Introduction

During the summer of 2021, the House of Commons Standing Committee on Finance (the Committee) of the 43rd Parliament invited Canadians to share their thoughts on spending priorities for the next federal budget. Over the next several months, 495 individuals or groups submitted their written briefs to the Committee. Every one of these submissions was carefully translated, reviewed, and categorized by topic. A list of all such submissions can be found in Appendix B of this document, and the Committee sincerely thanks all participants.

Shortly following the start of the 44th Parliament, the Committee undertook its pre‑budget consultations in advance of the 2022 federal budget. From 31 January to 14 February 2022, the Committee invited 29 witnesses to discuss their proposals in person via video-conference. These meetings were held in a “hybrid” format, with members attending either virtually or in-person, under strict health and safety protocols. It is in consideration of these meetings and the written briefs received that the Committee presents its recommendations for the 2022 federal budget.

As the scope of the pre-budget consultations extends to all current and prospective federal spending, the content of this report is necessarily diverse. While this diversity is reflected in the Committee’s recommendations to the government, these recommendations are united by common goals: to grow the economy, to protect the tax base, and to recover fully from the COVID‑19 pandemic. For example, the Committee’s recommendations pertaining to research and development, start-ups and innovation in Chapter 4, and those calling for further investments in trade-enabling infrastructure in Chapter 7 were made with a view to grow the economy and enhance productivity. As well, in making their recommendations to review and improve the tax system and to provide additional resources to the Canada Revenue Agency in Chapter 2, the Committee was mindful of protecting Canada’s tax base. Lastly, recommendations for further temporary support for businesses and individuals, including in the tourism and cultural sectors in Chapters 4 and 7, aim to ensure Canada fully recovers from the pandemic.

This report, which contains the Committee’s recommendations and select quotes from witnesses and submissions, is divided into six substantive chapters. These chapters divide the subject matter of the pre-budget consultations into the following categories: Federal Fiscal Policy and Government, People, Businesses, Environment and Climate Change, Indigenous Priorities, and Communities.

Chapter 2: Fiscal Policy and Government

The pandemic had a deep impact on the Canadian economy. The lockdown and other containment measures, as well as supply chain disruptions caused a recession in 2020, during which the Canadian gross domestic product (GDP) decreased by 5.2%. Since then, the economic activity has rebounded, with real GDP growth reaching 4.7% in 2021. The Office of the Parliamentary Budget Officer (OPBO) projects that the recovery will continue in the coming years, with growth of 3.9% in 2022 and 2.9% in 2023.

In response to the pandemic, the federal government implemented a wide range of measures to assist Canadian individuals, businesses, sectors and communities during these difficult times. The response included direct support measures, loans, tax deferrals and other liquidity support measures. According to the OPBO, the federal government will have spent $354.2 billion from the onset of the pandemic until the end of 2021‑2022 as part of its COVID‑19 Economic Response Plan.

The fiscal response to the pandemic as a share of GDP among G7 countries is shown in Figure 1. Compared to other G7 countries, Canada relied relatively more on additional spending and foregone revenue measures than on the provision of equity, loans and guarantees.

Figure 1—Fiscal Response to the COVID‑19 Pandemic among G7 Countries, January 2020 to September 2021 (percentage of gross domestic product)

Note: The standard reference year for gross domestic product is 2020.

Source: Figure prepared by the Library of Parliament based on data obtained from the International Monetary Fund, Fiscal Monitor Database of Country Fiscal Measures in Response to the COVID-19 Pandemic, October 2021.

As a result of the federal fiscal response to the pandemic and the recession experienced in 2020, the federal government’s deficit increased from $39.3 billion in 2019‑2020 to $327.7 billion in 2020‑2021. This significant increase in the deficit led to an increase in the federal debt-to-GDP ratio from 31.2% to 47.6% over the same period. In its most recent Economic and Fiscal Update, the federal government has reaffirmed its Budget 2021 commitment to reduce the federal debt as a share of GDP over the medium term and unwind pandemic-related deficits. According to the OPBO, the deficit will decrease to $139.8 billion in 2021‑2022 and gradually onwards, reaching $17.5 billion in 2026‑2027. It also projects that the federal debt-to-GDP ratio will decline from a peak of 47.7% to 42.3% over the same period.

The Bank of Canada also implemented extraordinary measures to respond to the economic shock experienced by the Canadian economy in 2020. It decreased the target for the overnight rate by 0.5 percentage points on three occasions in March 2020, bringing it from 1.75% to 0.25%, its effective lower bound. In addition, the Bank of Canada began making large‑scale purchases of federal and provincial government bonds, as well as corporate bonds. These actions were intended to lower borrowing costs for governments, consumers and businesses and assist financial markets, with a view to support economic growth and avoid deflation. As indicated by the OPBO, the federal debt service ratio – that is, the ratio of public debt charges to tax revenues – reached an all-time low of 7.2% in 2020‑2021 due to lower interest rates. However, the Bank of Canada has begun increasing the target for the overnight rate in March 2022 in response to the current high level of inflation in the Canadian economy, which will lead the federal debt service ratio to reach 11.5% by 2026‑2027, as projected by the OPBO.

Witnesses who spoke on fiscal policy and government made proposals on federal finances, tax reform and compliance and federal government organizations.

Federal Finances

Witness proposals pertaining to federal finances focused on intergovernmental relations, fiscal management, government assistance and pandemic-related spending.

With respect to intergovernmental relations, witnesses focused on equalization and transfers to the provinces and territories, including the Canada Health Transfer and the Canada Social Transfer. Witnesses discussed fiscal management and stressed the importance of limiting government spending in order to balance the budget in the short term. Others spoke about the importance of reducing the federal debt-to-GDP ratio in order to ensure long-term fiscal sustainability.

On the issue of government spending, the Committee heard proposals to cut funding for media and Crown corporations, ensure financial transparency and end business subsidies. Regarding the pandemic, witnesses said that the federal government should ideally establish a time frame for ending government assistance. Others proposed that the government come up with specific rules regarding future government pandemic spending. Lastly, several witnesses urged the government to not increase taxes in order to support economic recovery, while other witnesses suggested the introduction of new forms of taxation.

Recommendation 1

Present, as soon as possible, a plan to return to a balanced budget that includes several scenarios to adjust for economic conditions.

Recommendation 2

Maintain a gross debt-to-GDP ratio following the trajectory in the 2021 Economic and Fiscal Update and, should economic growth and/or fiscal efforts permit, revise these targets downward.

“The Conference Board points out that, in Canada, 5.1 million people will turn 65 in the next 10 years. However, in its current form, the Canada Health Transfer does not account for population aging. Its formula is based on an equal per capita amount. For this reason, the Réseau FADOQ believes that the Canadian government must change the formula for calculating the Canada Health Transfer by factoring in population aging in the provinces and territories in order to enhance the amounts where it is needed most.”

Recommendation 3

Factor in population aging in the provinces and territories in the formula for calculating the Canada Health Transfer.

Recommendation 4

Provide, on a regular basis, an update on the state of public finances, as recommended by the Parliamentary Budget Officer, including making it a practice to provide economic updates in the fall.

Recommendation 5

Amend the legislation to change the release date of the public accounts.

Tax Reform and Compliance

Several witnesses proposed that the government undertake a comprehensive public review of the tax system. Some said that such a review should aim to limit tax loopholes used particularly by high-income earners and large corporations. With respect to compliance, some witnesses proposed strengthening the general anti-avoidance rule as quickly as possible. The witnesses called on the government to continue promoting corporate transparency and to release the financial returns of big international corporations for each tax jurisdiction they operate in.

Others proposed a review of the Canada Revenue Agency’s processes for distributing various benefits to make them more effective.

“Chartered Professional Accountants of Canada has long called for a full review of Canada’s tax system so that it’s simpler, fairer, more efficient and more competitive. As a first step in a multi-staged process, the government should execute its new comprehensive review of tax expenditures, with an expanded mandate to simplify the system by streamlining tax credits and deductions and eliminating inefficient or poorly targeted tax preferences.”

Recommendation 6

Conduct a systematic review of tax and budget measures in order to redirect efforts and funding away from less effective measures and toward the most effective and efficient policy instruments.

“In recent years, the federal government repeatedly promised to review federal tax expenditures to ensure that the wealthy don’t benefit from unfair tax breaks. Any reviews have been internal with modest results. The federal government should be much more ambitious and the Standing Committee on Finance can play a role in helping it, by holding its own public review of regressive tax expenditures and loopholes.”

Recommendation 7

Undertake a public review to identify federal tax expenditures, loopholes and other tax avoidance mechanisms that particularly benefit high incomes, wealthy individuals and large corporations and make recommendations to eliminate or restrict these.

Recommendation 8

Examine additional ways for the federal government to reduce wealth and income inequality through the tax system, while generating additional revenues to pay for improved public services.

Recommendation 9

Address growing income inequality and generate revenue for poverty reduction programing by eliminating tax loopholes, closing tax havens, taxing extreme wealth, and implementing excess profit tax focused on corporate pandemic windfalls.

Recommendation 10

Amend legislation to remove taxpayer signature requirements for the T183 and RC71 in a manner that is consistent with the Department of Finance Canada’s 2022 legislative proposals as part of Budget 2022 enabling legislation.

Recommendation 11

Expedite permanent approval for e-signature use on all remaining forms that are necessary to meet tax filing requirements.

Recommendation 12

Initiate discussions with the Quebec government to reach a practical and innovative agreement on the matter of a single tax return, focused on the taxpayers’ best interests.

Recommendation 13

Proceed with its General Anti-Avoidance Rule consultation immediately.

Recommendation 14

Respect the spirit of Bill C-208, An Act to amend the Income Tax Act (transfer of small business or family farm or fishing corporation), by holding consultations if there are amendments, as promised, in order to facilitate intergenerational transfers.

Recommendation 15

Undertake a broad review of how the federal government could significantly increase the amount, detail, quality and timeliness of information publicly available on the financial conditions of individuals, corporations and trusts, including ownership, assets, income and taxes paid.

Recommendation 16

Continue to improve corporate transparency and make public the country-by-country financial reports of large transnational corporations.

Recommendation 17

Amend the Income Tax Act to ensure the continuation of the tax-deferral program.

Federal Government

The Committee received several proposals related to compensation and staffing levels in federal organizations. Witnesses proposed reducing the Governor General of Canada’s salary and benefits, including the pension. Others proposed reducing government spending through a combination of attrition, job cuts and wage rollbacks for federal employees and parliamentarians. Some witnesses also suggested reducing the size of Cabinet and the Senate budget.

Witnesses also discussed issues surrounding the implementation of community benefit agreements and workforce development agreements for federal infrastructure projects to promote learning and create opportunities for underrepresented groups, such as Indigenous people, racialized individuals and persons with a disability.

Recommendation 18

Consider how federal and provincial governments could, in a post-pandemic world, more effectively deliver the many benefits that are delivered through the Canada Revenue Agency’s tax and benefit system infrastructure, including the introduction of free automatic tax filing.

Recommendation 19

Fund the Canada Revenue Agency so that it is equipped to address high-profile tax loopholes, while maintaining strong leadership at the Organisation for Economic Co‑operation and Development for a more ambitious and fairer application of the base erosion and profit shifting initiative for developing countries.

Recommendation 20

Provide the Canada Border Services Agency and the Canadian Food Inspection Agency the resources and training they need to adequately enforce dairy import regulations at the Canadian border, and to conduct audits of foreign farms and processors to ensure all imported products are produced according to Canadian production standards.

Recommendation 21

Implement community benefits agreements or workforce development agreements on federally procured infrastructure and construction projects.

Chapter 3: People

The pandemic has had a dramatic impact on employment in Canada and around the world. Business closures caused by COVID-19 and health measures intended to slow the spread of the virus resulted in record lows in the labour market.

Between February and April 2020, Canada lost 3 million jobs, nearly 2 million of them full time. In September 2021, employment returned to pre-pandemic levels and continued to rise until December 2021, before dropping by 1% (or 200,000 jobs) in January 2022, due in part to stricter health measures brought in to slow the spread of COVID-19.

Figure 2—Number of Jobs in Canada, January 2018 to January 2022 (millions)

Source: Figure prepared by the Library of Parliament using data obtained from Statistics Canada, “Table 14-10-0287-01: Labour force characteristics, monthly, seasonally adjusted and trend-cycle, last 5 months,” accessed 1 March 2022.

In February 2022 the unemployment rate was 5.5%. It has dropped by 7.9 percentage points since May 2020 (13.4%) and has now returned to its pre-pandemic level. Although employment is recovering, there are significant lingering losses in certain industries. Accommodation and food services continue to be particularly hard hit, with employment levels down 26.4% from what they were in February 2020.

There were 896,100 job vacancies (or 5.2%) in December 2021, up 87.9% compared to December 2020. Accommodation and food services (142,300 vacancies or 10.9%) and health care and social assistance (137,100 vacancies or 5.9%) were particularly affected.

The higher number of job vacancies is due in part to labour market imbalances, such as skilled labour shortages and geographic mismatches between job vacancies in certain regions and available workers in others.

In addition to employment and labour issues, the Committee heard proposals pertaining to education and skills training, health care, children, families and social policy, personal taxation and consumption taxes, as well as retirement income and seniors.

Employment and Labour

Proposals related to employment and labour called for action with respect to the Canada Emergency Response Benefit, the Canada Worker Lockdown Benefit, the Canadian Recovery Benefit, Employment Insurance, the mobility of skilled trades workers, sector-specific retraining and relocation, apprenticeship loans and grants, the Union Training and Innovation Program, pathways to permanent residency, support for micro-credentials, employee retention, the Temporary Foreign Worker Program, and policies that impact the retirement age of Canadians.

Recommendation 22

Support the modernization of Employment Insurance (EI), whose limitations were laid bare during the pandemic, through social dialogue with the main stakeholders in the labour market.

Recommendation 23

Contribute on an ongoing basis to EI and make improvements such as a higher replacement rate or a minimum amount on what the unemployed receive such as the $500 per week provided under the Canada Emergency Response Benefit and the Canadian Recovery Benefit and a lower threshold for hours of entry into the Employment Insurance program.

Recommendation 24

Make improvements to EI by increasing flexibility in the program and recognizing the uniqueness of the construction labour force.

Recommendation 25

Develop a comprehensive plan on how to better integrate the self-employed into the EI system.

Recommendation 26

Fund the forecasted actuarial deficit in the EI account through a payment from the consolidated fund.

Recommendation 27

Substantially increase amounts for labour market development agreements.

“The findings of several studies on the subject are clear: experienced workers want to remain in the workforce for a variety of reasons. However, they prefer a more background, mentoring role, to be used for their expertise and for knowledge transfer.”

Recommendation 28

Develop an action plan to promote retaining and hiring experienced workers that addresses awareness, training and labour market re-entry assistance.

Recommendation 29

Introduce a tax credit for experienced workers.

Recommendation 30

Streamline the Labour Market Impact Assessment process by reducing the requirements for applicants, lowering the fees per application, using modern telecommunication tools and ending the duplication of responsibilities between the two governments. The process should be streamlined and its outcome more predictable for in-demand jobs.

Recommendation 31

Ensure the sustainability of the agreement between the federal government and Quebec on relaxing Temporary Foreign Worker Program requirements.

Recommendation 32

Process immigration applications and issue work permits faster so that applications from candidates selected by Quebec are processed as quickly as those from other provinces.

“The construction industry continues to face chronic labour and skills shortages, and … will need to recruit more than 148,000 new workers over the decade to keep pace with retirements and demand. A significant portion will need to come from groups traditionally underrepresented in the current construction labour force, including women, Indigenous people, and new Canadians.”

Recommendation 33

Make changes to the immigration system to respond better and more quickly to labour shortages in residential construction through permanent immigration solutions.

Recommendation 34

Establish coordinating officers to organize and dispatch labour resources in areas with high rates of seasonal employment.

Recommendation 35

Increase the Canada Workers Benefit and expand it to people with no employment income.

Recommendation 36

Increase the maximum weekly earnings threshold for caregiving benefits.

Recommendation 37

Extend the EI benefit period to a maximum of 52 weeks for caregivers who must leave work temporarily to care for a family member.

Recommendation 38

Offer a three-year enhancement to the Ready, Willing and Able inclusive workplace program.

Recommendation 39

Commit to a fair transition to better offset the negative effects of perceived labour and labour market changes and to adequately finance the necessary measures to this end.

Education and Skills Training

The Committee was presented with various proposals concerning education and skills training in written submissions. With respect to education, the Committee received proposals that included making campus infrastructure more sustainable and to support post-secondary education through a national strategy and expanded student grants and scholarship programs. Proposals were also submitted to improve access to mental health services on campuses and to upgrade colleges’ digital infrastructure.

On the topic of skills training, witnesses and organizations presented proposals that included addressing labour shortages, namely by investing in reskilling and upskilling programs and in a national collaborative platform, particularly in key industries, and by implementing dedicated permanent residency streams for international students. Witnesses also argued for training and retraining programs designed to help the transition to a net-zero world.

Recommendation 40

Enact a national post-secondary education strategy in cooperation with provinces and territories, and commit—in support of this strategy—an additional $3 billion through transparent transfer payments to provinces and territories.

“Structural and financial constraints on post-secondary institutions have hindered their ability to provide necessary mental health services. The need for mental health services has far outpaced their delivery, as evidenced by growing waiting lists and restrictions on‑campus services.”

Recommendation 41

Allocate $300 million per year, over two years, to improve on-campus mental health services. The fund, modeled after the Post-Secondary Institutions Strategic Investment Fund, would allow post-secondary institutions to apply for federal grants to improve on‑campus mental health services.

Recommendation 42

Extend eligibility for Canada Student Grants to graduate students.

Recommendation 43

Increase funding for student scholarship programs by $120 million on a recurring basis, thus re‑establishing the importance of student scholarships within the overall envelope of the Canada Research Granting Agencies.

Recommendation 44

Maintain current funding levels to Canada Student Grants past the 2022‑2023 school year, permanently doubling grant maximums for eligible students from $3,000 to $6,000 per academic year.

“In order for a generational investment in training to have a deep and lasting effect on skilling workers – especially indigenous peoples and young Canadians looking to succeed in a changing economy – it needs to partner with and fund inclusive programs that prepare workers for the green, sustainability-focussed jobs of today and the future.”

Recommendation 45

Ensure workers enjoy the full benefits of the recovery from the pandemic by ensuring collaboration between governments, educators and employers on projects that will create and maintain good jobs, are good for the environment, are inclusive, and address socio‑economic inequality.

Recommendation 46

Commit to working with the Canadian Colleges for a Resilient Recovery to train up to 50,000 Canadians across the country to develop the specialized skills needed to work in high-growth sectors of the low-carbon economy.

Recommendation 47

Provide funding for training and skills programs at college, cégeps, institutions, and polytechnics in the form of tuition support, curriculum development, indigenous and youth support programs and direct funding support to the Canadian Colleges for a Resilient Recovery in Budget 2022.

Recommendation 48

Support a green and inclusive recovery by ensuring that the physical and digital infrastructure of colleges are included within the scope of national infrastructure investments, and contributing up to:

- $5 billion to make college campuses more sustainable, accessible, advance innovation and improve learning spaces for Indigenous students; and

- $1.4 billion to upgrade colleges’ digital infrastructure, technology and cybersecurity systems; integrate simulation and virtual/augmented reality in hands-on courses; and provide digital support services for student success.

Recommendation 49

Accelerate sustainability initiatives at colleges and in communities by investing $100 million over 5 years in a new network of 50 College Sustainability Centres across Canada to leverage college assets such as industry and community partnerships, as well as campus infrastructure to meet Canada’s net zero goals.

“The shift to remote work during the pandemic has been profound and forced business leaders to adapt. Pandemic disruptions have also made it more challenging for Canadian companies to recruit and retain highly skilled workers. Over the past few months, we’ve been hearing from our members about how it’s harder than ever to find the workers these companies need to grow.”

Recommendation 50

Boost Canada’s talent pool through the development and implementation of permanent residency streams for international students graduating from colleges and equip colleges to improve labour market outcomes of international students by providing additional support throughout their transition to Canada.

Recommendation 51

Ensure Canada remains competitive in its ability to recruit, retain, and reward workers in a new post-pandemic economy that is increasingly distributed, global, and digitally dependent by establishing reliable pathways to permanent residency for high-growth company recruitment, accelerating support for upskilling and re-skilling programs in Canada and establishing a $40 million fund to develop national micro-credentials for key labour market sectors.

Recommendation 52

Strengthen Canada’s technical/trades training capacity by investing $50 million to develop over 1,000 shared online resources for college technical/trades programs available on a national collaborative platform.

Recommendation 53

Continue to invest in people through apprenticeship loans and grants and make improvements to the Union Training and Innovation Program to better equip training centres to meet new challenges and demands in the labour market.

Recommendation 54

Increase Canada’s commitment to international development to support skills training and applied research for the transition to a net zero world.

Health

Witnesses appearing before the committee discussed implementing a workplace strategy for health care workers, national health care standards for seniors, certain mental health services and programs, Indigenous-led mental health initiatives, changes to the Patented Medicine Prices Review Board, and safe lodging for those undergoing treatment or recovery.

Recommendation 55

Invest $57 million in core community mental health services and programs in order to ensure that all Canadians have access to the care they need, no matter where they live.

“Canadians require timely access to care and treatment in their own communities in order to recover from mental illnesses and substance use problems. To ensure this, we need strong federal leadership.”

Recommendation 56

Increase investments in supportive housing for people with mental illnesses and substance use problems in order to ensure that they have safe places to live as they recover.

Recommendation 57

Support the health and well-being of Canadians through funding of ParticipACTION for $50 million over five years.

Recommendation 58

Establish a federal interdepartmental task force on the promotion of physical activity, working with provinces, territories, and external stakeholders on developing a new national physical activity strategy.

Recommendation 59

Review how the prices of patented drugs are set, including through a reform of the Patented Medicine Prices Review Board.

Recommendation 60

Work collaboratively with patients, caregivers, and provincial and territorial governments to develop national care standards for home care and long-term care, regulated by the same principles as the Canada Health Act.

Recommendation 61

Establish new national standards to ensure that seniors receive universal, public, comprehensive and portable health care, and ensure that new federal funding to provinces is subject to these conditions.

Recommendation 62

Require provinces and territories to offer the same public health care to international students as is provided to domestic residents, in accordance with its duties under the Canada Health Act.

Recommendation 63

Establish a federal workplace strategy for health care workers.

Children, Families and Social Policy

With respect to children, families and social policy changes, witnesses focused on the Canada child benefit, income supports, poverty reduction, the national daycare initiative, federal disability benefits, and a Canadian livable income program.

“When it comes to a Canada livable income, substantial basic incomes already exist in Canada for families with children and for seniors. However, adults in the middle of their age range and who don’t have high incomes are left out from supports. The one support that they might be able to access, the Canada workers benefit, has received several significant changes in recent years, although it only covers workers with working income. One of the reasons people live in poverty is that they don’t have working income for some reason.”

Recommendation 64

Establish a responsibility point within government, accountable to a designated minister, with staff, expertise and other resources required to develop options for a national income security program that is federally led and consistent with basic income principles, especially unconditionality.

Recommendation 65

Engage with the Government of Prince Edward Island, as it has requested, and invite other jurisdictions (such as Newfoundland and Labrador, where similar basic income modelling has recently been done), to design a national basic income program. Such a program could use a Federal—Provincial-Territorial framework for transitioning to a new system, similar to collaboration that ushered in the national child benefit system in the 1990s.

Recommendation 66

Engage with stakeholders in developing design options, including former basic income pilot participants, recipients of other income security programs, and people with research, policy design, and implementation expertise on basic income type programs.

Recommendation 67

Create a system for income support eligibility determination and benefit distribution for marginalized people outside of the personal income tax system.

Recommendation 68

Implement a Canada Emergency Response Benefit repayment amnesty for everyone living below or near the low-income measure.

Recommendation 69

Address the growing inequalities laid bare and exacerbated by the COVID-19 pandemic by increasing funding for public services that benefit everyone.

“It is families who are experiencing systemic discrimination, First Nations, Inuit, Métis, racialized, immigrants, newcomers, children and families with disabilities, in lone mother led families, among other marginalized groups who are disproportionately poor, who are concentrated in low-waged, precarious working conditions and who have been disproportionately impacted by the economic fallout of the pandemic.”

Recommendation 70

Invest substantially in the base amount to allow the Canada child benefit to continue to reduce child poverty rates across the country.

Recommendation 71

Adopt more ambitious poverty reduction targets and invest in reducing overall poverty, and poverty in marginalized communities, by 50% between 2015‑2025 based on the after-tax low-income status of census families based on Census Family Low Income Measure using annual T1 Family File data.

Recommendation 72

Speed up the design and implementation of the new federal disability benefit.

Recommendation 73

Create a federal disability benefit for children.

Personal and Consumption Taxes

Appearing before the Committee, witnesses highlighted the political contribution tax credit, dividing family business income among siblings, intergenerational transfers, the taxation of house-flipping, income tax rates for individuals, the capital gains inclusion rate, the proposed luxury goods tax, the tax on split income, the caregiver tax credit, a personal energy rebate, the future taxation of energy, transfers of small businesses or family farms, and a tax credit for experienced workers.

“The Government has a responsibility to ensure a system of tax fairness is in place for all Canadians and to support skilled trades workers who build our infrastructure and communities.”

Recommendation 74

Create a skilled trades workforce mobility tax deduction to allow skilled trades workers to deduct work-related travel costs when these costs are not covered by their employer.

Recommendation 75

Eliminate the capital gains tax on donations of shares in private corporations or real property to charities.

Recommendation 76

Make the caregiver tax credit refundable.

Recommendation 77

Adopt a progressive excise tax system, similar to the U.S. Craft Beverage Modernization and Tax Reform Act, to help small Canadian distillers (and other craft alcohol producers) compete in Canada and abroad.

Retirement Income and Seniors

Proposals dealing with seniors and retirement income focused on the Guaranteed Income Supplement, emergency payments to seniors, community care agencies, Old Age Security, and protections for federally regulated retirement plans.

“Unprecedented longevity, declines in personal savings rates, and reduced access to workplace pension plans have all contributed to growing retirement insecurity.”

Recommendation 78

Increase Old Age Security benefits by 10% for all seniors eligible for the program.

Recommendation 79

Extend the Old Age Security benefits of deceased individuals by three months for the surviving spouse.

Recommendation 80

Revise the Old Age Security indexing method to account for wage growth in Canada.

Recommendation 81

Increase the Guaranteed Income Supplement by at least $50 per month for all seniors.

Recommendation 82

Increase the income threshold below which Guaranteed Income Supplement benefit amounts are not reduced.

Recommendation 83

Release the funds that have been earmarked in the Economic and Fiscal Update 2021 to repay seniors who lost a portion or all of their Guaranteed Income Supplement benefits as a result of receiving Canada Emergency Recovery Benefit.

Recommendation 84

Review the limits, conditions and tax implications of converting RRSPs to RRIFs to ensure that experienced workers who wish to continue working or return to the workforce are not penalized.

Recommendation 85

Set up a pension fund insurance plan for federally regulated retirement plans.

Chapter 4: Businesses

In Canada, corporations have had to pay taxes on their taxable income since 1916. Since their introduction to the Canadian tax landscape, corporate income taxes have become the fourth most significant contributor to federal tax revenue, behind personal income taxes, taxes on goods and services and social security contributions, and represented 17.1% of total federal revenues in 2020‑2021. In the computation of their income, corporations may namely deduct current expenditures and an amount representing the capital cost allowance (CCA) in relation to purchases of depreciable property. However, while current expenditures may generally be deducted in whole in the year in which they are paid, the amount of CCA is determined in accordance with prescribed rates which vary for different classes of depreciable property. Consequently, CCA has often been used as a means to encourage investment in a particular sector of the economy, for example by increasing the prescribed rate to 100% for one or more classes of depreciable property. However, such a measure decreases corporations’ income for tax purposes, which in turn contributes to a reduction of their taxes payable.

Figure 3 shows the amount of taxes on corporate profits as a share of GDP for G7 countries and the average for OECD countries. For Canada, this share increased from 3.3% in 2014 to 4.2% in 2020, the highest value among selected jurisdictions.

Figure 3—Taxes on Corporate Profits as a Share of Gross Domestic Product. G7 and OECD Average (%)

Note: Tax on corporate profits is defined as taxes levied by all levels of government on the net profits (gross income minus allowable tax reliefs) of enterprises. It also covers taxes levied on the capital gains of enterprises.

Source: Figure prepared by the Library of Parliament using data obtained from Organisation for Economic Co‑operation and Development, Tax on corporate profits, accessed on 10 February 2022.

Additionally, although as a rule, Canadian-resident corporations must pay tax on their taxable income earned worldwide while non-resident corporations pay tax on their taxable income earned in Canada, the globalization of the economy as well as the advent of the digital economy has enabled multinational enterprises to avoid taxation in many countries, including Canada. After years of efforts led by the Organisation for Economic Co-operation and Development (OECD) to tackle this issue, detailed rules were published by the OECD in December 2021 which brought the international tax system one step closer to imposing a global minimum 15% corporate tax rate to certain multinational enterprises, starting in 2023. Canada has also been working domestically to implement a digital services tax which “would apply at a rate of 3 per cent on certain revenue earned by large businesses from certain digital services.”

In addition to corporate taxation, witnesses who appeared before the committee spoke about temporary support measures, tourism and agriculture, industry and innovation, as well as financial and payments systems.

Corporate Taxation

On the topic of corporate taxation, witnesses argued for the implementation of measures aimed at ensuring that corporations and real estate investment trust pay their fair share of taxes. Other proposals were related to the corporate tax rate, the Accelerated Investment Incentive and the tax measures aimed at print news media.

“Enabling businesses to write off cybersecurity-related investments will encourage investment and improve security. This measure should include software, education, training, certification and equipment in the same year those investments are made.”

Recommendation 86

Introduce a tax credit to incentivize businesses to make investments in cybersecurity and data protection.

Recommendation 87

Modernize the Accelerated Investment Incentive to include advanced technology asset classes such as software, machine learning and artificial intelligence.

Recommendation 88

Consider implementing a rural development tax credit similar to the Atlantic Investment Tax Credit to other regions, notably North Shore in Québec.

Recommendation 89

Follow through on its commitment in the last budget to ensure that all sectors, including the web giants, pay their fair share of Canadian profits, while maintaining strong leadership in building a global agreement on cross-border digital taxation.

Recommendation 90

Make it impossible for companies to repatriate tax-free dividends from tax havens.

Recommendation 91

Exclude aircraft from the manufacturing tax in Budget 2021 and that its implementation be delayed until its impact on the industry can be more accurately assessed.

Temporary Support for Organizations

With respect to temporary support for organizations, witnesses presented proposals on the Canada Emergency Wage Subsidy and the Tourism and Hospitality Recovery Program, particularly on the eligibility criteria. Witnesses also emphasized the need to continue supporting the recovery in sectors that are still struggling.

Recommendation 92

Allow commercial tenants to receive the Canada Emergency Rent Subsidy for all months that they have been eligible for it since the start of the pandemic and for which they were unable to receive Canada Emergency Commercial Rent Assistance.

Recommendation 93

Increase the loan forgiveness portion for all government-backed business loans and extend the Canada Emergency Business Account repayment deadlines.

Recommendation 94

Allow small businesses that created their companies during the pandemic to access COVID-19 programs, while doing verifications beforehand to prevent illegitimate requests.

Recommendation 95

Adjust its investment programs to reflect the needs of the aerospace industry, including revising the Strategic Innovation Fund and the Aerospace Regional Recovery Initiative, and provide better coverage for the aerospace industry through the Hardest-Hit Business Recovery Program.

Tourism

On the subject of tourism, witnesses argued for various measures aimed at supporting the recovery of the tourism industry and facilitating travel in light of the new realities brought upon by the pandemic.

With regard to measures aimed at supporting the recovery of tourism, witnesses requested an additional funding program for festivals and events that are not cultural in nature, a dedicated immigration pathway for workers in the tourism industry and the promotion of Canada as a travel destination, both nationally and internationally.

With respect to the measures aimed at easing travel, the Committee heard proposals on the necessity to have adequate resources, including Internet access, to implement travel restrictions and allow the use of the ArriveCAN app as well as the necessity to have a clear timeline for the removal of travel restrictions.

“Recovery of the travel economy also rests on addressing a number of issues impacting travellers' perception.”

Recommendation 96

Update the current narrative used by government around travel, eliminate barriers to travel, correct the current perception consumers now have about traveling to and from Canada, and provide a clear timeline for removing travel restrictions, including removing all testing and isolation requirements and blanket travel advisories.

Recommendation 97

Rebuild consumer confidence and brand Canada as a premier travel destination by increasing efforts to market and promote Canada's exceptional offerings to the world. This includes investments to create new initiatives that support the building of destination infrastructure and the development of new products.

Recommendation 98

Modify the Tourism and Hospitality Recovery Program to allow all seasonable businesses to access the program.

Recommendation 99

Ensure the Canada Border Services Agency has enough resources to effectively accommodate the COVID‑19 requirements of travellers crossing the Alaska-Yukon border.

Recommendation 100

Ensure travellers have access to the Internet in remote locations so the requirement ArriveCAN app can be accessed, such as the Skagway-Fraser border.

“Communities and small businesses rely on tourism to create jobs and enhance overall quality of life for Canadians. The tourism industry recovery is essential to the overall recovery of the economy and will only be possible with a comprehensive strategy to restart the tourism workforce.”

Recommendation 101

Develop a comprehensive pan-Canadian tourism workforce strategy that complements new investments in marketing and other recovery efforts.

Recommendation 102

Conduct in consultation with Tourism HR Canada, a comprehensive review of all current Immigration, Refugees and Citizenship Canada programs to identify opportunities and align policies that will work for tourism, and to create a dedicated immigration pathway for the sector.

Agriculture

With respect to agriculture, the committee heard proposals to improve soil health. As well, the Committee was presented with proposals in written submissions, including on business risk management and other support initiatives, and the Temporary Foreign Worker Program.

“We believe that investment in soil health is needed to unlock the full potential of carbon sequestration by ensuring the resilience of our agri‑food sector.”

Recommendation 103

Provide direct assistance to farmers to help them accelerate the adoption of practices that promote soil health, develop a Canada-wide soil health strategy, develop a Canada‑wide network to share information and resources related to soil health, finance research into cost‑effectiveness to identify the economic benefits of best soil health practices on various production systems, and provide funding for training and hiring 1,000 additional advisory services officers.

“[Business risk management] programs are needed more than ever. Farm businesses are increasingly exposed to a variety of emerging risks: the COVID-19 pandemic, trade wars between foreign countries affecting global agricultural markets, extreme weather events, etc.”

Recommendation 104

Maintain all existing business risk management programs and enhance them so that they are better tailored to emerging risks.

Recommendation 105

Implement a new program, called Agri-green, to compensate farmers who meet certain environmental requirements or apply certain practices.

Recommendation 106

Provide a cost-sharing program for organic certification and a permanent funding to review and maintain Canada’s organic standards.

Recommendation 107

Create a limited statutory deemed trust, similar to the U.S. Perishable Agricultural Commodities Act, support needed liquidity and protect produce sellers during bankruptcy.

Recommendation 108

Improve service standards and processing times for applications under the Seasonal Agricultural Worker Program and the Agricultural Stream of the Temporary Foreign Worker Program, including by working with source countries and implementing measures to further streamline the collection of biometrics and visa and work permit application processes.

Recommendation 109

Provide funding and resources at the federal level to support expanded efforts to reduce food loss and waste throughout the supply chain.

Recommendation 110

Continue to prioritize Labour Market Impact Assessments for key occupations related to the agriculture and agri-food sectors, as well as for work permits.

Recommendation 111

Provide a stable and predictable budget for agronomic and agri-environmental research and innovation.

Industry and Innovation

Witnesses who spoke about industry and innovation presented proposals related to the generation and protection of intellectual property, the support of the cyber-security sector, the electrification of Canadian mines and the economic development of communities.

With respect to the generation and protection of intellectual property, proposals were made to recognize costs related to intellectual property as Scientific Research and Experimental Development expenses, to expand Canada’s Intellectual Property Strategy and to ensure Canada’s corporate tax regime is competitive.

Regarding the support of the cyber-security sector, witnesses made proposals to offer incentives to cyber security companies and to reform the Workforce, Research and Development, and Cybersecurity Export Advancement Working Groups.

Recommendation 112

Accelerate recovery, growth and competitiveness by expanding participation in Canada’s research and development ecosystem through an additional and permanent investment of $40 million per year in college applied research capacity and the delivery of innovation solutions.

Recommendation 113

Increase the capital supply to support budding companies after start-up and before they become attractive to venture capital funds.

Recommendation 114

Introduce a production modernization tax credit to adopt existing technologies and significantly improve business productivity as a complement to the Scientific Research and Experimental Development tax credit.

Recommendation 115

Bolster intellectual property generation in Canada by allowing IP-related costs to be recognized as eligible Scientific Research and Experimental Development expenses for income tax purposes.

Recommendation 116

Establish a government action plan with the objective of fostering the commercialization of innovative technology in Canada and around the world.

“Canada lags other industrialized countries when it comes to business investment, digitization, and the adoption of advanced manufacturing technologies.”

Recommendation 117

Develop a strategy for the manufacturing sector to drive investment in advanced manufacturing and make products more technologically sophisticated, thereby enhancing their value, and including intangible assets to prepare for a digital shift in the manufacturing economy.

Recommendation 118

Invest in Quebec’s existing pharmaceutical infrastructure by providing support for local industry, increasing the stockpile of critical drugs, and enhancing tax credits and/or subsidies for modernizing or expanding manufacturing facilities in Quebec.

Recommendation 119

Support the local manufacturing of medical products.

Recommendation 120

Build on the national quantum and artificial intelligence strategies and drive innovation in advanced technologies by making targeted investments in initiatives at the intersection of commercial opportunity and research excellence; where there is a strong potential for Canadian companies to capture a significant share of resulting high-value activity.

Recommendation 121

Work with industry and stakeholders to develop a long-term national aerospace strategy to ensure that Canada can reach its full potential in addressing the global generational challenges we face. Key elements would include a:

- technology roadmap for aerospace sustainability;

- defence industrial strategy;

- cutting-edge air mobility strategy;

- space policy and plan;

- workforce and skills development programs; and

- plans for SME supply chain resilience and competitiveness.

“[…] the certification branch is not keeping pace with growth of the country’s aerospace industry. […] Attrition rates of highly experienced personnel is a major concern, and lack of budget often means backfilling of these positions is not possible.”

Recommendation 122

Make significant investments in the certification and regulation of Canada’s aircraft through Transport Canada Civil Aviation and in the National Research Council of Canada’s proposed national flight research centre.

Recommendation 123

Make the financial assistance delivered to the aerospace industry in the 2021‑2022 budget permanent and ensure that it is delivered quickly and with the least amount of red tape possible for recipients.

Recommendation 124

Champion Canada’s mining advantage by supporting electrification at mining locations across the country and promoting sustainable mining development and operations.

Recommendation 125

Implement a first patent program or patent incentive program similar to Quebec’s Passeport Innovation, to cover both the initial searching and establishment of an intellectual property strategy as well as the drafting and filing of—at least—a first patent application on an invention.

Recommendation 126

Fund the stimulus program directed to Canadian small and medium-sized enterprises for brand protection strategy to cover costs associated with clearance searches and trademark applications.

Recommendation 127

Implement legislation or policy mandating that all federal government subsidies and research grants must earmark a small percentage of the funds to be used on intellectual property strategic advice and professional services to ensure our public investments in Canadian innovations are protected and commercialized by Canadian companies.

Recommendation 128

Maximize the benefits of COVID-related research and development and address leakage of publicly funded intellectual property by expanding Canada’s Intellectual Property Strategy.

Recommendation 129

Promote the proactive nature of the communities and use the instincts developed during the COVID-19 pandemic. For example, by promoting short consumption cycles, local purchasing, and ensuring that entrepreneurs can develop other types of practices and clienteles while developing other daily practices.

“Our strength is our outreach and the strength of our volunteers and professionals on the ground. However, our direct connection to the communities and direct connection to entrepreneurs make us a key partner.”

Société d'aide au développement des collectivités et Centre d'aide aux entreprises

Recommendation 130

Consider some decentralization of interventions by the Department of Finance so that the agencies and organizations represented by la Société d'aide au développement des collectivités et Centre d'aide aux entreprises could play a more significant and obvious role in our communities.

Financial and Payment Systems

Witnesses appearing before the Committee argued for changes to the Canadian payment systems and the implementation of recommendations from the Advisory Committee on Open Banking.

“As consumers and [small and medium-sized enterprises] in countries like the United Kingdom reap the benefits of a well-regulated open finance regime, it is becoming increasingly urgent that the government proceed with a Canadian open banking regulatory system.”

Recommendation 131

Move forward with open banking and implement the recommendations that came out of the advisory committee on open banking, with clear timelines for legislative implementation, accompanied by the designation of a government lead to shepherd the process.

Recommendation 132

Deliver on the election promise to cut the average overall cost of interchange fees for merchants and ensure that these cuts go primarily to small and medium-sized businesses that currently pay the highest fees.

Recommendation 133

Reform the Code of Conduct for the credit and debit card industry in Canada to improve the transparency and consistency of fees charged by credit card companies, and introduce an independent dispute resolution process.

Recommendation 134

Prohibit credit card companies from charging fees on sales taxes or find a way to offset the additional costs to small and medium-sized enterprises by reimbursing them for these amounts.

Recommendation 135

Continue working with provincial governments on financial sector governance, specifically in relation to consumer-directed finance, retail payments, privacy and consumer protection.

Chapter 5: Environment and Climate Change

In Canada, the impacts of climate change are already being felt. According to Canada’s Changing Climate Report, Canada is warming faster than other parts of the world; Northern Canada is warming at more than double the global rate. Across Canada, the impacts of climate change include the increasing intensity and frequency of extreme weather events, such as floods, droughts, tornadoes, wildfires and heat waves, as well as sea-level rise, melting permafrost and changing availability of freshwater. For example, the extreme heat, wildfires, rainfall and flooding seen in British Columbia in the summer and fall of 2021 are considered by many experts to have been exacerbated by climate change.

Canada is party to the United Nations Framework Convention on Climate Change (UNFCCC). At the 21st conference of the parties to the UNFCCC in Paris in 2015, Canada and 194 other countries reached the Paris Agreement. The Paris Agreement represents the first legally binding and universal agreement on climate in UNFCCC history, with the aim of keeping global warming below 2°C and “pursuing efforts” to limit it to 1.5 °C. Evidence suggests that any temperature increase above 1.5°C is likely to have severe consequences for society and ecosystems.

Countries agreed to set their own greenhouse gas (GHG) emission reduction targets, referred to as nationally determined contributions (NDCs), and to update these with more ambitious targets every five years. Canada submitted its enhanced NDC to the UNFCCC secretariat in July 2021, committing to reduce GHG emissions to between 40% and 45% below 2005 levels by 2030. Canada enshrined this target, along with its commitment to reach net-zero emissions by 2050, into law when the Canadian Net-Zero Emissions Accountability Act received Royal Assent on 29 June 2021.

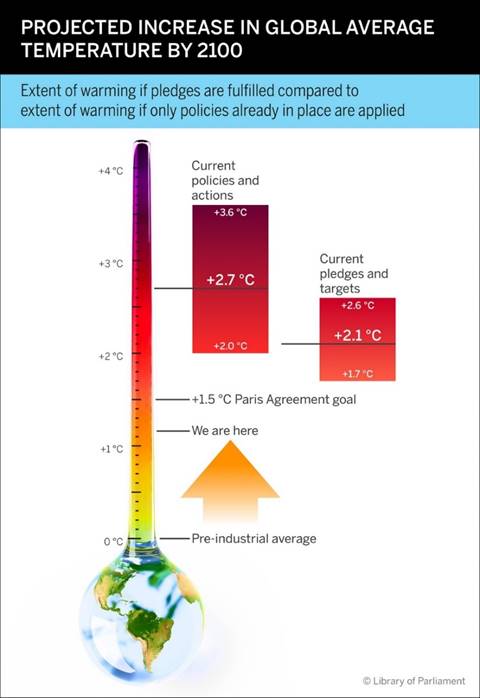

At the 26th Conference of the Parties (COP26) held in Glasgow in November 2021, about 150 countries committed to increase their efforts to reduce GHG emissions. The combined formal pledges made by all parties to the UNFCCC to date – if honoured – would limit the global temperature rise to between 1.7 °C and 2.6 °C above pre‑industrial levels. Figure 4 illustrates the disparity between the warming that will result from GHG emissions reductions pledged by countries and the policies that are currently actually being implemented.

Figure 4—Projected Increase in Global Average Temperature by 2100

Note: “Current policies and actions” refers to those already in place or underway. “Current pledges and targets” refers to those that have been formally submitted to the United Nations Framework Convention on Climate Change secretariat. The temperature shown in the middle of each coloured box is the “median” warming estimate in 2100. This means that there is a 50% chance that the calculated temperature will be exceeded if the given emissions pathway is followed.

Source: Figure prepared by the Library of Parliament using data obtained from Climate Action Tracker, “The CAT Thermometer explained,” The CAT Thermometer. In: Alison Clegg and Natacha Kramski, Library of Parliament, HillNote, COP26: Negotiating for 1.5 Degrees Celsius, 7 December 2021.

Canada’s second and current national climate plan, A Healthy Environment and a Healthy Economy, was released in 2020. This plan lays out the federal, provincial, and territorial actions to fight climate change and meet Canada’s international commitments to GHG emissions reductions.

On the subject of environment and climate change, witnesses focussed their remarks on the electrification of transports, the transition to a low-carbon economy and the preservation of natural environments.

Electrification of Transports

With respect to the electrification of transports, the Committee heard requests for the development of strategies and the setting of targets for zero-emission vehicles (ZEV) adoption, the renewal, expansion or reform of existing financial incentives for the purchase of ZEV and the introduction of new incentives. Proposals were also made to implement measures to support the development of ZEV supply chains, education and training initiatives regarding ZEV and the electrification of government and Crown corporation fleets.

“The future of mobility is electric, whether light-duty, mid‑size, heavy-duty or off-road vehicles.”

Recommendation 136

Adopt a clear, thought-out action plan to achieve its 100% zero-emission vehicle sales target by 2035.

Recommendation 137

Develop a Canadian electric mobility strategy to achieve Canada’s climate and electrification targets, with considerations for rural and remote communities.

Recommendation 138

Renew and expand eligibility for the Incentives for Zero-Emission Vehicles Program for individuals, businesses and vehicle fleets by restoring funding to the program and increasing the base manufacturer’s suggested retail price threshold for eligible light-duty vehicles to $60,000, with a cap of $69,999.

Recommendation 139

Create a green version of the Retire Your Ride program that is focused on Canada’s long‑term climate goals, meaning that the funds should only be available for the purchase of new or used zero-emission vehicles, transit passes and active transportation equipment (e.g., bicycles, electric or otherwise). This program should be stackable with other incentive programs.

Recommendation 140

Provide targeted incentives for the research and development of heavy and commercial electric vehicles, including the development of electric ambulances.

Recommendation 141

Support the development and increase economies of scale in the Canadian zero-emission vehicle supply chain to accelerate the reduction in battery prices and zero-emission vehicle technologies by leveraging research and development, Strategic Innovation Fund, resource exploration and other economic development funding.

Transition to a Low-Carbon Economy

Speaking on the transition to a low-carbon economy, witnesses proposed measures related to the elimination of fossil fuel subsidies, Canada’s carbon pricing framework, the energy efficiency of homes and buildings and the inclusion of Indigenous Peoples in emission‑reducing initiatives. The Committee also heard proposals for the development of a circular economy strategy and investments in green technologies.

Recommendation 142

Publish a roadmap for eliminating ineffective fossil fuel subsidies by 2025 with a robust definition to meet Canada’s G20 and G7 commitments, adopt robust legislation and a fair transition plan that supports workers and communities that depend on fossil fuel development, and reorient public finance in line with Canada’s climate change commitments.

“Urgent, proactive action is required to ensure that Canadian workers in the energy sector are not left behind. An April 2021 TD report estimates that 50 to 75 per cent of the 600,000 workers in the oil and gas sector—between 312,000 to 450,000 workers—are at risk of displacement in the transition to Net Zero through 2050.”

Recommendation 143

Support energy workers impacted by the transition to a green economy—particularly workers in the oil and gas sector by ensuring that retraining opportunities or relocation supports are available and by introducing a sector-specific task force that includes labour, industry stakeholders and government representatives to assess the industry’s needs during this pivotal transition period.

Recommendation 144

Develop and implement a national electrification framework to help Canada reach its decarbonization targets.

“As Canada relies more on electricity for its energy needs, it must ensure the system remains cost-effective and reliable.”

Recommendation 145

Assess Canada’s climate change adaptation needs in the energy sector and establish an Energy Climate Adaptation Fund.

Recommendation 146

Prioritize discussions on modernizing electricity regulatory frameworks with provinces and territories.

Recommendation 147

Coordinate and complement energy efficient financing and incentive programs.

Recommendation 148

Implement a coherent, green, inclusive industrial strategy with enough funding to meet post‑pandemic challenges, spur economic recovery and build a resilient and inclusive economy in the long term. This strategy must include concrete ideas, such as:

- investing in the energy transition and the fight against climate change;

- consolidating operations in existing industries, strengthening secondary and tertiary processing operations and adopting procurement strategies that shorten supply chains; and

- investing in infrastructure projects, including those with a social mission, and supporting businesses through targeted and conditional financial assistance for job creation, better salary conditions, environmental progress, as well as Canada-wide investments.

Recommendation 149

Adopt a national circular economy strategy by working with the provinces, territories and municipalities.

Preservation of Natural Environments

Witnesses who spoke about the preservation of natural environments made proposals related to the management of terrestrial and marine protected areas, Indigenous-led conservation efforts, the development of a Pan-Canadian approach to the management of fresh water, Canada’s commitments regarding the Great Lakes and the establishment of an office of environmental justice.

“[I]t is now critical to focus more attention on addressing the related climate and biodiversity crises and shaping a world that is equitable, carbon-neutral and nature-positive for current and future generations of Canadians and people worldwide.”

Recommendation 150

Provide permanent funding to reach Canada’s protected areas targets, to effectively manage terrestrial and marine protected areas, and to support Indigenous-led conservation and stewardship, as well as to support local conservation-focused economies. This would include support for protected areas established and/or managed by the federal government as well as by Indigenous, provincial, territorial, and municipal governments, and other partners.

Recommendation 151

Invest in a Pan-Canadian Approach to Fresh Water with shared responsibility between federal departments and other levels of government.

Recommendation 152

Work closely with industry to adopt a systemic approach to finding ways of reducing plastic waste. These solutions must be evidence-based and involve a combination of education, innovation and investment in key infrastructure.

Recommendation 153

Expand the size and scope of the Natural Heritage Conservation Program to propel Canada toward becoming nature positive by 2030 and carbon neutral by 2050.

Recommendation 154

Contribute $19.44 million to the Great Lakes Fishery Commission, which would fulfill a binational promise and help improve the fishery.

Recommendation 155

Establish a new high-level office of environmental justice, learning from a model already in place in the United States since the early 1990s.

Adaptation to Climate Change

The Committee was presented with proposals in written submissions on the topic of adaptation to climate change, including for increased funding and the creation of new roles and responsibilities within the government in order to respond to climate change and address its impact on people and infrastructure.

“Effective recovery starts before an emergency and is linked closely with Disaster Risk Reduction, emergency preparedness and resilience.”

Recommendation 156

Invest $200 million to withstand the direct and indirect impacts of climate change through targeted strengthening of individual and household resilience capacity.

Recommendation 157

Appoint an advisor on national disaster resilience to scan for future tail-risk events, such as earthquakes, pandemics, cyber attacks and catastrophic floods, and to advise on the measures needed to prepare Canadians and their governments and businesses properly.

Recommendation 158

Extend and enhance its recent work to reduce the risk and impact of flooding across Canada.

Recommendation 159

Expand the Disaster Mitigation and Adaptation Fund to $4 billion, and from this amount dedicate $500 million to natural infrastructure solutions.

Recommendation 160

Establish the Canadian Centre for Climate Information and Analytics as a first priority under the Sustainable Finance Action Council to help public and private sector organizations assess, disclose and manage escalating physical risks.

Recommendation 161

Fund and prioritize the completion of the National Climate Adaptation Strategy, ensuring it protects people and infrastructure from the threat of increased flooding, wildfire, heat, drought and other extreme weather events.

Recommendation 162

Implement the measures requested by the Coalition for a Climate Proof Canada to further protect Canadians, create a culture of preparedness and build a country that is resilient to natural disasters.

Chapter 6: Indigenous Priorities

In Canada, Indigenous peoples (First Nations, Inuit and Métis) represent a young and fast-growing segment of the population. As shown in Figure 5, the share of individuals aged 0 to 14 in 2016 was relatively larger among Indigenous Peoples than among the non‑Indigenous population.

Figure 5—Share of the population aged 0 to 14 years and 65 years and over by Indigenous Identity in Canada, 2016 (%)

Source: Figure prepared by the Library of Parliament using data obtained from Statistics Canada, Aboriginal peoples in Canada: Key results from the 2016 Census, 25 October 2017.

According to Statistics Canada, over 1.67 million people (or 4.9% of the total population) identified as First Nations, Inuit or Métis in 2016. By 2041, it is estimated that the Indigenous population could represent between 2.5 million and 3.2 million individuals in Canada (or 5.4% to 6.8% of the total population).

Pursuant to article 3 of the United Nations Declaration on the Rights of Indigenous Peoples, “Indigenous peoples have the right to self-determination. By virtue of that right, they freely determine their political status and freely pursue their economic, social and cultural development.” Yet, First Nations, Inuit and Métis communities continue to face significant barriers to economic development across Canada. For instance, the National Collaborating Centre for Indigenous Health notes that “[s]tructural inequities and unique barriers can make it difficult for Indigenous communities to attract and facilitate economic growth.”

Removing barriers to economic development in Indigenous communities and achieving economic reconciliation would not only benefit First Nations, Inuit and Métis, but Canada as a whole. In 2019, the National Indigenous Economic Development Board reported that “[c]losing the socio-economic gaps between Indigenous and non‑Indigenous people in Canada could lead to a $27.7 billion annual contribution to the Canadian Gross Domestic Product (GDP).”

Under section 91(24) of the Constitution Act, 1867, matters related to First Nations, Inuit and Métis peoples and their lands generally fall within the jurisdiction of the federal government. Indigenous Services Canada and Crown-Indigenous Relations and Northern Affairs Canada, among others, administer several programs to Indigenous peoples, communities, businesses and organizations. The federal government offers programs and funding to support economic development in Indigenous communities, including:

- The Access to Business Opportunities and Access to Capital streams of the Aboriginal Entrepreneurship Program, an initiative managed by the National Aboriginal Capital Corporations Association (NACCA);

- The Indigenous Growth Fund (an initiative led by NACCA);

- The Strategic Partnerships Initiative;

- The Indigenous Community Infrastructure Fund; and

- The pandemic-related Indigenous Community Business Fund.

In addition, the First Nations Fiscal Management Act (FNFMA) and the First Nations Land Management Act (FNLMA) have established optional regimes through which participating First Nations may gain additional authority over financial and land management, as well as supports from First Nations fiscal and land management institutions. One of the main goals of these statutes is to enable economic development in First Nations communities. It should be noted, however, that the FNFMA and FNLMA do not apply to Inuit and Métis.

On the topic of Indigenous priorities, witnesses focused their testimony on issues surrounding development and access to capital, taxation policy, and other areas.

Witnesses who spoke about development and access to capital made proposals for Indigenous-led economic development, the establishment of a First Nations Infrastructure Institute, more support for the FNFMA institutions, the monetization of major capital transfers and an Indigenous land title and registry system.

With respect to taxation policy, the Committee heard requests for greater fiscal powers for First Nations, including with respect to sales and excise taxes, as well as for further support for the development of a First Nations-federal-provincial fiscal relationship.

The Committee also heard proposals about other issues, such as funding for child welfare, the implementation of Calls to Action from the Truth and Reconciliation Commission and the Calls to Justice from the National Inquiry into Missing and Murdered Indigenous Women and Girls, as well as the need for an Indigenous housing strategy.

“The [First Nations Fiscal Management Act] stands as an international example of how to respect indigenous rights and achieve economic reconciliation by implementing indigenous jurisdiction.”

Recommendation 163

Renew the mandates of the institutions created by the First Nations Fiscal Management Act to provide greater fiscal authority to First Nations, improve financial and statistical management frameworks, and support more First Nations.

Recommendation 164

Supports amendments to the First Nations Fiscal Management Act to improve First Nations access to capital, facilitate the exercise of First Nations jurisdiction and build capacity and resources for innovation and provide decision-making power to First Nations.

Recommendation 165

Amend the First Nations Fiscal Management Act to enhance the mandates of the institutions created by that Act, support the publication of more First Nations Fiscal Management Act statistical information, and provide statutory funding for these institutions.

Recommendation 166

Support the development of an Indigenous land title and registry system framework for additions to reserve as advanced by the First Nations Lands Management Board.

“All sectors identified by the [Truth and Reconciliation Commission] must do their part [to advance reconciliation], including postsecondary institutions.”

Recommendation 167

Deliver on the Truth and Reconciliation Commission Calls to Action, including those directed to postsecondary institutions by supporting the development of:

- Indigenous language revitalization and diploma/degree programs in Indigenous languages in partnership with Indigenous institutions and communities;

- open educational resources to train all students, faculty and staff on the history of Indigenous peoples and the legacy of residential schools, Indigenous rights, legal and health issues; and

- skills-based training for all students, faculty and staff in intercultural competency, conflict resolution, human rights, and anti-racism.

Recommendation 168

Establish multi-year funding for community-based youth organizations to deliver programs on reconciliation, and establish a national network to share information and best practices per Truth and Reconciliation Commission Call to Action 66.

Recommendation 169

Fund full implementation of both the 94 Calls to Action from the Truth and Reconciliation Commission and the 231 Calls to Justice from the National Inquiry into Missing and Murdered Indigenous Women and Girls.

Recommendation 170

Look at the 12 levers of Indigenous economic design and invest into those structures, moving outside of the emphasis particularly on programs and services.

Recommendation 171

Look at investing into structures, systems and tools, and convening an economic space for Indigenous-led leadership.

Recommendation 172

Renew and enhance the sunsetting Friendship Centre funding at a minimum of $60 million per year for at least the next 10 years.

Recommendation 173

Include Indigenous peoples in climate initiatives, such as working towards net zero, carbon capture in the agriculture sector, and liquified natural gas projects.

Recommendation 174

Commit to a fourth urban and rural Indigenous housing strategy.

Recommendation 175

Increase funding for Indigenous-led mental health initiatives, including doubling the budget of the Aboriginal Health Human Resources Initiative.

Recommendation 176

Allocate funding toward immediate compliance with the Canadian Human Rights Tribunal ruling to provide equitable funding for child welfare services on reserve, ensure the full application of Jordan’s Principle and the Spirit Bear Plan.

Recommendation 177

Reduce poverty in Indigenous communities by investing in those communities in a manner that allows them to direct how those funds are used.

Chapter 7: Communities