INDU Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

Positioning Canada as a Leader in the Supply and Processing of Critical Minerals

Introduction

On 26 January 2022, the Standing Committee on Industry and Technology (the Committee) passed a motion to undertake a study of:

- how Canada can best protect it’s national security by preventing the sale of critical mineral assets to hostile foreign interests;

- how Canada can leverage the role that the critical minerals sector will play in driving our clean energy future by positioning Canada as a reliable and sustainable supplier of green technologies, including the development and manufacture of next-generation battery technology;

- how Canada can reduce its reliance on and vulnerability to foreign supply chains when it comes to the sourcing and processing of critical minerals;

- the potential for Canada to be a world leader in the production and transformation of critical minerals, particularly as it relates to the growing battery and electronic vehicle ecosystem in Canada and across North America; and

- how Indigenous communities can be active participants in this sector.[1]

Over the course of this study, the Committee heard from 24 witnesses in February and March 2022. After the Committee finished hearing testimony for this study, the federal government announced investments for critical minerals in its 2022 budget, including $3.8 billion to implement Canada’s first critical minerals strategy.[2] The Committee believes that this report’s findings can guide the federal government in implementing this strategy.

The Canadian Mining Industry and Critical Minerals

The energy transition in many countries is contributing to an increase in demand for many minerals. Many advanced technologies used to produce electricity without greenhouse gas (GHG) emissions and to electrify transportation require many types of minerals. For example:

- the average electric vehicle (EV) can require six times the amount of minerals a conventional car does;

- batteries used in EVs are composed primarily of nickel, cobalt and lithium, minerals that are not typically used in the manufacture of conventional vehicles; and

- a wind plant needs up to nine times more mineral resources than does a gas‑fired plant.[3]

The Honourable Greg Rickford, Minister, Ministry of Northern Development, Mines, Natural Resources and Forestry, Government of Ontario, said “There is no green economy without mining.”[4]

In March 2021, the Government of Canada released a list of 31 critical minerals available in Canada, some of which are already being mined (Figure 1). The Government of Canada has identified these minerals as being of strategic importance to Canada because they are essential to Canada’s economic security, are required for the transition to a low carbon economy and are a sustainable source of essential minerals for Canada’s economic partners.[5]

Figure 1—List of Canada’s Critical Minerals (2021)

Source: Natural Resources Canada, Critical minerals.

Critical minerals are essential not only for the energy transition, but also for many industries.[6] For example, rare earth elements (REEs) are used in different ways for EVs and conventional vehicles.[7] Professor Karim Zaghib said that REEs are of such great importance for many technologies that they should be considered national security elements.[8] David Billedeau of the Canadian Chamber of Commerce pointed out that some minerals, such as potash, are essential for food security, as they are vital for crop production and quality.[9] Figure 2 provides examples of different uses of minerals.

Figure 2—Uses of Critical Minerals

Source: Figure prepared by the Library of Parliament.

Canada has reserves of many minerals that will be in high demand in the years to come. Matthew Fortier, from Accelerate: Canada’s ZEV Supply Chain Alliance, said that Canada is one of the few Western countries that has all the critical minerals.[10] For example, Canada has all the minerals needed to produce EV batteries.[11] It is also possible that there are solid lithium deposits in every province and territory in the country.[12]

According to witnesses, critical minerals exploration in Canada is lacking. Citing Statistics Canada data, Jeff Killeen, from the Prospectors and Developers Association of Canada, explained that high mineral prices in recent years have increased exploration activity in Canada, but the share of exploration spending directed at critical minerals such as cobalt, lithium, graphite or REEs accounted for less than 3% of domestic activity in 2021.[13] He also noted that Natural Resources Canada’s Top 100 Mineral Exploration Projects Map for 2020 shows that there was just one lithium exploration project amid many exploration projects for precious metals.[14] Professor Benoît Plante said that Canada could develop its expertise in critical minerals by building on the expertise developed in the base and precious metals sector.[15]

The Global Mining Context

Global demand for many minerals will continue to increase significantly by 2050 to meet the needs of the energy transition. For example, as Figure 3 shows, global demand for lithium and graphite could increase by 488% and 494%, respectively, between 2018 and 2050. Benoit La Salle, President and Chief Executive Officer of a mining company, said that mineral prices have risen significantly in the past year in response to this large increase in demand.[16] He believes these prices will continue to rise, as demand is expected to continue to grow in the coming decades.[17]

Figure 3—Change in Demand for Minerals Necessary for the Energy Transition from 2018–2050

Source: Figure prepared by the Library of Parliament using data from the Government of Quebec, Critical and strategic minerals – Québec Plan for the Development of Critical and Strategic Minerals 2020-2025, p. 1.

Many countries are already investing in mineral exploration and development to power their energy transition. These countries include the People’s Republic of China (PRC), Australia and several European countries.[18] Many witnesses described the current situation as a minerals race.[19] Witnesses said that all Western countries are lagging behind the PRC in developing a critical mineral supply chain.[20] Some witnesses expressed concern that Canada is missing this opportunity, as it is still not investing enough in critical minerals exploration, and stressed the importance for Canada to quickly position itself in this minerals race.[21] Juan Merlini, from Vale Canada Limited, said that the “size of the challenge, the investments that are required, the amount, the volume, the stability that is required to fulfill the EV industry is unprecedented, and that’s the support we need from all levels.”[22]

Witnesses deplored that the value chain for critical minerals is currently dominated by one country. The PRC controls most of the refining and processing of many minerals, including lithium and REEs.[23] Citing a Bloomberg New Energy Finance report, Daniel Breton from Electric Mobility Canada said that, in 2020, the PRC controlled 80% of the world’s critical mineral refining, including REEs, and 77% of the world’s battery cell manufacturing capacity.[24] He also stressed that having control does not necessarily mean having the mines in one’s own country, but having invested in the mines of other countries as well. Mr. Billedeau, like many witnesses, expressed serious reservations towards this situation, saying that Canada’s “economic and environmental ambitions should not hinge on importing critical minerals from any one country, particularly when we have abundant reserves here at home.”[25]

One country’s dominance of the critical minerals supply chain poses many risks. Witnesses said that the PRC has already used its dominance of the critical minerals chain to reduce global supply and increase prices for some critical minerals, including REEs.[26] Meredith Lilly, an associate professor, argued that, while the PRC complied with a World Trade Organization (WTO) ruling as a result of this dispute,[27] Canada cannot rely on the PRC to fulfill its trade treaty obligations.[28] Charles Burton, a senior fellow, argued it would be worrisome if the PRC gained a geopolitical advantage over minerals that are central to the advanced technology sectors, as it could use this position against Canada.

The witnesses discussed national security issues related to the PRC. Dr. Burton noted that, while Canada should be agnostic to a national security threat assessment, the approach with the PRC should be different, as all PRC companies are controlled in one way or another by the Chinese Communist Party.[29] He added that Canada should subject all PRC acquisition requests to a National security review under the Investment Canada Act.[30] For example, some witnesses thought that Canada should have prevented the 2021 acquisition of Neo Lithium Corporation, a mining company incorporated in Ontario whose main asset is the Tres Quebradas (3Q) lithium project in Catamarca province, Argentina, by Zijin Mining Group Co.[31] Dr. Lilly said that Canada should be more strategic in its application of the national security review process by consulting with allies and adapting it to geopolitical circumstances.[32]

Considering these risks, it is important to diversify the critical minerals supply chain. This would prevent any one country from gaining dominance.[33] It would also allow Canada to reduce risks along its entire supply chain, particularly given increasing tensions between the PRC, Russia and the Western alliance.[34] To do this, Dr. Burton proposed that Canada collaborate with like‑minded countries and groups that respect WTO rules to ensure that supply chains are not interrupted for political or geostrategic reasons.[35] Canada should develop its own value chain of advanced technologies, including EVs, by extracting and processing minerals domestically, while maintaining a comprehensive understanding of the supply chain.[36] Mr. Breton argued that Canada must avoid being in the same situation it was in with geopolitical tensions in the 20th century because of its dependence on foreign oil.[37]

Building a Resilient Supply Chain

Background

Canada’s many advantages enable it to play an important role in the global advanced technologies value chain.[38] Witnesses said that, in addition to having reserves of most critical minerals, Canada has a skilled labour force, low-cost access to inputs such as water and land, a stable and predictable geopolitical situation, a free trade agreement with the United States and a strong environmental framework.[39]

Several witnesses said that Canada’s mining standards are an asset in the global advanced technologies value chain and set Canadian products apart from the competition.[40] For example, Sarah Houde from Propulsion Québec said that Canadian batteries won’t compete with PRC batteries on price, but on the fact that they are more environmentally responsible.[41] Mr. Breton said that Canada can be a reliable source for critical minerals for partners like the United States (U.S.) and Europe.[42] Ms. Houde added that some parts of the country are using low-carbon, low‑cost renewable energy.[43] According to Mr. Billedeau, environmental sustainability and economic competitiveness are tethered.[44]

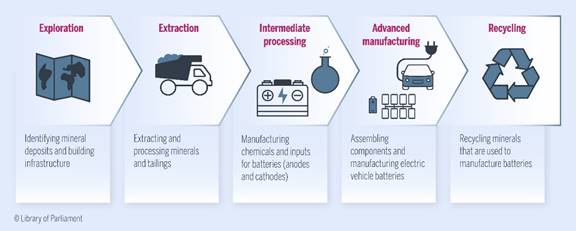

It is therefore critical for Canada to quickly establish a comprehensive critical minerals strategy, including extraction, processing and end-of-life management of advanced technologies made from these minerals, to position itself as a leader in this area.[45] Figure 4 shows the stages of the battery value chain that could be included in a Canadian critical minerals’ strategy.

Figure 4—Battery Value Chain

Source: Figure prepared by the Library of Parliament.

Importance of electrification of the Canadian Transportation sector

The federal government must continue to support Canada’s rapidly changing automotive industry. Mr. Fortier said that the automotive industry is Canada’s second largest export industry and accounts for 10% of its manufacturing gross domestic product (GDP).[46] Canada’s established automotive industry is one of its strengths in developing an advanced technologies value chain.[47] However, the automotive industry is undergoing major changes, and Patrick Gervais from Lion Electric said that the question is not whether the electrification of transportation is going to happen, but how it’s going to happen.[48] Moreover, in Canada, in addition to conventional vehicle manufacturers, Lion Electric, a manufacturer of all-electric heavy-duty vehicles, has just announced the construction of a battery manufacturing facility for EVs in Mirabel that will be operational by the end of 2022.[49]

The electrification of transportation could have significant economic benefits for Canada. Mr. Breton said that there are many types of EVs—bikes, cars, buses, trucks, boats, snowmobiles, and mining trucks—which makes it an important industry.[50] As well, EV companies prefer to source minerals close to their facility to minimize their environmental footprint and to secure supply.[51] As Mr. Fortier explained, developing an EV sector in Canada is economically multiplying because if a manufacturer in Canada sources critical minerals in Canada it would create jobs throughout the value chain.[52]

Several witnesses said that Canada needs to rapidly develop a national critical minerals strategy to attract and retain EV manufacturers, create value-added jobs, and take advantage of Canada’s strategic position to be a leader in the EV production chain.[53] Without this strategy, the long-term commitments of auto manufacturers to Canada will remain uncertain.[54]

Securing Access to Critical Minerals

Securing the supply of critical minerals in developing an advanced technologies value chain is critical for Canada. Witnesses said that having the factories and expertise to manufacture batteries in Canada is meaningless if access to critical minerals is not secured.[55] If Canada focuses only on manufacturing advanced technologies and imports the necessary minerals, it will remain dependent on other countries.[56] With growing demand for advanced technologies such as EVs and with many other suppliers in the supply chain turning to Asian companies for their critical mineral supplies, Canada could face disruptions in access to critical minerals.[57] Eventually, Canada could lose the ability to import critical minerals altogether, as witnesses explained that the PRC government’s strategy is to buy the minerals and sell only batteries and EVs in the future, and all Canada will be able to do is import technologies, not minerals.[58]

Witnesses expressed concerns about the sale of Canadian mineral deposits to foreign companies. For example, Quebec recently sold a lithium project to Australians.[59] Mr. La Salle worried about this situation, because foreign companies will sell the extracted resources to companies in their own country and not to the Canadian market, jeopardizing the supply of minerals to Canadian companies.[60] Martin Ferron, Mayor of Malartic, was also concerned that foreign companies buying mines in Canada are not building relationships with local communities, especially First Nations, to understand their realities and to contribute to the mining industry in the region where the mine is located.[61]

Having a national critical minerals strategy would enable Canada to take a coherent approach to protecting its mineral deposits. Mr. La Salle said that Canada must protect its mineral reserves, as “[i]t’s the same as it was for masks. When we needed masks [at the start of the COVID-19 pandemic], we found out that countries around the world were keeping them for themselves. When we need lithium, graphite and nickel, everybody in the world will be looking for them.”[62] He added that the federal government needs to give Canadian mining companies “the freedom to make sure our projects are discovered by us, developed by us and sold by us.”[63] Establishing a national critical minerals strategy would also help secure the supply of minerals across the advanced technologies value chain.[64]

Encouraging Timely Development of the Mining Sector

The time frame for extracting and processing critical minerals for new deposits can be lengthy, underscoring the importance of Canada acting now to develop critical minerals here.[65] Many witnesses said that it can take at least 10 years from discovering a deposit to developing a mine.[66] Dr. Zaghib added that it can take up to seven years to transform minerals into the materials needed for batteries (e.g., anodes and cathodes) on an industrial scale.[67] Witnesses added that each battery plant will need a lithium mine and a graphite mine, so Canada needs to start exploration and development as soon as possible if it is to open plants that make every component of a battery in Canada.[68]

Witnesses explained the work their companies are doing to advance lithium development in Canada. Trevor Walker, President and Chief Executive Officer of Frontier Lithium, said that his company is developing a lithium project in Ontario. Frontier Lithium’s preliminary economic assessment indicates that the mine could have a 26‑year mine life and enough lithium to support the production of roughly 500,000 EVs a year. He noted that he has received government funding to advance this project.[69] Amanda Hall of Summit Nanotech said that her company has developed a sustainable and economical way to extract lithium. She has received funding from international investors, although she would have preferred Canadian investors. She attributed this to greater risk aversion among Canadian investors.[70]

Exploration costs associated with critical minerals can be high and unpredictable. Witnesses said that, in addition to facing high exploration costs, mining companies must wait several years, once the mine is in production, before seeing returns on investment.[71] Mr. Glencore added that, since mining companies do not set the price on minerals, they cannot stabilize operations by passing on costs to customers.[72]

Some witnesses believed that the high cost could limit critical mineral exploration. Mr. Killeen said that current mining projects are more targeted towards projects with a shorter payback period, such as gold or copper deposits in a known area with processing capacity.[73] Canada’s natural resources industry remains underdeveloped because of limited exploratory work, particularly in northern regions where there is a lack of infrastructure. Yet, according to Mr. Billedeau, these regions must be developed if Canada is to become a major critical mineral supplier globally.[74] Mr. Killeen said that Canada should develop a better inventory of known resources and reserves to inform infrastructure decision making.[75]

Mines are far from the infrastructure of major centres, which makes exploration more complex, but it also provides an opportunity for rural and remote areas. Mr. Ferron said that locating mining projects away from major centres would accelerate economic recovery in parts of Canada where few opportunities exist.[76] Mr. Ferron and Mr. Rickford both emphasized the importance of developing the mining industry around the mine, which will bring wealth and economic diversification to rural and remote areas through the intermediate processing of minerals.[77] M. Rickford added that the government should build a corridor of prosperity and break the isolation of remote communities by providing them with the resources and infrastructure to prosper in the long term.[78]

Some witnesses felt that some aspects of Canada’s regulatory system hinder the timely development of the mining sector. A few witnesses said that the Canadian regulatory system is complex and the time frames are too long.[79] Mr. Walker argued that unpredictable timelines needed to obtain a permit for the development of a mine, the infrastructure and the chemical processing plants are a barrier for companies and leave them financially weakened, putting them at risk of being taken over by foreign-owned companies. This jeopardizes Canada’s ability to be a leader in the critical minerals sector.[80] Witnesses suggested that Canada put mechanisms in place to reduce these administrative delays.[81] For example, Dr. Zaghib suggested forming an interdepartmental committee to reduce regulatory delays.[82] Mr. Breton noted that, even with a faster regulatory process, Canada must work in a thorough way regarding the environmental impact of mines.[83]

Witnesses suggested various approaches that the federal government could take to accelerate the development of Canada’s critical minerals sector:

- Intensify public geoscience activities.[84] This would include identifying in advance the impacts of opening a new mine on local communities, land access and energy demands;[85]

- Implement measures to strengthen and expand partnerships between universities and mining companies;[86]

- Subsidize the production of critical minerals to reduce costs and make Canadian products more competitive;[87]

- Implement measures to reduce investor risk, for example by providing regulatory predictability and stability, and streamlining processes.[88]

Mr. Ferron believes that, if the community and the other parties involved in the opening of a mine have a positive image of the mining company, it would speed up its financing and its operation.[89]

Some witnesses said that mining companies need more financial support. Mr. Plante stated that Canada should support innovation by providing more funding measures specific to critical minerals to increase research efforts.[90] He explained that the Quebec government developed the Joint Research Program on Sustainable Development of the Mining Sector to encourage collaboration among mining stakeholders. Through the program, researchers only need to find a company willing to contribute 10% of the amount requested, in the form of financial, human or material resources, for the proposed project.[91] He added that the Quebec government can’t meet all the demand for this program. He said that there are no similar programs at the federal level, but that the federal government could increase funding through similar mechanisms.[92] Mr. Ferron added, “If you want to get a full sector up and running faster, funding is key.”[93]

Witnesses discussed existing incentives to stimulate the development of Canada’s mining sector. Mr. Killeen and Mr. Gratton both noted that flow-through shares and the Mineral Exploration Tax Credit (METC)[94] are important to supporting long-term investment in the mining industry.[95] Mr. Ferron also believed that special tax credits for mining would boost the exploration of potential deposits. He added that Quebec had offered flow-through shares for mineral exploration in the past, which he felt had good results.[96] Josée Méthot, from the Quebec Mining Association, agreed.[97] Pierre Gratton of the Mining Association of Canada suggested that doubling the METC and permanently adopting it would put Canada in front of every other country in the world as a target for metal and mineral exploration. Otherwise, there is no guarantee that companies would come to Canada to invest.[98]

However, witnesses said that entrepreneurs and project developers have enough funding for research, exploration and development but need government support for intermediate processing.[99] Mr. Gervais said that mining companies need support for intermediate processing of minerals, as demand in Canada is not yet high enough to stimulate the sector’s development.[100]

Finally, a Canadian critical minerals strategy would stimulate the timely development of the critical minerals sector. Mr. Xavier regretted that mining companies currently have to work with different governments in silos rather than in a coordinated fashion.[101] Several witnesses agreed that a critical minerals strategy would enable the federal government to work with stakeholders to accelerate the sector’s development and secure capital at each stage of the value chain.[102] A critical minerals strategy would also reinforce the Canadian brand as a secure and reliable supplier.[103]

Developing Expertise in Intermediate Processing

Becoming a major battery manufacturer would have many benefits for Canada. As Figure 4 shows, to make batteries, minerals are first processed into anodes and cathodes to make cells and then assembled into modules. The modules are then combined to make battery packs.[104] Establishing a battery industry would provide many jobs in proximity to mines beyond their operations, helping to build a corridor of prosperity in rural and remote areas.[105] It would also reduce GHG emissions from extraction and transporting minerals and processed products,[106] keep critical minerals in Canada and ensure stable access to the components needed to manufacture EVs.[107] With its competitive advantages, including its proximity to car manufacturing plants, which would allow batteries to be integrated into EVs manufactured here, Canada could become a major battery manufacturer.[108]

Yet in 2022 Canada is still not refining and processing the critical minerals to produce batteries. Canada does not produce the right kind of nickel for batteries and does not process lithium.[109] Mr. Breton said that in 2021 almost all the lithium extracted in Canada was sent to the PRC to be processed.[110] Mr. Breton and Mr. Gervais regretted that Canadian EV companies still have to source cells for batteries from Europe and Asia.[111] To demonstrate Canada’s lag in developing battery manufacturing capacity, Mr. La Salle said that, in early 2022, there were 240 battery manufacturing plants being built worldwide, but none in Canada.[112] Yet global demand for batteries is already high and supply is not keeping up.[113]

Several witnesses said that Canada should move quickly to position itself in cell manufacturing, as this is the key to becoming a leader in the electrification of transportation.[114] Robert Kunihiro of Stromvolt Americas said that his company is striving to be the first battery cell manufacturer in North America and could eventually support the Canadian car and light truck market.[115]

Witnesses shared various suggestions for encouraging the development of battery manufacturing expertise in this country. The federal government could:

- Provide various types of financing. According to witnesses, mining companies in Europe and the U.S. already have a great deal of support from their governments to support intermediate processing.[116]

- Make investments to bring back the domestic microelectronic chip industry[117] using local silicon.[118]

- Make regulations that promote innovation specifically for EVs and the development of products in Canada and avoid “[g]oing for the lowest bidder,” which “kills innovation.”[119]

- Develop an industrial policy like a “Buy Canadian Act” to encourage local development and provide incentives for Canadian companies to develop expertise.[120]

- Install more charging stations across the country to encourage EV purchases and therefore demand for batteries.[121]

Witnesses noted that there is currently competition among countries to attract investment from various companies wanting to establish and open a processing plant.[122] Canada must provide support to develop its expertise in advanced technology manufacturing, and attract partners and capital.[123]

To support the development of intermediate processing expertise in Canada, some witnesses highlighted the need to build domestic research and development (R&D) capacity. For example, Ms. Houde suggested that the federal government develop an industrial policy in all sectors, particularly R&D, to determine where Canada would benefit from specializing.[124] She added that training programs aren’t available widely enough to meet the need for skilled talent in the mining sector.[125] Dr. Zaghib suggested that three industry centres for mining and engineering be established in different regions of the country to design machine prototypes for critical mineral processing with full technology transfer to build a new manufacturing industry in Canada. He said this strategy would create many jobs and strengthen Canada’s industrial independence.[126]

In terms of R&D, Mr. Ferron and Mr. Plante pointed out that the Research Institute of Mines and Environment at the University of Quebec in Abitibi-Témiscamingue brings together many experts in the mineral sector. The institute coordinates the different steps of the critical minerals value chain, from exploration to recycling. They both believed that the institute shows that Abitibi-Témiscamingue is fertile ground not only for mineral exploration, but also for intermediate processing.[127] According to Mr. Plante, thanks to its competitive advantages, such as its pool of expertise and mining partners in the area, Abitibi-Témiscamingue is the ideal place to host the Critical Battery Minerals Centre of Excellence announced in the 2021 federal budget.[128]

Finally, witnesses emphasized the importance of including end-of-life management of batteries and other advanced technologies in developing a Canadian critical minerals strategy. Minerals can be recycled indefinitely and waste materials can be recovered and processed at each stage of the value chain, demonstrating the importance of developing an industry for recycling battery components.[129] Mr. Xavier said that recycling minerals would help offset carbon emissions associated with processing these minerals.[130] Dr. Zaghib said that Quebec has developed an excellent circular economy for batteries.[131] Witnesses said the federal government needs to help establish this sector, for example through financial incentives and a regulatory framework to support innovation.[132] Mr. Rickford agreed, adding that the private sector should also be involved in establishing a minerals and advanced technology recycling sector.[133]

Coordinating Efforts

Many stakeholders have a role to play in developing the advanced technologies value chain, underscoring the importance for Canada of putting a critical minerals strategy in place. This strategy would coordinate stakeholders’ efforts at different levels, for example with international partners, provinces and territories, and Indigenous communities. Mr. Billedeau said that, to have a comprehensive critical minerals strategy, the federal government must have ongoing consultations with stakeholders along the advanced technologies value chain, for example with battery manufacturing stakeholders.[134] He also noted that at that point in time he was not aware of any consultations being undertaken by the federal government specific to this strategy.[135]

North America

Canada and the U.S. would benefit from building a strong partnership on critical minerals. Witnesses said that Canada must develop a strategy with the U.S. to be successful.[136] This strategy would enable Canada, in cooperation with the U.S., to compete with Asia and Europe.[137] Witnesses explained that the U.S. wants to build a domestic critical minerals supply chain, but doesn’t have the critical minerals to do so, whereas Canada has all of the necessary resources.[138] Ms. Houde added that the regionalization of supply chains demonstrates the importance of a Canada-U.S. coalition, where Canada could supply not only critical minerals, but also value‑added materials and components.[139] Mr. Breton added that this would create quality jobs in Canada.[140] Witnesses also noted that discussing national security issues related to critical minerals and the supply chain would increase American interest in working with Canada.[141] Mr. Kunihiro stressed the “need to work with our U.S. friends – our U.S. brothers and sisters – to effectively compete.”[142] Finally, Ms. Hall said Canada should also work with countries in South America to establish a battery supply chain.[143]

In January 2020, Canada announced the finalization of a Canada-U.S. action plan for collaboration on critical minerals. In this announcement, the federal government stated that:

The Action Plan will guide cooperation in areas such as industry engagement; efforts to secure critical minerals supply chains for strategic industries and defence; improving information sharing on mineral resources and potential; and cooperation in multilateral fora and with other countries. This Action Plan will promote joint initiatives, including research and development cooperation, supply chain modelling and increased support for industry.[144]

Mr. Billedeau said that this plan will give Canada opportunities to be a major continental player in supplying minerals for clean-tech energy supply chain resiliency and digital components vital for cybersecurity.[145] He added that the Canada-United States-Mexico Agreement provides a competitive advantage to serving North American markets in the regional EV value chain by reducing logistical and procurement costs.[146]

Witnesses raised concerns about protectionist U.S. policies that could hinder the development of the Canadian and broader North American EV sector. For example, Mr. Billedeau said that “the chamber doesn’t support protectionist measures between Canada and the U.S., our largest trading partner, since such policies could have significant unintended consequences.”[147]. Mr. Breton said that the Build Back Better Act proposed by the U.S. President goes against the collaboration between the two countries.[148] According to Mr. Gervais, Canada should make sure that its companies can export parts to the U.S. for integration into different kinds of EVs by negotiating a high enough percentage of Canadian parts in North American EVs.[149]

Provinces and Territories

Witnesses also discussed the importance of collaboration between the provinces and the federal government in developing a comprehensive critical minerals strategy. Mr. Killeen suggested that public geoscience activities would support to provinces and municipalities to better understand the resources they possess. He said that this is the only way that like minds can be brought together.[150] Mr. Walker claimed that it is important to partner with the provinces to:

put together SWAT teams or those few experts who truly understand the window of opportunity in a particular new commodity such as lithium, in order to focus on assets that can be really meaningful toward building out the value chain. Through that process, what’s important, really—tying back into the indigenous question—is, again, building up the understanding, especially in the north, of what exploration through to the mining development means and building the capacity for maximizing indigenous participation. That really is the place where we see governments at various levels playing huge roles in really helping to facilitate.[151]

Some provinces already have a critical minerals strategy in place. For example, Mr. Gratton noted that Quebec already has a critical minerals strategy that the federal government could learn from.[152] Ms. Méthot added that Quebec has already developed a battery industry, which is helping to stimulate demand for Quebec’s critical minerals.[153] Mr. Rickford noted that Ontario launched its critical minerals strategy in March 2022, investing $29 million to advance exploration and innovation in the mining sector. He added that Ontario also wants to be involved in critical minerals processing and will soon have the first cobalt processing facility in North America.[154]

Several witnesses noted that every region of Canada could benefit from the energy transition because, as Table 1 shows, they have different strengths and can benefit from the advanced technology value chain in complementary ways.[155] According to Mr. Ferron, because the supply chain for critical minerals is still developing across the country, it is important to establish areas of expertise and research in universities and companies to coordinate the strengths of each region.[156]

Table 1—Overview of the Strengths of Each Canadian Region in Building a Battery Value Chain, Based on Evidence

Region |

Strengths in Building a Critical Minerals Value Chain |

Atlantic |

|

Quebec |

|

Ontario |

|

Prairies |

|

British Columbia |

|

Territories |

|

Source: Table prepared by the Library of Parliament using evidence from: INDU, Evidence, 4 February 2022, 1355 (Dahn), INDU, Evidence, 4 February 2022, 1315 (Walker), INDU, Evidence, 11 February 2022, 1340, 1455 (Zaghib), INDU, Evidence, 11 February 2022, 1405 (Fortier), : INDU, Evidence, 15 February 2022, 1550 (Ferron), INDU, Evidence, 15 February 2022, 1630 (Billedeau), INDU, Evidence, 15 February 2022, 1645 (Gervais), INDU, Evidence, 22 March 2022, 1605, 1625 (Rickford), INDU, Evidence, 22 March 2022, 1655, 1700 (Méthot), INDU, Evidence, 22 March 2022, 1645 (Plante), INDU, Evidence, 22 March 2022, 1650 (Xavier).

It is therefore important for Canada to coordinate the actions of each province and territory through a Canadian critical minerals strategy.[157] Dr. Zaghib said that collaboration between the regions would strengthen the Canadian value chain and position Canada on the international market.[158] It would present Canada as a real alternative to working with the PRC or Russia on critical minerals.[159] Mr. Rickford said that, without a critical minerals strategy, partners such as the U.S. will negotiate directly with provinces or territories that have a strategy rather than with Canada. He added, “And, boy, wouldn’t it be a shame if the federal government missed out on that important dialogue?”[160] According to Ms. Houde, the federal government faces a rare opportunity to have a decisive impact on several regions at the same time.[161]

Indigenous Communities

It is critical that Indigenous people have a significant role in developing a comprehensive value chain for critical minerals. Several witnesses emphasized the importance of Indigenous participation in the mining sector.[162] Mr. Rickford said that “the success of our projects over the past couple of years has been characterized by a substantive role, a partnership both in the context of the private partner and the relationship with the government when the indigenous communities have led.”[163] Mr. Ferron explained that in the past, Indigenous communities were often overlooked in mining development but are now asking to be partners and to be consulted. These communities want the opportunity for development through the natural resource sector, which offers value-added jobs in these communities.[164]

To facilitate collaboration with Indigenous communities, companies can establish exploration agreements. These agreements cover a range of topics, from respecting existing treaty rights in various communities to helping build capacity with the communities as exploration towards development takes place. It also includes the creation of business opportunities and collaboration with regard to any matters surrounding investments and working together with government on investments needed for critical mining assets in the North.[165] Frontier Lithium and Glencore Canada said that their companies have already established agreements with Indigenous communities.[166] Mr. Ferron added that agreements already exist between mining companies and the Algonquin First Nations in Abitibi and the Cree in the North.[167] According to Mr. Walker, it is important for mining companies to build relationships, form constructive partnerships and understand the realities of the communities directly affected by their operations.[168]

Witnesses shared ways to strengthen Indigenous participation in Canada’s critical minerals supply chain. Mr. Billedeau said that a critical minerals strategy can create opportunities that facilitate Indigenous partnerships.[169] Mr. Walker suggested that revenue sharing with Indigenous communities would create alignment with the players.[170] He also suggested that government consider reducing income tax for Indigenous members to encourage them to work in their traditional lands and incentivize further participation.[171]

Observations and Recommendations

Over the course of this study, witnesses agreed on the importance of quickly putting in place a Canadian critical minerals strategy. With all of its competitive advantages, for example its critical mineral reserves, automotive industry and high mining standards, Canada has the potential to become a leader in the global supply of critical minerals and in the development of an advanced technology value chain. It must therefore do everything possible to become one quickly. The Committee notes the House of Commons Standing Committee on Natural Resources’ report on critical minerals, tabled in June 2021.[172] In particular, the Committee supports the report’s first recommendation regarding the importance of developing a strategic vision for developing Canada’s critical minerals industry.

Following the completion of testimony, on 7 April 2022, the federal government announced investments for critical minerals in Budget 2022, including $3.8 billion over eight years beginning in 2022-2023 to implement Canada's first critical minerals strategy.[173] The Committee welcomes this announcement, but still believes the findings of this report are relevant to inform the Government of Canada's implementation of this strategy and to underscore the importance of implementing it as soon as possible. The Committee therefore recommends:

Recommendation 1

That the Government of Canada, in collaboration with Indigenous communities, various stakeholders in Canadian industry, and the provinces and territories, and while respecting their jurisdiction and their own strategies, file right now a critical minerals strategy that will namely:

- position Canada as a leader in supplying critical minerals and reduce the dominance of any one country in this chain;

- secure critical mineral supply chains including, but not limited to, within the context of national security;

- ensure reliable and ongoing access to critical minerals for the development of advanced technologies;

- stimulate timely development of the Canadian mining sector by addressing the urgent need to improve implementation of the Impact Assessment Process to avoid developing the perception that Canada is an unpredictable and slow destination for mining and other investment, and supporting exploration in higher cost areas;

- lead to comprehensive consultations in identifying barriers and red tape to ensure that a national critical mineral strategy is developed in the lens of stimulating timely development of the Canadian mining sector by reducing regulatory barriers and supporting exploration in higher cost areas; while also considering national security, economic and environmental implications;

- establish an intermediate processing sector;

- establish a mineral recycling sector and continuously maintain and enhance natural capital and optimize resource performance through attention to material and energy flow, including promoting the adoption of the circular economy;

- build on the objectives established as part of the critical and strategic mineral strategies of the provinces and territories;

- promote scientific innovation and develop technologies that will ensure the resilience and security of critical minerals and materials supply chains, without relying on resources and processing from authoritarian countries;

- catalyze and support private sector adoption of a national sustainable capacity for critical minerals and the materials supply chain;

- leverage the strengths of each Canadian region in building an advanced technology value chain;

- support the rapidly evolving Canadian automotive sector;

- strengthen the lithium-ion battery industry within the battery value chain for electric and intelligent transportation; and

- strive to complete and release a comprehensive critical minerals strategy before December 31, 2022, and if that timeline is not met, that the Minister of Innovation, Science and Industry, alongside relevant departmental officials, should appear before the House of Commons Standing Committee on Industry and Technology for at least two hours to provide an update on the status and development of this strategy.

Recommendation 2

That the government establish an interdepartmental committee to develop innovative, more flexible and effective regulations and create a predictable environment for mining companies, while taking into account provincial jurisdiction and the goal of reducing bureaucracy. And that, in this exercise, the Committee examine the opportunity to better align environmental requirements to eliminate duplication.

Recommendation 3

That the Government of Canada ensure that the Critical Battery Minerals Centre of Excellence be established near mining communities that have university- and college-level expertise in this field, and that the Centre increase the research and development capacity in this sector and promote the transition from ideation to commercial use.

Recommendation 4

That the Government of Canada introduce major incentives to:

- support critical minerals exploration to ensure a larger supply of critical minerals for clean technology manufacturing;

- support the energy transition of its economy to use clean technologies;

- improve supply chain infrastructure to make it more sustainable and climate resilient; and

- greatly increase the funding for basic and applied research for universities and colleges near regions where critical minerals are mined.

The Committee welcomes the March 2022 announcements of two battery plants in Quebec and one in Ontario:

- On 4 March 2022, the German company BASF announced that it had acquired a site in Bécancour, Quebec, to build an intermediate mineral processing and battery materials recycling plant. It plans to have the plant operational by 2025.[174]

- On 7 March 2022, General Motors announced a collaboration with POSCO Chemical and the governments of Canada and Quebec to build an intermediate mineral processing plant for battery manufacturing.[175]

- On 23 March 2022, the Government of Ontario announced that, with the support of the municipal, provincial and federal governments, LG Energy Solution and Stellantis would build a large-scale EV battery manufacturing plant in Windsor. The plant is expected to be operational by 2025.[176]

The Committee believes that these announcements reiterate the importance of quickly implementing a Canadian critical minerals strategy, as Canada must ensure that these new plants have the necessary supply of critical minerals.

During this study, several witnesses emphasized the importance of greater critical minerals exploration in Canada to better understand where resources are located and how extensive they are. However, the Committee understands that, as some witnesses explained, such work can be very costly. Given this, the Committee supports the second recommendation in the report of the House of Commons Standing Committee on Natural Resources, which proposes, among other things, that the Government of Canada increase its capacity to carry out geoscience work. The Committee therefore recommends:

Recommendation 5

That the Government of Canada, in cooperation with the territories and provinces, increase its capacity to carry out geoscience work, particularly in rural, remote, and northern regions, to:

- establish an accurate inventory of available reserves in order to better understand the physical environment and geological potential in order to establish appropriate conservation measures;

- develop the necessary infrastructure for mining in key areas with a particular focus on addressing the longstanding infrastructure deficit that makes Canada’s North one of the most expensive places to mine in the world; and

- support the development of these minerals as quickly as possible, while taking into account rigorous social and environmental standards and the priorities of local communities.

As it heard during this study, the Committee believes that developing mining industries can lead to significant economic and social benefits for rural and remote regions where they are located. Establishing a mining industry in these regions would create stable, value-added jobs that would help retain communities’ populations. The Committee also believes that building partnerships between universities or research centres and mining companies is beneficial not only for the region in question, but also for the entire Canadian mining industry. The Committee believes that Canada would benefit from further mining development in rural and remote regions to ensure their long-term prosperity. The Committee therefore recommends:

Recommendations 6

That the Government of Canada, in collaboration with various stakeholders in the region, including researchers, workers, unions and mining companies, provide incentives to ensure that the development of a new mine supports sustainable use of the land by encouraging intermediate processing companies to set up near the resource in order to establish a mining industry in the affected region, which will lead to the creation of a corridor of prosperity in those regions, including the creation of roads and the development of cellular and Internet services, government services in these regions and electricity infrastructure, which will ensure long-term prosperity for these regions.

The Committee shares the concerns expressed by many witnesses about measures introduced, or announced, by the U.S. government with respect to the automotive sector. Given the proximity of many Canadian and U.S. industries, including the automotive industry, and the regionalization of supply chains for critical minerals, the Committee believes that it is crucial for the Canadian and U.S. governments to work together and not put in place policies that could harm their respective industries. This cooperation is also important for national security reasons. The Committee therefore recommends:

Recommendation 7

That the Government of Canada, in its discussions with the United States, focus on commonalities and especially on Canada’s supply of critical minerals and ensure that U.S. policies reflect the North American market:

- for automobiles and other types of electric vehicles such as buses, heavy trucks, mining trucks, snowmobiles, boats and so on and their integrated manufacturing ecosystem, including the harmonization of electric vehicles incentives;

- for the electric transportation sector and the integrated lithium-ion battery manufacturing ecosystem; and

- for the supply of critical minerals in the value chains of other industries, including computer technologies, semiconductors and optical sensors, and in support of food security for crop production.

Recommendation 8

That the Government of Canada work with its international partners and allies to diversify global supply and ensure that best practices for sustainable mining and processing are adopted.

During this study, several witnesses stressed the importance of increased collaboration between the Canadian mining industry and local communities affected by this industry, particularly Indigenous communities. Several mining companies stated that they have already established exploration agreements with Indigenous communities. The Committee believes that these partnerships must continue to develop and expand, as the development of Canada’s critical minerals sector could have significant economic benefits for the country in the years to come, and Indigenous communities must benefit as much as any other community. The Committee therefore recommends:

Recommendation 9

That the Government of Canada introduce initiatives to encourage Indigenous peoples to fully participate in developing the mining sector, not only in exploration work but throughout the value chain of advanced technologies involving critical minerals.

Recommendation 10

That the Government of Canada inform the INDU Committee of any changes to its investments in Canada’s critical and strategic minerals strategy in a detailed quarterly report, listing each program, all funding recipients, the province, the date the funds were allocated and the amount of funding allocated.

[1] House of Commons, Standing Committee on Industry and Technology [INDU], Minutes, Meeting No. 3, 26 January 2022.

[2] Government of Canada, Budget 2022.

[5] Government of Canada, Critical minerals. Some jurisdictions such as Quebec use the term “critical and strategic minerals” while the Government of Canada uses the term “critical minerals” to encompass both.

[6] INDU, Evidence, 4 February 2022, 1305 (Benoit La Salle, Aya Gold and Silver), INDU, Evidence, 22 March 2022, 1640 (Rickford).

[7] INDU, Evidence, 4 February 2022, 1325 (Pierre Gratton, Mining Association of Canada), INDU, Evidence, 11 February 2022, 1320 (Daniel Breton, Electric Mobility Canada).

[10] INDU, Evidence, 11 February 2022, 1400 (Matthew Fortier, Accelerate: Canada’s ZEV Supply Chain Alliance).

[11] Natural Resources Canada, Minerals and Metals Facts.

[12] INDU, Evidence, 11 February 2022, 1415 (Jeff Killeen, Prospectors and Developers Association of Canada).

[14] INDU, Evidence, 11 February 2022, 1450 (Killeen). See also: Natural Resources Canada, Map of the Top 100 Mineral Exploration Projects of 2020.

[18] INDU, Evidence, 4 February 2022, 1305 (La Salle), INDU, Evidence, 11 February 2022, 1315 (Fortier).

[19] INDU, Evidence, 4 February 2022, 1305 (La Salle), INDU, Evidence, 4 February 2022, 1420, 1425 (Gratton), INDU, Evidence, 4 February 2022, 1345 (Sarah Houde, Propulsion Québec), INDU, Evidence, 15 February 2022, 1545 (Patrick Gervais, Lion Electric), INDU, Evidence, 22 March 2022, 1735 (Josée Méthot, Quebec Mining Association).

[20] INDU, Evidence, 11 February 2022, 1400 (Fortier), INDU, Evidence, 11 February 2022, 1345 (Breton).

[21] INDU, Evidence, 4 February 2022, 1305 (La Salle), INDU, Evidence, 4 February 2022, 1420 (Gratton), INDU, Evidence, 4 February 2022, 1345 (Houde), INDU, Evidence, 11 February 2022, 1325 (Killeen), INDU, Evidence, 11 February 2022, 1400 (Fortier) INDU, Evidence, 11 February 2022, 1345 (Breton), INDU, Evidence, 15 February 2022, 1610 (Gervais), INDU, Evidence, 22 March 2022, 1655 (Méthot), INDU, Evidence, 22 March 2022, 1700 (Robert Kunihiro, Stromvolt Americas Inc.).

[23] INDU, Evidence, 4 February 2022, 1325 (Gratton), INDU, Evidence, 11 February 2022, 1320 (Breton), INDU, Evidence, 22 March 2022, 1555 (Rickford).

[24] INDU, Evidence, 11 February 2022, 1320 (Breton). See also: Bloomberg New Energy Finance, China Dominates the Lithium-ion Battery Supply Chain, but Europe is on the Rise, 16 September 2020.

[26] INDU, Evidence, 11 February 2022, 1320 (Breton), INDU, Evidence, 4 February 2022, 1110 (Meredith Lilly, As an individual).

[27] World Trade Organization, DS432: China — Measures Related to the Exportation of Rare Earths, Tungsten and Molybdenum.

[31] INDU, Evidence, 4 February 2022, 1110 (Lilly), INDU, Evidence, 11 February 2022, 1335 (Burton), INDU, Evidence, 22 March 2022, 1610 (Rickford). See also: Neo Lithium Corporation, Zijin Mining to Acquire Neo Lithium Corp. in All‑Cash Offer, 12 October 2021.

[33] INDU, Evidence, 4 February 2022, 1110 (Lilly), INDU, Evidence, 11 February 2022, 1425 (Burton), INDU, Evidence, 11 February 2022, 1435 (Breton), INDU, Evidence, 22 March 2022, 1605 (Rickford).

[34] INDU, Evidence, 11 February 2022, 1310 (Charles Burton, As an individual), INDU, Evidence, 22 March 2022, 1710 (Merlini).

[36] INDU, Evidence, 4 February 2022, 1110 (Lilly), INDU, Evidence, 11 February 2022, 1335 (Burton).

[38] INDU, Evidence, 4 February 2022, 1110 (Lilly), INDU, Evidence, 4 February 2022, 1315 (Trevor Walker, Frontier Lithium), INDU, Evidence, 1555, 22 March 2022 (Rickford), INDU, Evidence, 22 March 2022, 1710 (A. J. Nichols, Vale Canada Limited).

[39] INDU, Evidence, 4 February 2022, 1315 (Walker), INDU, Evidence, 4 February 2022, 1330 (Houde), INDU, Evidence, 11 February 2022, 1315 (Fortier), INDU, Evidence, 11 February 2022, 1320 (Breton), INDU, Evidence, 15 February 2022, 1545 (Gervais), INDU, Evidence, 15 February 2022, 1630 (Billedeau).

[40] INDU, Evidence, 4 February 2022, 1450 (Houde), INDU, Evidence, 11 February 2022, 1405 (Fortier), INDU, Evidence, 15 February 2022, 1545 (Gervais), INDU, Evidence, 15 February 2022, 1605 (Billedeau), INDU, Evidence, 22 March 2022, 1740 (Amanda Hall, Summit Nanotech Corporation).

[45] INDU, Evidence, 4 February 2022, 1325 (Gratton), 1320 (Breton), INDU, Evidence, 15 February 2022, 1540 (Billedeau), INDU, Evidence, 22 March 2022, 1700 (Kunihiro).

[46] INDU, Evidence, 11 February 2022, 1315 (Fortier).

[53] INDU, Evidence, 11 February 2022, 1315 (Fortier), INDU, Evidence, 11 February 2022, 1320 (Breton), INDU, Evidence, 15 February 2022, 1610 (Gervais).

[55] INDU, Evidence, 4 February 2022, 1305 (La Salle), INDU, Evidence, 4 February 2022, 1435 (Gratton), INDU, Evidence, 22 March 2022, 1710 (Merlini).

[56] INDU, Evidence, 4 February 2022, 1435 (Gratton), INDU, Evidence, 15 February 2022, 1540 (Billedeau), INDU, Evidence, 15 February 2022, 1545 (Gervais).

[58] INDU, Evidence, 4 February 2022, 1410 (La Salle), INDU, Evidence, 11 February 2022, 1350 (Breton).

[64] INDU, Evidence, 4 February 2022, 1305 (La Salle), INDU, Evidence, 4 February 2022, 1435 (Gratton), INDU, Evidence, 22 March 2022, 1710 (Merlini).

[66] INDU, Evidence, 4 February 2022, 1425 (Gratton), INDU, Evidence, 4 February 2022, 1430 (Houde), INDU, Evidence, 11 February 2021, 1310 (Zaghib), INDU, Evidence, 11 February 2022, 1325 (Killeen), INDU, Evidence, 15 February 2022, 1650 (Ferron), INDU, Evidence, 22 March 2022, 1710 (Merlini).

[68] INDU, Evidence, 4 February 2022, 1420 (La Salle), INDU, Evidence, 15 February 2022, 1645 (Gervais).

[71] INDU, Evidence, 15 February 2022, 1540 (BiIledeau), INDU, Evidence, 22 March 2022, 1645 (Plante), INDU, Evidence, 22 March 2022, 1650 (Peter Xavier, Glencore Canada), INDU, Evidence, 22 March 2022, 1710 (Merlini).

[75] INDU, Evidence, 11 February 2022, 1325, 1335, 1430 (Killeen). Note: In 2019, Australia, the United States and Canada created the Critical Minerals Mapping Initiative to develop a better understanding of known critical mineral resources, identify new sources of supply through critical mineral potential mapping and promote critical mineral discovery in all three countries.

[77] INDU, Evidence, 15 February 2022, 1550 (Ferron), INDU, Evidence, 22 March 2022, 1600 (Rickford).

[79] INDU, Evidence, 4 February 2022, 1320 (Walker), INDU, Evidence, 11 February 2022, 1410 (Killeen), INDU, Evidence, 22 March 2022, 1610 (Rickford), INDU, Evidence, 22 March 2022, 1655 (Méthot), INDU, Evidence, 22 March 2022, 1725 (Merlini).

[81] INDU, Evidence, 4 February 2022, 1320 (Walker), INDU, Evidence, 4 February 2022, 1435 (Gratton), INDU, Evidence, 11 February 2022, 1440 (Breton).

[86] INDU, Evidence, 22 March 2022, 1730 (Plante), INDU, Evidence, 22 March 2022, 1650 (Xavier), INDU, Evidence, 22 March 2022, 1710 (Merlini).

[91] Government of Quebec, Joint Research Program on Sustainable Development of the Mining Sector.

[94] The Mineral Exploration Tax Credit (METC) is an investment incentive created by flow-through shares (FTS). It is a 15% tax credit on eligible expenses that investors are deemed to incur through an FTS. Initially announced as a temporary measure in the October 2000 Economic Statement and Budget Update, the METC was extended annually until the Fall 2018 Economic Statement, when it was renewed for five years, until 31 March 2024.

[95] INDU, Evidence, 11 February 2022, 1325 (Killeen), INDU, Evidence, 4 February 2022, 1425 (Gratton).

[99] INDU, Evidence, 4 February 2022, 1445 (La Salle), INDU, Evidence, 15 February 2022, 1615 (Gervais).

[102] INDU, Evidence, 15 February 2022, 1540 (Billedeau), INDU, Evidence, 4 February 2022, 1315 (Walker), INDU, Evidence, 4 February 2022, 1325 (Gratton), INDU, Evidence, 11 February 2022, 1315 (Fortier), INDU, Evidence, 11 February 2022, 1320 (Breton), INDU, Evidence, 22 March 2022, 1650 (Xavier), INDU, Evidence, 22 March 2022, 1655 (Méthot), INDU, Evidence, 22 March 2022, 1725 (Nichols).

[103] INDU, Evidence, 15 February 2022, 1540 (Billedeau), INDU, Evidence, 4 February 2022, 1325 (Gratton), INDU, Evidence, 22 March 2022, 1655 (Méthot).

[106] INDU, Evidence, 11 February 2022, 1455 (Zaghib), INDU, Evidence, 15 February 2022, 1610 (Gervais).

[108] INDU, Evidence, 4 February 2022, 1315 (Walker), INDU, Evidence, 4 February 2022, 1330 (Houde), INDU, Evidence, 11 February 2022, 1400, 1425 (Fortier), INDU, Evidence, 1735 (Méthot).

[109] INDU, Evidence, 4 February 2022, 1435 (Gratton), INDU, Evidence, 4 February 2022, 1340 (Dahn), INDU, Evidence, 15 February 2022, 1645 (Gervais).

[111] INDU, Evidence, 11 February 2022, 1440 (Breton), INDU, Evidence, 15 February 2022, 1545, 1600 (Gervais).

[112] INDU, Evidence, 4 February 2022, 1420 (La Salle). Following the committee’s meetings, companies have announced plans to build battery plants for electric vehicles in Quebec and Ontario. See: BASF, BASF acquires site for North American battery materials and recycling expansion in Canada, 4 March 2022; General Motors, GM Expands its North America-focused EV Supply Chain with POSCO Chemical in Canada, 7 March 2022; Government of Ontario, Ontario Secures Largest Auto Investment in Province’s History, News release, 23 March 2022.

[114] INDU, Evidence, 4 February 2022, 1430 (Houde), INDU, Evidence, 11 February 2021, 1435 (Zaghib), INDU, Evidence, 15 February 2022, 1545 (Gervais).

[116] INDU, Evidence, 4 February 2022, 1440 (La Salle), INDU, Evidence, 11 February 2021, 1310 (Zaghib).

[117] On 28 February 2022, following Mr. Zaghib’s testimony, the Government of Canada announced an investment of $240 million to “help solidify Canada’s role as a global leader in photonics and will bolster the development and manufacturing of semiconductors.”

[122] INDU, Evidence, 4 February 2022, 1305 (Dahn), INDU, Evidence, 15 February 2022, 1545 (Gervais).

[123] INDU, Evidence, 4 February 2022, 1305 (Dahn), INDU, Evidence, 11 February 2022, 1320 (Breton), 1725 (Merlini).

[127] INDU, Evidence, 15 February 2022, 1635 (Ferron), INDU, Evidence, 22 March 2022, 1645 (Plante).

[128] INDU, Evidence, 22 March 2022, 1735 (Plante). See also: Government of Canada, Budget 2021: A Recovery Plan for Jobs, Growth, and Resilience, p. 163.

[129] INDU, Evidence, 11 February 2022, 1455 (Breton), INDU, Evidence, 15 February 2022, 1645 (Billedeau).

[132] INDU, Evidence, 4 February 2022, 1350 (Houde), INDU, Evidence, 11 February 2022, 1320, 1455 (Breton).

[135] Ibid.

[136] INDU, Evidence, 4 February 2022, 1330 (Houde), INDU, Evidence, 15 February 2022, 1620 (Billedeau), INDU, Evidence, 22 March 2022, 1700 (Kunihiro).

[138] INDU, Evidence, 22 March 2022, 1555 (Rickford), INDU, Evidence, 22 March 2022, 1700 (Kunihiro).

[141] INDU, Evidence, 4 February 2022, 1335 (Lilly), INDU, Evidence, 11 February 2022, 1430 (Breton).

[144] Government of Canada, Canada and U.S. Finalize Joint Action Plan on Critical Minerals Collaboration.

[148] As of early 2022, the Build Back Better Act has not passed the U.S. Senate. If passed in its current form, the Act provides a tax credit for the purchase of U.S.-made electric vehicles from U.S. materials.

[155] INDU, Evidence, 4 February 2022, 1345 (Houde), INDU, Evidence, 11 February 2022, 1405 (Fortier), INDU, Evidence, 15 February 2022, 1630 (Billedeau), INDU, Evidence, 22 March 2022, 1605 (Rickford).

[157] INDU, Evidence, 4 February 2022, 1330 (Houde), INDU, Evidence, 22 March 2022, 1605 (Rickford), INDU, Evidence, 22 March 2022, 1700 (Méthot), INDU, Evidence, 22 March 2022, 1725 (Merlini).

[162] INDU, Evidence, 4 February 2022, 1315 (Walker), INDU, Evidence, 15 February 2022, 1550, 1655 (Ferron), INDU, Evidence, 22 March 2022, 1630 (Rickford).

[168] INDU, Evidence, 4 February 2022, 1450 (Walker), INDU, Evidence, 15 February 2022, 1550 (Ferron).

[172] House of Commons Standing Committee on Natural Resources, From Mineral Exploration to Advanced Manufacturing: Developing Value Chains for Critical Minerals in Canada, June 2021.

[173] Government of Canada, Budget 2022. The Government of Canada also made announcements related to the mining sector in Budget 2021: an investment of $1.5 billion in targeted support for critical minerals projects, including up to $1.0 billion over six years for the Strategic Innovation Fund. In Budget 2022, it also announced up to $9.6 million over three years to create a Critical Battery Minerals Centre of Excellence, and a mineral exploration tax credit in 2022.

[174] BASF, BASF acquires site for North American battery materials and recycling expansion in Canada, 4 March 2022.

[175] General Motors, GM Expands its North America-focused EV Supply Chain with POSCO Chemical in Canada, 7 March 2022.

[176] Government of Ontario, Ontario Secures Largest Auto Investment in Province’s History, News release, 23 March 2022.