FINA Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

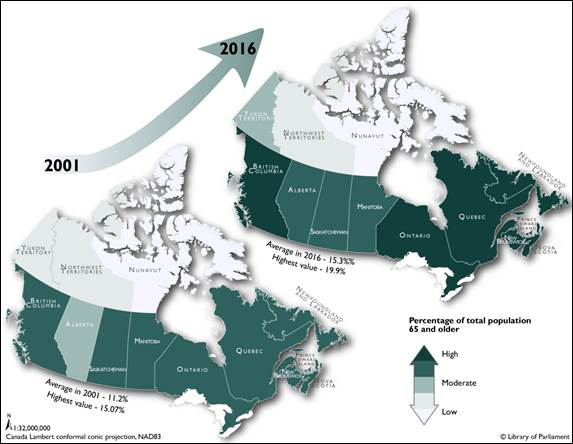

DRIVING INCLUSIVE GROWTH: SPURRING PRODUCTIVITY AND COMPETITIVENESS IN CANADACHAPTER ONE: INTRODUCTIONAccording to the Bank of Canada (the Bank), in the first half of 2017, Canada’s gross domestic product (GDP) growth exceeded 4%; it is expected to average 3.1% by the end of the year. Because of this strong economic performance, Canada is now the fastest-growing economy among the Group of Seven (G7) countries. That said, in order to continue improving living standards into the future, Canada will need to ensure that its workers and businesses are productive and competitive. For this reason, the House of Commons Standing Committee on Finance (the Committee) encouraged Canadians to participate in its pre-budget consultations in advance of the 2018 federal budget by providing their thoughts and proposals on the topics of productivity and competitiveness. In some sense, the choice of these topics supports that of the pre-budget consultations a year ago: economic growth. A. OVERVIEW OF PRODUCTIVITY AND COMPETITIVENESSProductivity measures the efficiency with which production inputs, such as labour and capital, are being used in an economy to produce a given level of output. As explained by David Dodge – a former Governor of the Bank – in a 2005 speech to the Humber College Institute of Technology & Advanced Learning, the key determinants of productivity include “the education, training, and experience of the workers and the amount and type of equipment available to them,” as well as technological innovation and changes in both organizational and management practices. In his view, these “determinants are, in turn, influenced by broader factors such as competition, openness to foreign trade and investment, macroeconomic policies, and the efficiency of financial markets.” The Organisation for Economic Co-operation and Development (OECD) defines the term “competitiveness” as a measure of a country's advantage or disadvantage in selling its products or services in international markets. Productivity and competitiveness are interconnected concepts that contribute to strong economic growth and rising living standards. For example, the more efficiently Canadian businesses use resources to produce goods and services (that is, the more productive they are), the greater their advantage in selling these goods and services in international markets (that is, the more competitive they will be). In a 2010 statement to the Ottawa Economics Association, Mark Carney – also a former Governor of the Bank – explained that, as Canada’s population ages, the country’s labour force participation rate and hours worked will decline. As a result, economic growth will depend more on productivity growth that it has in the past decades. As shown in Figure 1, the impact of demographic aging on economic growth will likely vary among the provinces and territories because their populations are not aging at the same rate. Figure 1 – Percentage of Total Population 65 and older, by Province or Territory, 2001 and 2016 (%)

Source: Map prepared by the Library of Parliament, 2017, using data from Natural Resources Canada (NRCan). Boundary Polygons. In: Atlas of Canada National Scale Data 1:5,000,000 Series. Ottawa: NRCan, 2013; and Statistics Canada. 2001 and 2016 Census of Canada. Census Profile Tables at the Province Level. Using CHASS (accessed 10 November 2017). The following software was used: Esri, ArcGIS, version 10.3.1. Contains information licensed under Open Government Licence – Canada and Statistics Canada Open Licence Agreement. B. LIVING STANDARDS, PRODUCTIVITY AND COMPETITIVENESS: AN INTERNATIONAL COMPARISONCanada’s living standards, productivity and competitiveness can be assessed in an international context, including by comparing Canada’s performance on these three measures to that of other G7 countries. As shown below, Canada is performing close to the G7 average. 1. Measuring the Living Standards of CanadiansGDP per capita is commonly used as a broad measure of the average living standards, or the overall economic well-being, of a country. In 2016, and as shown in Figure 2, Canada had the third-highest GDP per capita among the G7 countries, after the United States and Germany. Figure 2 – Gross Domestic Product per Capita, G7 Countries and G7 Average, 2016 (US $, Current Prices and Current Purchasing Power Parities)

Note: To adjust for price differences across countries for identical products, a calculation of gross domestic product that uses purchasing power parity assumes that a given product has the same price in each country. Source: Figure prepared using data obtained from: Organisation for Economic Co-operation and Development, “Level of GDP per capita and productivity,” accessed 10 November 2017. 2. Measuring the Productivity of CanadiansLabour productivity is defined as the amount of goods and services produced by one hour of labour; it can be measured by GDP per hour worked. Figure 3 shows, for 1997–2016, the average growth in GDP per hour worked over each five-year period. For Canada, this growth rate for 2012–2016 was 0.7%; for 1997–2001, it was 2.2%. The G7’s average labour productivity growth rates declined continuously over the 1997–2016 period. Figure 3 – Average Labour Productivity Growth, G7 Countries and G7 Average, 1997–2001 to 2012–2016 (%)

Note: Average for time period 2012–2016 for Japan excludes 2016. G7 average for 2016 excludes Japan. Source: Figure prepared using data obtained from: Organisation for Economic Cooperation and Development, “Growth in GDP per capita, productivity and ULC,” accessed 6 November 2017. 3. Measuring the Competitiveness of Canadian Businesses in International MarketsIn a 2016 speech to the Saskatoon Regional Development Authority, Stephen Poloz – the current Governor of the Bank – characterized international trade as the “lifeblood” of the Canadian economy. Canada relies on exporting goods and services in order to sustain its living standards. Given the interdependence between countries, Canadian businesses must produce goods and services as efficiently as possible in order to remain competitive in the global economy. The OECD publishes a number of indicators of international competitiveness, including value-added exports as a percentage of GDP; this indicator measures the extent to which a country’s domestic businesses are connected to foreign consumers through global value chains. According to Figure 4, when compared to the other G7 countries, Canada’s value-added exports are a significant proportion of its GDP, which means that the country’s domestic businesses are more connected to foreign consumers than are businesses in the other G7 countries. As well, Canada’s value-added exports as a percentage of GDP decreased between 2000 and 2014, which suggests deterioration in the international competitiveness of Canada’s domestic businesses over that period. Figure 4 – Value-Added Exports as a Percentage of Gross Domestic Product, G7 Countries, 2000 and 2014 (%)

Note: The year 2014 is the most recent for which data are available. Source: Figure prepared using data obtained from: Organisation for Economic Cooperation and Development, “1. Gross Domestic Product (GDP),” “Trade in Value Added (TiVA): December 2016” and “TIVA Nowcast Estimates,” accessed 6 November 2016. A second OECD indicator of international competitiveness is the unit labour cost, which assesses a country’s labour costs relative to the productivity of its workers. When a country’s unit labour cost is rising, labour costs are growing more rapidly than its workers’ productivity. Between 2000 and 2016, Canada’s unit labour costs grew more rapidly than those of Germany, France and the United States; consequently, over that period, Canada’s cost competitiveness deteriorated relative to them. Figure 5 – Unit Labour Cost Growth, Selected G7 Countries, 2000 and 2016 (%)

Note: Japan is excluded because no data are available for 2016. Source: Figure prepared using data obtained from: Organisation for Economic Cooperation and Development, “Growth in GDP per capita, productivity and ULC,” accessed 8 November 2017. 4. Towards the FutureBecause Canada’s economic growth will depend more on productivity as the country’s population ages, a federal focus should be policies and programs that strengthen Canada’s productivity and competitiveness to ensure that Canadian’s living standards will continue to increase in the future. From 19 September to 1 December 2017, the Committee heard proposals for improving Canada’s productivity and competitiveness from over 300 witnesses and received more than 400 written briefs. These proposals are summarized in this report in three categories: individuals, businesses and government. Chapter Two includes proposals for improving individuals’ productivity and competitiveness. The policy areas range from basic human needs such as health, security and wellbeing to professional advancement. In addition, witnesses called for certain government measures to support underrepresented groups, including seniors, Indigenous peoples, women and individuals with disabilities. Chapter Three concerns proposals for helping businesses to be more productive and competitive. The witnesses’ proposals focus on the costs and regulatory requirements that come with running a business, as well as the overall business environment and labour market. Furthermore, it includes witnesses’ proposals pertaining to certain sectors, some of which include: agriculture and agri-food, air transportation, electric vehicles, financial services, fisheries and aquaculture, forestry and mining, manufacturing and shipbuilding, oil and gas, rail, tobacco and tourism. Chapter Four summarizes witnesses’ proposals related to the government’s role in helping Canadian individuals and businesses to become more productive and competitive. In this regard, witnesses emphasized the government’s economic and fiscal policies, environmental, scientific and social policies, as well as federal policies on infrastructure and transportation. In launching its pre-budget consultations in advance of the 2018 federal budget, the Committee posed the following question: What federal measures – such as education and training, health, housing, and labour market participation measures – would help Canadians to be more productive? A. HEALTH, SECURITY AND WELLBEINGIn its 2015-16 Report on Plans and Priorities, Health Canada indicated that one of the key priorities for the government is “to ensure a highly engaged, healthy, productive and effective workforce." Health Canada is contributing to this “by cultivating innovation and respect, communication, and recognition, which will lead to improved productivity and excellence in service to Canadians in our ever-changing work environment.” In commenting on health and social assistance issues, the Committee’s witnesses highlighted healthcare, mental health, childcare, the Canada Social Transfer and social assistance measures, housing, and safety and security as factors that contribute to individuals’ productivity. 1. HealthcareFigure 6 – Health Spending Per Person, Canada’s Provinces and Territories and Canada’s Average, 2017 ($ and %)

Source: Map of the Canadian Institute for Health Information, “How does health spending differ across provinces and territories?,” accessed 21 November 2017. In terms of national programs, the Canadian Union of Public Employees and the Canadian Labour Congress insisted on enforcing the Canada Health Act. Canada Without Poverty, the Canadian Union of Public Employees and the Canadian Labour Congress proposed developing a “national pharmacare program”. For the Public Service Health Care Plan, the Canadian Counselling and Psychotherapy Association suggested including the services of counsellors and psychotherapists as an eligible expense. The Canadian Union of Public Employees recommended the creation of a “national health strategy,” with a focus on the social determinants of health such as lifestyle, income inequality, job security, education and housing affordability. Similarly, the Canadian Labour Congress encouraged a commitment to a long-term, national health funding arrangement with provinces and territories. Confédération des syndicats nationaux suggested increasing funding for the Canada Health Transfer. Furthermore, the Quebec Employers' Council stressed reconsidering the Canada Health Transfer Agreements. The Canadian Union of Public Employees encouraged more support and leadership on healthcare initiatives and suggested that the government provide new funding for any new healthcare program. It recommended that the government plan for the long-term financial stability of these programs. Multiple witnesses touched on increasing awareness of specific health initiatives. ParticipACTION suggested a collaborative “full-court press” approach centered on public education and engagement in the physical activity movement in an effort to make the population more active and asked for $10 million per year for five years to fund the “Let’s Get Moving Movement.” The Canadian Association of Optometrists also asked to establish a public awareness campaign about the importance of eye health and vision care with $25 million over five years to fund it. It also requested the government consider developing a National Framework for Action such as the Australian National Framework for Vision Health. The Canadian Cancer Society asked for the government to partner with them by contributing $10 million to cancer information programs. Also, Rogers Group Financial supported the creation of a nationwide approach to inform Canadians of the need to plan for long-term care funding expenses and to develop a more unified approach for subsidizing access to long-term care services. The Centre for Israel and Jewish Affairs advocated for Canada-wide palliative care to improve the quality and provide more support for caregivers. Also, it suggested ensuring that the system respects psychosocial and spiritual needs. Canadian Labour Congress supported investment in home and community care. Further, the Canadian Medical Association encouraged the government to provide capital investment in residential care infrastructure, including retrofit and renovation as well as develop explicit operating principles for home care funding. It also suggested improving the awareness of the Canada Caregiver Credit and make it a refundable tax credit for caregivers. The Atlantic Chamber of Commerce promoted continuing the tax-exempt status of health and dental plan benefits. The Halifax Chamber of Commerce suggested that investment would be welcome to fund preventative healthcare. Coalition québécoise sur la problématique du poids also mentioned increasing investment in preventing weight-related problems. HealthCareCAN suggested helping healthcare organizations and requested $25 million over five years to the Public Health Agency of Canada in order to fund projects centered on antimicrobial resistance. Further investment requests came from the Canadian Cardiovascular Society, who asked for $2.5 million annually over five years in order to launch a heart health initiative. As well, Association des collèges et universités de la francophonie canadienne called for investing $130 million for healthcare professionals’ initial and continued education at more post-secondary institutions. It also asked for increased investment in expanding access to high-quality French language health services. The Canadian Association of Radiologists requested increased investment of $612 million over five years for imaging equipment, $9 million over three years in project diagnostic imaging tools and $10.5 million over three years in medicine and healthcare for artificial intelligence resources. Ovarian Cancer Canada and the Canadian Cancer Society supported funding towards health research. The former specifically called for the investment of $2.25 million in developing new research models, $2.25 million to identify and prioritize the development of new treatment methods, and $2.25 million to stratify patients in clinical trials. It also recommended establishing a formal mechanism to allow patient representatives to contribute to decision-making and regulatory processes on issues related to health and health research. Quebec Employers' Council advocated for greater private sector involvement in healthcare in specific areas where it is justified. The Juvenile Diabetes Research Foundation Canada proposed that Section 118.3(1.1)(d) of the Income Tax Act be amended by replacing the words “even if those” with the words “except where those” in order to help those with type 1 diabetes (T1D) for the purposes of claiming the disability tax credit (DTC). It also asked the government to amend Section 118.3(1)(a.1)(ii) and section 118.3(1.1) of the Income Tax Act by changing “14 hours” to “10 hours” to remove uncertainty and inequity of eligibility for Canadians with T1D. 2. Mental HealthThe Canadian Psychiatric Association called on the need to increase annual funding earmarked for mental health and raised the issue of research, noting that less than 5% of the Canadian Institutes of Health Research’s grant funding goes to mental health research, while the burden of mental health stands at a higher level. The Committee heard support from witnesses such as the Canadian Alliance on Mental Illness and Mental Health for the establishment of a five-year $100-million mental health innovation fund to jump-start the spread of innovation and lead to systemic and sustainable change that effectively addresses needs. The Canadian Psychiatric Association suggested that such an innovation fund could act as a strategic catalyst for change across the country. In speaking of investments, Kids Help Phone talked about the effectiveness of its mental health helpline, such as Good2Talk in Ontario, and recommended to develop a national mental health helpline for post-secondary students that would involve appropriate partners in each province/territory and across Canada. The Canadian Federation of Students drew attention on the need for dedicated funding to improve on-campus mental health services to improve access to mental health supports for young people in Canada. To address risks of impediments on economic growth resulting from an increase in students struggling with mental health concerns and from non-completion of education, the Canadian Alliance of Student Associations felt that funding for upfront costs of mental health assessments required for academic accommodations should be available through the Canada Student Loans Program. Mental health was also commented on with respect to health and safety. The Canadian Association of Fire Chiefs indicated that funding mental health prevention would help expedite access to mental health services offered to first responders, such as fire departments. Kids Help Phone also suggested improving access to mental health services through the launch of a national texting service. Addictions and Mental Health Ontario voiced the need for timely intervention and prevention of the impact of mental illnesses over an individual’s life. After advocating for the creation of a “Mental Health Parity Act,” the Canadian Alliance on Mental Illness and Mental Health explained that communities and workplaces need to support mental health and physical health equally through their policies, programs and benefits. The Canadian Alliance on Mental Illness and Mental Health further suggested that the Expert Advisory Panel on Mental Health should include a wide range of mental health stakeholders from the public and private sectors as well as people who faced mental health challenges. The Canadian Counselling and Psychotherapy Association raised the issue of gaps in the understanding of what is being delivered and the need for improved accountability and transparency of mental healthcare delivery, and suggested that these gaps be addressed through the implementation of a standardized set of pan-Canadian indicators. In order to ensure a level playing field between counsellors and other mental healthcare providers, the Canadian Counselling and Psychotherapy Association stressed that mental health professional counselling services should be affordable to all Canadians, and suggested that all mental health counselling services be exempted from the goods and services tax/harmonized sales tax (GST/HST). 3. ChildcareIncreased federal spending on childcare and indexation of the Canada Child Benefit were viewed by Canada Without Poverty as key measures to limit poverty and prevent economic activity decline. The need to develop much more robust public policy and implementation plans for the child care system was insisted upon by the Canadian Child Care Federation, who also argued that Canada currently spends less on child care than other advanced economies. Hoping for a universal, affordable, high quality and inclusive system for all children and families in Canada, the Child Care Advocacy Association of Canada asked for additional funding in the child care federal spending envelope to begin building an early learning and child care system in Canada. The Canadian Child Care Federation added that enhanced funding in the next federal budget to begin building an early learning and child care system would play a critical role in fully utilizing the potential of the female labour force. The Canadian Labour Congress agreed that increased funding for childcare spaces is needed to increase the labour-market participation of mothers. The Canadian Child Care Federation further argued that an increase in female labour force participation is positively associated with labour productivity growth, and suggested that an expanded and more detailed evidence-based child care policy framework could support better policy-making and allow more women to enter the workforce. The Canadian Centre for Policy Alternatives pointed out that the Quebec Parental Insurance Program and its five weeks of “father only” leave has demonstrated a significant unmet need for such leave, with 78% of men now taking parental leave in Quebec, compared to 27% in the rest of Canada. The Canadian Union of Public Employees mentioned that the government should ensure quality, universality and affordability in child care. 4. Canada Social Transfer and Social Assistance MeasuresThe Canadian Association of Social Workers encouraged the government to adopt a “Social Care Act” to provide a guide to social investments, such as the Canada Social Transfer. An increase in funding to the Canada Social transfer was proposed by the Confédération des syndicats nationaux, Canada Without Poverty and the Canadian Labour Congress. The Canadian Alliance on Mental Illness and Mental Health, and the Canadian Association of Social Workers called for implementation of a universal basic income for all Canadians. In regards to refugees, Canada Without Poverty asked for the removal of the minimum residency requirement to be eligible for social assistance. Northwest Territories/Nunavut Council of Friendship Centres supports providing justice clients with transitional support and housing. An investment in treatment and services aimed at preventing the opioid crisis from worsening in Ontario was encouraged by Addictions and Mental Health Ontario. Big Brothers Big Sisters Canada outlined a three-year investment strategy of $20 million to advance a Canada-wide approach to mentoring programs. Moreover, the Atlantic Partnership for Literacy and Essential Skills requested $600,000 in funding in order to ensure that there is no reduction in support to existing programs. The Community Sector Council Newfoundland and Labrador promoted the consideration of a “social innovation fund” that would be similar to the strategic innovation fund, but with an emphasis on social innovation. 5. HousingFigure 7 – Percentage of Households in Core Housing Need, Canada’s Provinces and Territories and Canada’s Average, 2016 (%)

Note: Statistics Canada defines a household in core housing need as one whose dwelling is considered unsuitable, inadequate or unaffordable and whose income levels are such that they could not afford alternative suitable and adequate housing in their community. Source: Figure prepared using data obtained from: Statistics Canada, “Core Housing Need, 2016 Census,” accessed 17 November 2017. The Committee was presented with a range of suggestions with respect to housing. For example, implementing a “national housing strategy” to ensure affordability was mentioned by the Canadian Home Builders' Association, the Government of the Northwest Territories and the Northwest Territories/Nunavut Council of Friendship Centres. The Federation of Canadian Municipalities stressed the importance of ensuring that adequate funding would be available for such a strategy and Canada Without Poverty encouraged the government to continue to work with municipalities in this regard. The Burnaby Board of Trade also encouraged this partnership with municipalities in an effort to address the rapid increase in housing prices. The City of Calgary called on the government to improve access to affordable housing. As well, the Canadian Home Builders' Association supported improved access for first-time home owners and recommended supporting affordable residential development with ready transit access. A 10-year investment of $20 million above the current funding level for social and affordable housing was also proposed by the City of London. The Appraisal Institute of Canada had many recommendations on housing, such as mandating appropriate valuation fundamentals for investments and expanding the Office of the Superintendent of Financial Institutions (OSFI) B-20 and B-21 guidelines for lenders providing mortgage financing. Further, it recommended enhancing Canadians’ financial literacy respecting mortgages and the dynamics of the real estate market, especially for seniors and new Canadians. Finally, it encouraged more access to reliable data on affordable housing. The Canadian Home Builders' Association also recommended more documentation of statistics, measures and indicators to deal with the issue of supply in the housing market. The Northwest Territories Association of Communities encouraged allocating more funding to overcome gaps in the housing supply. As well, the Co-operation Housing Federation of Canada suggested designating supply measures to encourage the development of more affordable housing. It further recommended improvements in prepayment terms for co-operatives (co-ops) holding high interest Canada Mortgage and Housing Corporation (CMHC) mortgages. In regards to social housing, Addictions and Mental Health Ontario suggested the construction of a minimum of 30,000 additional supportive housing units over 10 years, funded by targeted investments from the National Housing Fund. The City of London supported an increase in funding allocated to the Homeless Partnering Strategy to reduce homelessness. Additional increases in funding were requested by the YWCA Yellowknife for infrastructure, specifically for transitional emergency housing and child care facilities. The Northwest Territories and Nunavut Construction Association encouraged the government to provide incentives to install energy retrofits for home owners in an effort to target adverse climate change effects. The Canadian Labour Congress further suggested the introduction of a “national green homes and building strategy.” Similarly, the Government of the Northwest Territories proposed lowering energy costs through infrastructure investments. The Canadian Home Builders' Association added that the government should facilitate market adoption of net zero housing that Canadians can afford and the adoption of the Home Retrofit Program to advance energy efficiency. It also encouraged energy literacy by strengthening the EnerGuide rating System. Canada Without Poverty recommended an increase in the capital gains tax payable on the profits derived from selling secondary residences and the implementation a tax on foreign investment in property as a way to address the financing of housing and the perception that housing is simply a commodity. The Canadian Home Builders' Association added that a home renovation tax credit could target key policy objectives. It also suggested fixing taxation such that it inhibits new market rental production. The Canadian Association of Fire Chiefs recommended modernizing the Building Code. Airbnb encouraged implementing “light” regulations on home sharing but also cautioned not to overregulate those who only home share occasionally. Canadian Home Builder’s Association suggested that the government undertake a review of federal investment in housing research and development. Specifically, it encouraged investment in research to build more energy efficient housing that does not cost more to build, and to continue investment in initiatives such as Natural Resources Canada’s Local Energy Efficiency Partnerships (LEEP) and building-official acceptance of innovations. 6. Safety and SecurityThe Committee was informed about emergency services and disaster preparedness, with Kids Help Phone requesting the creation of a national registry of emergency services contacts in Canada, and the Federation of Canadian Municipalities asked the government to support national programs such as a $2-billion Disaster Mitigation and Adaptation Fund to combat national disasters and extreme weather events. With respect to firefighting, the Canadian Association of Fire Chiefs called for $50 million annually for fire-related policy and research including complete modifications to Building Code applications and maintenance of the National Fire Incidence Database. It also commented that the government needs to maintain the volunteer firefighter tax credit and review Employment Insurance (EI) requirements in order to ensure that volunteer firefighters are not negatively affected by some requirements. The Saskatchewan Association of Rural Municipalities advocated that the government work with the Government of Saskatchewan to initiate an emergency fund that allows local fire departments to recover the costs associated with fire services. It also supported a mechanism to allow rural municipalities to receive payments under Mutual Aid Agreements. No Fly List Kids raised the issue of false positives on the no-fly list that affects both children and adults. It reiterated the need for full funding to create a redress system to distinguish innocent children and young adults from persons of criminal interest. On the topic of hate-crime prevention, the Centre for Israel and Jewish Affairs emphasized the need for additional funds to modernize the Security Infrastructure Program. It also believed that more resources are needed to support the development of dedicated police hate-crime units, modelled on those in British Columbia, Montreal and other jurisdictions. Furthermore, it supported a national education campaign about the dangers of hate-speech directed at both law enforcement and the Canadian public. 7. The Committee’s RecommendationsWith a view to ensuring that people are productive workers and community members because they are physically and mentally healthy, the Committee recommends that the Government of Canada implement the following measures: Recommendation 1 Work with territorial and Indigenous governments to reduce the smoking rate in Indigenous communities. Recommendation 2 Provide funds to the Canadian Cardiovascular Society’s pan-Canadian heart health initiative. Recommendation 3 Invest in ovarian cancer research to advance a personalized medicine platform for this cancer and to reduce the five-year mortality rate associated with it. Recommendation 4 Work with the provinces/territories to introduce a pan-Canadian prescription drug program. Recommendation 5 Commit to developing a Canadian action plan for brain health. The action plan should include increased brain health research, meaningful care and supports. Recommendation 6 Provide funding to ParticipACTION’s multi-year, multi-channel national engagement initiative. Recommendation 7 Support the availability of mental health services in Northern and remote communities by implementing loan forgiveness for social workers who practise in such communities. Recommendation 8 Ensure that the Canada Student Loans program provides funding to support the upfront costs of mental health assessments required for academic accommodations. Recommendation 9 Address anxiety, depression and suicide among Canadian youth by supporting a program in cooperation with a pan-national around-the-clock post-secondary mental health service, as well as a new national texting service for mental health services. Recommendation 10 Commit to expand the Mental Health Commission of Canada’s Road to Mental Readiness and Mental Health First Aid Programs to first responders and public health officials. Recommendation 11 Support mental health counselling and psychotherapy services by classifying them as zero-rated supplies for the purpose of the goods and services tax and the federal portion of the harmonized sales tax. Recommendation 12 Create and fund a national registry of emergency services contacts. The registry should include all 24/7 local and accessible numbers to 911 dispatch centres across Canada, to enable crisis line operators the ability to directly refer to the necessary emergency service providers. Recommendation 13 Work to reduce recidivism rates, create safer communities, and offer much-needed programming in correctional institutions by making the necessary investments in the revitalization of Canada’s prison farms. Recommendation 14 Allocate the funds needed to establish a robust and effective redress system to end technical issues regarding “false positives” and other errors associated with the Passenger Protect Program, or “No Fly List.” Recommendation 15 Invest in preventative healthcare for Canadians. B. EDUCATION, SKILLS AND EMPLOYMENTAs outlined in the OECD report The Future of Productivity, “investment in education and skills is particularly important to ensure that workers have the capacity to learn new skills, to make the most of digitization and to adapt to changing technologies and working conditions. Skills and productivity are the real sources of strong, inclusive and sustainable growth.” In commenting on these issues, the Committee’s witnesses stated that education, individual labour and skills development, labour market information, mobility, integration and participation rates, personal income tax, wages and benefits, EI, and immigration and border services are factors that contribute to individuals’ productivity. 1. EducationThroughout its meetings, the committee heard proposals relating to the importance of education in Canada from various witnesses; among them, the Canadian Union of Public Employees and the Canadian Labour Congress advocated for the creation of a “Post-Secondary Education Act” that would ensure that national standards for post-secondary education are met, as well as provide transfer payments for post-secondary education. The latter, as well as the Canadian Federation of Students, argued in favour of universally free and accessible post-secondary education. With respect to dedicated funding for post-secondary institutions, the Canadian Association of University Teachers underscored the need for increased federal support for post-secondary institutions, with federal transfers dedicated to post-secondary education to be increased by $400 million per year. The Canadian Federation of Students added that the federal transfers to provinces and territories for post-secondary education should be restored to 1996 levels, at a federal fiscal cost of $5.48 billion per year. As well, the Southern Alberta Institute of Technology requested that the regional funding agencies receive predictable annual funding to address uncertainty in their projects. The Canadian Alliance of Student Associations proposed the creation of a Tri-Agencies pilot grant program to support the development and distribution of open educational resources, such as free textbooks that are – or could be – available online. Universities Canada, the Canadian Association for Graduate Studies and the Southern Alberta Institute of Technology emphasized the need to increase and facilitate the movement of international post-secondary students into Canada. The latter stressed that the government could adopt a nationwide “common front” to the attraction of international students, despite education falling under the constitutional powers of the provinces. The Canadian Association for Graduate Studies also suggested that the Canadian Graduate Scholarships Program be expanded to further open Canada and Canadian universities to the world and ensure diversity in graduate education. With respect to student debt in Canada, the Canadian Alliance of Student Associations believed that the government ought to establish a Canada-wide interest-free non-repayment period on student loans to support students in their transition to employment and improve their overall productivity. The Conference Board of Canada remarked that the government should invest more in early childhood education, and the Canadian Association for Graduate Studies found that there should be increased support for the education and training of graduate students. Furthermore, the Canadian Consortium for Research believed that greater harmonization, upgrades and strategic focus should be brought to the system of graduate students and postdoctoral fellow supports with a total base funding increase of $140 million per year to be phased in over four years, in equal increments of $35 million per year. The Southern Alberta Institute of Technology also suggested that a “strategic infrastructure fund” or “knowledge infrastructure program” should be undertaken annually, as post-secondary facilities need to be upgraded annually to meet the needs of industry across the country. 2. Individual Labour and Skills DevelopmentThe Committee was told about the role of labour and skills development in making Canadians more productive. For example, the Halifax Chamber of Commerce emphasized the importance of effective training programs for Canadians. The Canadian Apprenticeship Forum proposed to implement a national vision for vocational education and training by sharing and adopting innovative programs across Canada as well as supporting more research, experimentation and evaluation. The Northwest Territories and Nunavut Construction Association voiced support for more education and training. The Burnaby Board of Trade noted that the federal government should work with the provinces and territories to deliver innovative and effective training programs. The Government of the Northwest Territories pointed out that in the north, education and training related measures must be flexible to be effective. With regard to work-integrated learning, including apprenticeships and internships, Polytechnics Canada argued that the government should create a “nationally registered apprenticeship number” to have a more complete picture of trades training processes. It asked for a scaling of existing federal work-integrated learning supports. In addition, it also suggested an investment in national prior learning recognition supports for mid-career workers. The Board of Trade of Metropolitan Montreal stated that the government should focus its attention on the requalification of workers in order to maintain productivity. With a focus on youth work-integrated learning, the Canadian Association of Student Financial Aid Administrators advocated for a federal “work-study program” that would prioritize access to on-campus jobs to students who rely on the Canada Student Loans Program. The Canadian Chamber of Commerce called for an expansion of Employment and Social Development Canada (ESDC)’s Youth Employment Strategy to equip youth with digital skills. The Canadian Alliance of Student Associations asked the government to expand the Canada Summer Jobs Program to include 400,000 new part-time year-round jobs. The Halifax Chamber of Commerce believed that the government should increase its support for youth and recent graduates to take part in experiential educational opportunities. The Community Sector Council Newfoundland and Labrador suggested that the financial support for youth employment programs should be increased. In terms of skills training in the workplace, the Confédération des syndicats nationaux insisted that besides the needs of businesses, training programs should support workers’ autonomy by making the skills acquired transferable. The Northwest Territories/Nunavut Council of Friendship Centres shared that they can implement “grassroots” training to employment initiatives open to people from all age groups. The Association of Canadian Faculties of Agriculture and Veterinary Medicine suggested that additional investments should be made in employees’ training and development. The Community Sector Council Newfoundland and Labrador added that career development learning sessions should be incorporated into employment programs funded by the federal government. It also expressed that the framework for delivering work and career training programs should be formed by a group of non-profit leaders with career development experience. Regarding literacy, the Canadian Labour Congress remarked that the government should restore funding for literacy programs and literacy organizations, such as the Office of Literacy and Essential Skills. It also commented that the government should invest in a new “national workplace literacy program.” The Association of Canadian Publishers stressed the importance of maintaining existing reading and literacy programs as well as establishing new programs for new Canadians, Indigenous communities, at-risk youth, and others. In commenting on regional and sector-specific education and training funding, the Northwest Territories Chamber of Commerce urged that the funding to the Aurora College needs to be increased to strengthen its training program. It also voiced its support for an expansion of the Canada-NWT Job Grant. The Association des collèges et universités de la francophonie canadienne requested that the government enhance the study programs, the research, and the networking initiatives of the post-secondary institutions of the Canadian Francophonie. The Recreation Vehicle Dealers Association of Canada proposed that the government should create an “Apprenticeship Travel Grant” for the apprenticeship training programs that require travelling. 3. Labour Market Information, Mobility, Integration and Participation RatesTo help ensure that Canadians have the right mix of skills and experiences to succeed in their careers, and in order to help employers design training programs for new workers, the Business Council of Canada stressed that comprehensive and accessible labour market information (LMI) is needed. It concurred that the creation of a comprehensive, widely promoted hub of LMI data at the national level would help post-secondary institutions, job-seekers and employers make more informed decisions. In addition, the Greater Charlottetown Area Chamber of Commerce was of the view that all federal programming that supports the transition of school to work should be examined in order to ensure that the level of funding and program designs are meeting current labour market challenges and needs. From a programing perspective, the Canadian Association of University Teachers touched on the need to strengthen the Federal Contractors Program (FCP) under the Employment Equity Act by reducing the threshold to ensure that more Canadian workplaces are subject to this Act, as well as enhancing enforcement and compliance to help Canadian organizations and businesses further diversify their workforce. The Canadian Centre for Policy Alternatives called for more support for part-time workers. Canadians wages, working conditions and training for child-care workers were pointed out by the Canadian Union of Public Employees as collective challenges that would require increased funding over the next decade through shared framework respectful of the provinces, territories and aboriginal communities. From a regional community perspective, the Burnaby Board of Trade described how productivity suffers when traffic and congestion is experienced by workers commuting to work, or businesses who are delivering goods and services to their customers. It viewed continued government's investment in both rapid transit and major transportation infrastructure as the most direct way for the 2018 federal budget to achieve tangible improvements in efficiency and productivity in the movement of our goods, services, and people. The committee also heard about the economic restructuring in response to the “4th Industrial Revolution,” which is characterized by the massive and rapid infiltration of digital technologies into all stages of design, production, distribution and consumption of goods and services in all sectors. The Quebec Employers' Council indicated that workers lack the required skills to work effectively in a digital environment and asked that this become a priority, in terms of both young Canadians who are still in school and the Canadians who are employed. Some witnesses also highlighted the need to build a skilled and mobile workforce able to respond to short-term labour gaps and longer-term demographic changes, but they cautioned that duplication of efforts should be avoided. The Council of the Great Lakes Region suggested that the federal the government work collaboratively with Ontario and Quebec, as well as other cities, to align and leverage investments in skills training and talent attraction. The Toronto Region Board of Trade also spoke about the Future Skills Lab (FSL) as a means to provide better training and employment data by sector and region, and help direct federal job grants towards areas of economic growth with a view to align with provincial funding, avoid duplication and achieve the best results possible. Increased access to training and mobility of workers was identified by the Atlantic Chamber of Commerce in order to better respond to market needs, and the Atlantic Partnership for Literacy and Essential Skills requested that annual investments of $600,000 be made in Atlantic Canadians with a focus on the people who have inadequate skills for the workplace. Colleges and Institutes Canada spoke about persistent regional skill shortages and high unemployment in Atlantic Canada and the need to bolster Canadian productivity and competitiveness by providing greater access to research grants and internships, particularly for increasing students’ involvement in applied research. The Canadian Association for Graduate Studies suggested that additional investments in Mitacs accelerate internship programs could help promote research culture across labour sectors. Polytechnics Canada reasoned that all forms of post-secondary education and training should be on an equal footing and requested that the government should make it easier for people to respond to labour market trends and improve the economic opportunities for all workers in all sectors. To reduce existing shortages of highly skilled workers in Canada’s agricultural sector, the Agricultural Institute of Canada suggested to invest in a comprehensive “human capital strategy,” and the Agriculture and Agri-Food Labour Task Force called for a national career awareness initiative to better connect with agricultural career opportunities. Speaking of jobs, trades, credentials and the need to enable students to acquire skills required to be competitive in a global marketplace, the Windsor-Essex Regional Chamber of Commerce asked the government to drive changes in apprentice ratios and encourage a larger number of young Canadians – possibly through tax incentives – to take on skilled trades as a career. The Canadian Home Builders' Association found that measures with a federal leadership component could help promote young people getting into the skilled trades, nurturing parity of esteem in Canada for trade paths compared to university paths. Also, once people are in the trades, it called for harmonized qualifications across Canada to promote labour mobility. The Toronto Region Immigrant Employment Council maintained that there is a need for investments in mentoring programs across Canada to improve the employment outcomes of skilled immigrants and to encourage employers to hire them. The Greater Vancouver Board of Trade explained that recognition of foreign credentials needs to be looked at in order to attract, develop and retain human capital in Canada. 4. Personal Income Tax, Wages and benefitsFigure 8 – Taxes on Personal Income as a Percentage of Gross Domestic Product, G7 Countries, 2000 and 2015 (%)

Note: The Organisation for Economic Co-operation and Development defines taxes on personal income as taxes levied on the net income (gross income minus allowable tax reliefs) and capital gains of individuals. This indicator relates to government as a whole (all government levels). 2015 is the latest year for which data are available. Source: Figure prepared using data obtained from: Organisation for Economic Co-operation and Development, “Tax on Personal Income,” accessed 20 November 2017. In providing comments to the Committee about taxation measures applicable to individuals, the Board of Trade of Metropolitan Montreal proposed that the personal income tax system should provide better incentives for unemployed individuals to return to work. The Confédération des syndicats nationaux indicated that the government should reduce the stock option deduction in order to promote tax fairness. In discussing wages and benefits for individuals, Canada Without Poverty asked the government to set national wage standards so that a living wage indexed to the Consumer Price Index can be achieved. The Canadian Labour Congress believed that the government should promote measures that strengthen wage formation, raise labour standards and give workers more bargaining power. The Retail Council of Canada voiced its opposition to a tax rule change that would have treated retail workers’ discounts as taxable benefits. The Canadian Union of Public Employees urged the government to develop a modernized fair wage policy that requires federal procurement and funding to uphold certain level of social and environmental standards. 5. Employment InsuranceThe Committee was told about various reforms to EI. The Canadian Labour Congress identified a need for implementing a single national eligibility standard, a review of the valid job separation eligibility requirement and suggested a reversal of the 2014 changes to the economic regions. It also recommended that Service Canada should strive to provide proper and timely advice to Canadians. Regarding sickness benefits, the Canadian Labour Congress requested a reform of the clawback to allow workers to top up their income and expand the number of weeks for sickness benefits. The Canadian Cancer Society expanded on this and proposed the extension of the EI Sickness Benefit to up to 26 weeks. The Confédération des syndicats nationaux called for the creation of an independent EI fund that would be kept separate from the rest of the government’s revenues and suggested that increasing the benefit period would better protect seasonal workers. It, along with the Canadian Labour Congress, also advocated for an increase in the replacement rate to at least 60% of the maximum insurable earnings. The Canadian Labour Congress further suggested implementing a single national eligibility standard for EI regular benefits with a threshold of 360 hours. Restaurants Canada supported making EI beneficiaries eligible for transportation allowances in order to find work where the jobs are located. It also pointed out that the government should grant youth employers a 12-month “holiday” on EI contributions to promote the hiring of youth. The Canadian Federation of Independent Business also recommended the implementation of the “EI holiday” for hiring youth. The Quebec Employers' Council remarked that EI should strive to have a balance between incentives to work and compensation for being unemployed. The Canadian Construction Association advocated allowing unemployed construction workers to be eligible to receive an advance from their approved benefit of up to $2,000. The Canadian Union of Public Employees encouraged ending the Social Security Tribunal and advised restoring the following: Employment Insurance Boards of Referees, the EI Umpire, the Canada Pension Plan (CPP) and Old Age Security (OAS) Review Tribunals, and the Pensions Appeals Board in an effort to restructure the system. 6. Immigration and Border ServicesWitnesses provided testimony with regard to individuals immigrating into Canada, as well as the processes that all individuals face when traveling or entering into the country. The Canadian Airports Council and the Greater Toronto Airports Authority recommended that additional funding be allocated to the Canada Border Services Agency (CBSA), as travel is an important aspect to Canada’s trade and tourism. The Greater Toronto Airports Authority also requested that additional funding be allocated to the Canadian Air Transport Security Authority (CATSA) for this reason, as well as advocated in favour of the implementation of a federally mandated level of service for border screening. Similarly, the Atlantic Canada Airports Association felt that the system for security screening at Canadian airports should be strengthened. Also speaking on this topic, the Tourism Industry Association of Canada highlighted that the government should invest in new technologies to accelerate the move towards mandatory biometrics information collection at the country’s borders. The Toronto Region Board of Trade noted that the border remains a major impediment to businesses that rely on an integrated North-American supply chain, and that the government should speed up improvements to border infrastructure. With respect to immigration, the Canadian Chamber of Commerce noted that express entry program should be improved in order to address skills gaps in the Canadian workforce. The Toronto Region Board of Trade believed that the government should create a “global skills strategy” that includes new work permit exemptions, a two-week processing time for certain high-skilled workers and the creation of a “global talent stream” in order to attract world-leading talent to Canada. The Atlantic Chamber of Commerce proposed that the application and processing for immigrants and temporary foreign workers should be simplified, and that the government should reduce the hurdles for international graduates to immigrate to Canada. With respect to new immigrants to Canada, the Halifax Chamber of Commerce pointed out that additional funding for settlement services would help to retain workers in specific regions, and the Agriculture and Agri-Food Labour Task Force contended that increased outreach to new immigrants could connect them to sectors with labour shortages – such as the agricultural sector – to the benefit of the Canadian economy. The Greater Charlottetown Area Chamber of Commerce endorsed regular summary reports on Atlantic Province immigration and the status of the Atlantic Canada Opportunities Agency’s international immigration program in order to better attract, retain and integrate international immigrants into local economies. 7. The Committee’s RecommendationsIn order to support the productivity of people by ensuring that their educational and training needs are met, the Committee recommends that the Government of Canada should take the following actions: Recommendation 16 Increase Canadian students’ access to undergraduate research opportunities. Recommendation 17 Increase funding for Indigenous students pursuing post-secondary education and increase the number of students eligible for support under the Post-Secondary Student Support Program. Recommendation 18 Expand employment options and career transition opportunities for students through investments in incubators for student entrepreneurs at post-secondary institutions. Recommendation 19 Support a pilot grant through the Social Sciences and Humanities Research Council of Canada, the Natural Sciences and Engineering Research Council of Canada and the Canadian Institutes of Health Research that would provide students and faculty with an incentive to develop open educational resources. Recommendation 20 Expand funding for youth employment programs, including Canada Summer Jobs and the Skills Link program. As well, the government should require that career development learning opportunities be incorporated into all employment programs that it funds. Recommendation 21 Continue to work with stakeholders and make targeted investments to strengthen apprenticeship and training programs in order to ensure sufficient labour resources to meet the evolving needs of the economy, including support for green trades. Recommendation 22 Support the Atlantic Partnership for Literacy and Essential Skills by providing stable, adequate and predictable funding to their literacy programs. Recommendation 23 Enhance existing financial literacy programs. Particular attention should be paid to the needs of specific demographic groups. Recommendation 24 Review the Social Security Tribunal and consider restoring the following: Employment Insurance Boards of Referees, the EI Umpire, the Canada Pension Plan (CPP) and Old Age Security (OAS) Review Tribunals, and the Pensions Appeals Board in an effort to restructure the system. C. UNDERREPRESENTED GROUPSIn their report Policies for Stronger and More Inclusive Growth in Canada, the OECD concluded that “policy action is needed to enable all Canadian people to be well integrated into the labour market and contribute to economic prosperity, to give all Canadian firms a chance to create jobs, enhance their productivity and disseminate innovative ideas, and to put in place strong governance structures that support inclusive growth objectives.” In commenting on underrepresented groups, the Committee’s witnesses talked about Canada’s aging population and retirement savings and identified Indigenous peoples, women, individuals with disabilities and other underrepresented groups as those for which specific federal actions could make significant improvements in their ability to contribute to the Canadian economy. Figure 9 – Selected Underrepresented Groups as a Percentage of the Canadian Population, 2016 (%)

Note: 2016 Census provides 2015 data for low-income persons. Source: Figure prepared using data obtained from: Statistics Canada, “Data Products, 2016 Census,” accessed 20 November 2017. 1. Aging Population and Retirement SavingsRegarding seniors, the Fraser Institute recognized the challenges associated with an aging population in both the short and long terms. The Canadian Labour Congress advocated for the development of a “national senior strategy.” Expanding public funding to assist in the development of such a strategy was suggested by the Canadian Medical Association. The Canadian Union of Public Employees also supported expanding funding to assist with long-term care of seniors. Ag-West Biotech Inc. encouraged the government to find a way to support longer life expectancy. It offered two suggestions: increasing the age of eligibility to Old Age Security by one year or allowing small business owners to make extraordinary contributions to their Registered Retirement Savings Plans (RRSPs) when unusual events occur. The Business Council of Canada also proposed increasing the age of eligibility for Old Age Security and the Guaranteed Income Supplement from 65 to 67. As per RRSPs, Rogers Group Financial suggested the government permit RRSP annuitants to withdraw up to $2,000 per year from their RRSP or Registered Retirement Income Fund (RRIF) tax-free to fund qualifying long-term care insurance. The Canadian Worker Co-operative Federation proposed restoring pre-2011 Co-operative RRSP rules and to index the cap to inflation. The Investment Industry Association of Canada stressed the importance of improving tax-assisted retirement savings programs. The Canadian Medical Association called for an all-party parliamentary international study that would examine the approaches taken to mitigate inappropriate use of acute care for elderly persons. 2. Indigenous PeoplesThe Committee heard about a number of issues for Indigenous peoples. Regarding funding, Indspire recommended to increase the main agreement funding from Indigenous and Northern Affairs Canada (INAC) from $817,000 to $2,450,000 per year, with an increase of 2% annually thereafter. The North Saskatoon Business Association cautioned that this funding should be directed to actionable items rather than studies or reports. Conversely, the Conference Board of Canada stated that funding should be available to measure the progress of diversity targets and that initiatives for diversity need clear benchmarks. The Assembly of First Nations requested funding for Indigenous peoples in numerous capacities. It listed an increase in funding from INAC for education, infrastructure, claims, climate change mitigation, additions to reserves, child welfare as well as legislative and policy review. Further, it called for an increase in funding from other federal departments. The Saskatchewan Mining Association encouraged investing in the socioeconomic capacity of Indigenous communities, and the Mining Association of Canada suggested increasing funding towards health, housing, water, education, skills and entrepreneurship. Dene Nation added to these requests by suggesting an increase in both the stability and the amount of long-term financing for Indigenous peoples. The University of Saskatchewan, the Canadian Association for Graduate Studies, Colleges and Institutes Canada and the Federation for the Humanities and Social Sciences advocated for increased funding for Indigenous students. The Canadian Association of University Teachers urged the government to double the 2017 federal budget’s commitment to education, and Colleges and Institutes Canada proposed that the government invest in a second round of the Post-Secondary Institutions Strategic Investment Fund, and the Canadian Association for Graduate Studies called for the creation of graduate scholarships for First Nations students. Additionally, Indspire encouraged additional investments of an additional $5 million per year for Building Brighter Futures: Bursaries, Scholarships, and Awards Program, as the current funding of the program will expire in March of 2018 and currently only meets the needs of 11% of indigenous post-secondary students. The University of Victoria requested federal support for outreach and educational facilities of the Indigenous Legal Lodge. The North Saskatoon Business Association proposed that the government emphasize business development education and finance for band chiefs receiving funding and create educational programs for their bands. The Canadian Federation of Students suggested that $10 million in funding go towards the development of learning materials and language courses at the post-secondary level from the Aboriginal Languages Initiative. Addictions and Mental Health Ontario offered to partner with Indigenous communities on mental health and addiction. As well, the Canadian Counselling and Psychotherapy Association argued for the reversal of a 2015 decision to remove Canadian Certified Counsellors from the list of approved service providers for the First Nations Inuit Health Branch program. It also asked for additional funding for the program. Additionally, the Canadian Association of Social Workers committed to continue working with First Nations communities. Kids Help Phone supported the Truth and Reconciliation Commission of Canada Calls to Action. The Government of the Northwest Territories insisted on settling issues regarding outstanding land, and recourse and self-government agreements. Also, the University of Victoria requested working to restore the relationship between Indigenous peoples and the government, as well as building robust institutions. Colleges and Institutes Canada suggested investing $26 million per year in post-secondary institutions to support truth and reconciliation programming and “wrap around” services. The Canadian Chamber of Commerce and the Atlantic Chamber of Commerce requested an increase in funding towards Aboriginal financial institutions. The Canadian Chamber of Commerce specifically called for additional capital for Aboriginal Financial institutions in order to assist Indigenous entrepreneurs. The Canadian Labour Congress stressed the importance of eliminating the gap for child welfare funding for Indigenous children. The Tlicho Government of the Northwest Teerritories called for acknowledgement that INAC received its proposals and requested that they be included in the 2018 federal budget. The Mining Industry NL advocated for full participation of Indigenous peoples in mining by supporting education and training, business development partnerships and employment. Also, Colleges and Institutes Canada supported further skills training for Indigenous peoples. In addition, Canada Without Poverty stressed the need for dedicated funding for a National Right to Food Policy with collaboration with First Nations, Inuit, and Métis peoples. 3. WomenIn informing the Committee on women’s issues, Oxfam Canada advocated stopping a system that puts profits before people by taking steps to ensure women earn living wages. It commented that meaningful action needs to be taken to protect workers’ rights and address women’s precarious work through the following measures: modernize labour standards, adjust living wages, improve EI, and fund women’s rights organizations. The Canadian Centre for Policy Alternatives also suggested making direct investments in women’s organizations, which according to its calculations have been historically underfunded in Canada despite the important role that they play in providing expertise and research to the federal government. The Canadian Partnership for Women and Children's Health supported expanding the Official Development Assistance Program to include women and children’s health by investing $3.5 billion before 2020. The Canadian Association of Science Centres and the Business Council of Canada spoke about making science more inclusive by increasing participation of underrepresented groups and supporting women in science, technology, engineering and mathematics (STEM). Similarly, the Canadian Centre for Policy Alternatives advocated for investing equally in male and female dominated occupational sectors. It provided the example of instituting a living wage for home care workers. Additionally, the Canadian Labour Congress, Oxfam Canada and the Canadian Union of Public Employees recommended introducing a pay equity legislating as a measure to close the gender pay gap in Canada. Oxfam Canada encouraged setting up an advisory council on gender budgeting in order to set clear gender equality targets. The Conference Board of Canada added that funding should be available to measure progress towards these diversity targets. The Canadian Association for Graduate Studies encouraged starting review processes to eliminate unconscious bias against women for scholarships, research grants or fellowships. As well, the Business Council of Canada and Oxfam Canada suggested encouraging women to join the labour force through investment in child care. Oxfam Canada suggested that the Committee should ensure that at least 15% of witnesses for pre-budget consultations are women’s rights organizations or that their proposals are focused on gender equality. 4. Individuals with Disabilities and Other Underrepresented GroupsIn commenting on issues facing people with disabilities, the Canadian Dental Association asked the government to invest in existing or lapsed provincial and territorial oral health programs for people with disabilities, while the Centre for Israel and Jewish Affairs requested that a specific portion of the 2018 budget be allocated to affordable housing for people with disability. With regard to accessibility for people with disabilities, March of Dimes Canada advocated that the government take steps to make the accessibility criteria of the information and communications technology (ICT) systems and services mandatory for public procurement in Canada. It believed that making ICT accessibility for public procurement mandatory would demonstrate the government’s commitment to equality for people with disability and would make accessible products more affordable to the government as well as the community as a whole. The Canadian Association for Graduate Studies suggested that the Tri-Council update their funding and scholarship policies to ensure accessibility, accommodation and inclusivity of students with disabilities, including the access to essential graduate research-related activities for students with long-term disabilities. With a focus on those with limited means, Canada Without Poverty urged the government to adopt a human rights approach to the 2018 federal budget by analyzing the effect of spending on marginalized groups. It added that the new Canadian Poverty Reduction Strategy should also use a human rights approach with dedicated funding in the 2018 federal budget. The Co-operative Housing Federation of Canada commented that the government should preserve affordability of housing co-ops for low-income households while the Canadian Home Builders' Association said that instead of providing funding tied to specific social housing units, the government should introduce portable housing benefits that are tied to people in order to improve the mobility of lower-income families. The Northwest Territories/Nunavut Council of Friendship Centres believed that the government should conduct research into homelessness at a local level as it is one of the biggest barriers to success for their clients. The Community Sector Council Newfoundland and Labrador called on the government to continue its effort to help lower-income Canadians access post-secondary education through the Canada Learning Bond by increasing its ceiling and indexing it to inflation. The Canadian Labour Congress thought that the objectives of the Canadian Poverty Reduction Strategy could be achieved by measures such as strengthening employment standards and introducing a federal minimum wage in Canada. However, the Quebec Employers' Council and Restaurants Canada believed that the government should provide fiscal and tax incentives to encourage the hiring and training of marginalized Canadians. 5. The Committee’s RecommendationsRecognizing that different groups of Canadians – including children and youth, women, Indigenous peoples, persons with disabilities and seniors – have particular needs that must be met to ensure their productivity in their workplaces and their communities, the Committee recommends that the Government of Canada should ensure the implementation of the following: Recommendation 25 In partnership with relevant stakeholders, develop and implement a pan-Canadian mentoring program to increase access for tens of thousands of vulnerable young Canadians to the benefits and impacts of mentoring. Recommendation 26 Allocate the funding needed to develop and implement an early learning and child care system. This system should ensure that all Canadian children and families are able to access high-quality, inclusive child care services. Recommendation 27 Address violence against women by increasing the funds allocated to the Women’s Program at Status of Women Canada, in recognition that violence against women costs the Canadian economy $12 billion per year. Recommendation 28 Increase its investment in job training programs for Indigenous peoples and support reconciliation by providing increased funding for programs that strengthen Indigenous youth opportunities. These youth programs could include sports, culture and mentorship. Recommendation 29 Increase and update the funding agreement between Indigenous and Northern Affairs Canada and Indspire to deliver programs focused on reducing the educational gap between Indigenous and non-Indigenous Canadians. Funding provided to Indspire should be increased annually to account for inflation. Recommendation 30 Fulfill the Truth and Reconciliation Commission’s calls to action by providing the University of Victoria with financial support for an Indigenous Legal Lodge. This support should be delivered through Indigenous and Northern Affairs Canada. Recommendation 31 Provide support for the Northwest Territories/Nunavut Council of Friendship Centres. Recommendation 32 Allocate funding to affordable housing for people with disabilities. As well, the government should establish a plan that would ensure that 5% of all federal affordable housing investments are directed to support people with developmental disabilities. Recommendation 33 Allocate funding to existing or lapsed provincial/territorial oral health programs for vulnerable populations. Recommendation 34 Adopt a “whole of government” approach in developing a national seniors strategy. The strategy should include palliative and end-of-life care. Recommendation 35 Increase funding for multiculturalism programs that support community capacity building, enact a national plan against racism, promote inter-faith dialogue, and support the fight against racism and discrimination. Recommendation 36 Work towards eliminating the gap for child welfare funding for Indigenous children. Recommendation 37 Introduce pay equity legislation for federally regulated sectors and work with the provinces/territories as well as private sector stakeholders to close the gender pay gap in Canada. In launching its pre-budget consultations in advance of the 2018 federal budget, the Committee posed the following question: What federal measures – such as those that would help businesses to undertake research, innovation and commercialization – would help businesses to be more productive and competitive? A. TAXATION AND REGULATORY REQUIREMENTSAccording to the OECD’s working paper How do Taxes Affect Investment and Productivity?: An Industry-Level Analysis of OECD Countries, taxes can have an effect on countries’ material living standards by affecting the determinants of GDP per capita, labour, capital and productivity. In commenting on business taxes and regulatory issues, the Committee’s witnesses pointed out that corporate taxation, the small business tax rate, accelerated capital cost allowance, excise tax, carbon pricing, and modernization and red tape reduction are important factors that contribute to the productivity and competitiveness of Canadian businesses. 1. Corporate TaxationFigure 10 – Taxes on Corporate Profits as a Percentage of Gross Domestic Product, G7 Countries, 2000 and 2015 (%)