FINA Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

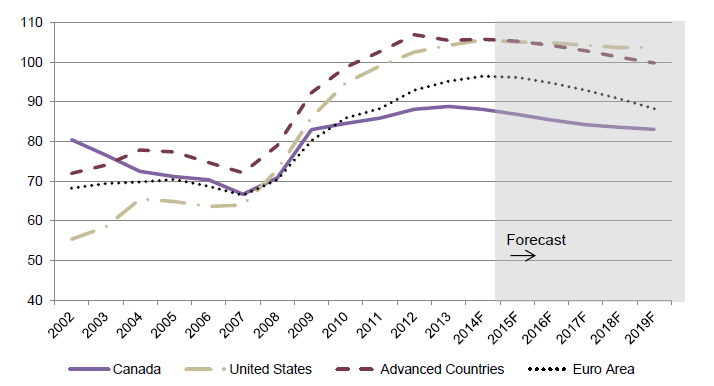

CHAPTER TWO: BALANCING THE FEDERAL BUDGET TO ENSURE FISCAL SUSTAINABILITY and Economic GrowthA. Background1. Fiscal Conditions and ProjectionsDuring the most recent global financial and economic crisis, reduced economic activity led to a decline in government revenue in several advanced countries; with an increase in government spending due – at least in part – to stimulus measures, some governments had budgetary deficits and higher levels of debt. Following the crisis, a number of these countries implemented measures to reduce their budgetary deficit, which the International Monetary Fund (IMF) believes stabilized the levels of debt, including in the euro area; however, it has noted that – by 2019 – debt levels as a percentage of gross domestic product (GDP) are still expected to exceed 100%, as shown in Figure 1. According to the IMF, “[h]esitant recovery and persistent risks of [low inflation] and reform fatigue call for fiscal policy that carefully balances support for growth and employment creation with fiscal sustainability.” Figure 1 – General Government Gross Debt as a Proportion of Gross Domestic Product, Canada, the United States, the Euro Area and Advanced Countries, 2002–2019

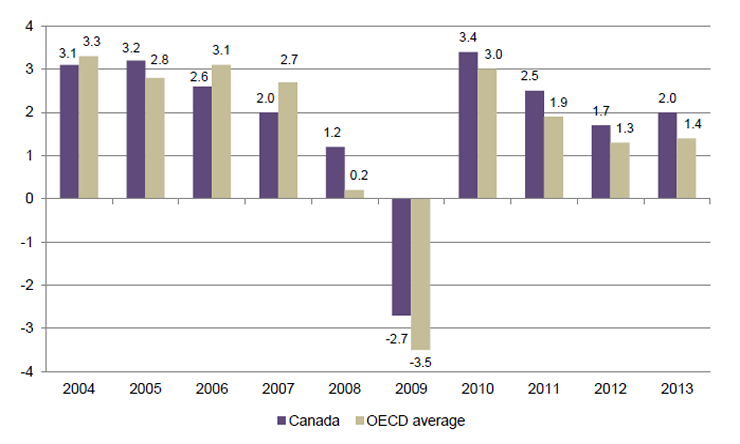

Notes: “F” indicates forecast. Data refer to the gross debt of the general government, which includes the federal, state or province and local levels of government. According to the International Monetary Fund, the advanced countries are Australia, Austria, Belgium, Canada, Cyprus, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hong Kong (Special Administrative Region of China), Iceland, Ireland, Israel, Italy, Japan, Latvia, Luxembourg, Malta, the Netherlands, New Zealand, Norway, Portugal, San Marino, Singapore, the Slovak Republic, Slovenia, South Korea, Spain, Sweden, Switzerland, Taiwan (Province of China), the United Kingdom and the United States. According to the International Monetary Fund, the euro area consists of 18 European Union member countries that have adopted the euro as their common currency and sole legal tender. The member countries are Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia and Spain. Source: Figure prepared using information from: International Monetary Fund, World Economic Outlook Database, 4 November 2014. Department of Finance data indicate that Canada’s federal budgetary deficit reached a peak of $55.6 billion in 2009–2010, and has been decreasing since then; it was $33.4 billion in 2010–2011, $26.3 billion in 2011–2012, $18.4 billion in 2012–2013 and $5.2 billion in 2013–2014. According to the Department of Finance’s Update of Economic and Fiscal Projections, the federal budgetary deficit will be $2.9 billion in 2014–2015, and there will be a budgetary surplus of $1.9 billion in 2015–2016. In 2013–2014, the federal debt – defined as the difference between the federal government’s total liabilities and total assets – was $611.9 billion and the federal debt as a proportion of GDP was 32.3%. These figures were – respectively – higher and lower than the 2012–2013 values of $609.4 billion and 33.3%. In 2013–2014, at the federal level, the net debt – defined as the difference between the federal government’s total liabilities and financial assets – was $682.3 billion and the net debt as a proportion of GDP was 36.3%. These figures were – respectively – higher and lower than the 2012–2013 values of $678.3 billion and 37.3%. In the 16 October 2013 Speech from the Throne, the federal government announced its intention to introduce balanced budget legislation that would “require balanced budgets during normal economic times, and concrete timelines for returning to balance in the event of an economic crisis.” To date, balanced budget legislation has not been introduced in Parliament. 2. Economic Conditions and ProjectionsAccording to Statistics Canada, the year-over-year growth rate in Canada’s real GDP was 1.0% in the fourth quarter of 2012, a post-2010 peak of 2.7% in the fourth quarter of 2013, 2.1% in the first quarter of 2014 and 2.6% in the second quarter of 2014. Figure 2 shows annual real GDP growth rates for Canada and the average for Organisation for Economic Co-operation and Development (OECD) countries over the 2004 to 2013 period. Since 2008, Canada’s real GDP growth rate has been consistently higher than the average for OECD countries; in 2013, Canada’s rate was the highest among the Group of Seven and euro area countries. Figure 2 – Annual Growth in Real Gross Domestic Product, Canada and OECD Countries, 2004–2013 (%)

Source: Figure prepared using information from: Organisation for Economic Co‑operation and Development, OECD.StatExtracts, accessed 4 November 2014. The Bank of Canada expects the Canadian economy to grow by 2.3% in 2014, 2.4% in 2015 and 2.3% in 2016. Household consumption is expected to contribute relatively less to real GDP growth than has been the case in the past, while the contributions by business fixed investment and exports are predicted to increase, particularly in 2014 for exports, and in 2015 and 2016 for business fixed investment. In his 4 November 2014 appearance before the Committee, the Governor of the Bank of Canada indicated that the export sector’s recent underperformance can be explained by the loss of production capacity, due in part to factory closures and restructuring in a number of non-energy export sectors since 2000. That said, he suggested that the outlook for the export sector is improving and that the low relative value of the Canadian dollar plays a role. Regarding business investment, he stated that “while companies plan to invest in new machinery and equipment, few are planning to expand their capacity, at least so far. This helps explain why business investment might be delayed ….” The Parliamentary Budget Officer, selected financial institutions, the IMF, the OECD, and the Department of Finance, which relies on a survey of private-sector forecasters when determining its forecast, have estimated that annual economic growth in Canada will be between 2.3% and 2.5% in 2014, and between 2.4% and 2.7% in 2015. B. Changes Proposed by Witnesses Invited to Address “Balancing the Federal Budget to Ensure Fiscal Sustainability and Economic Growth”In speaking to the Committee about balancing the federal budget to ensure fiscal sustainability and economic growth, witnesses invited to address this topic made proposals relating to federal budgetary policy, balanced budget legislation and fiscal reporting. 1. Federal Budgetary PolicyThe Canadian Council of Chief Executives, the Fraser Institute and the Macdonald-Laurier Institute stated that eliminating the federal budgetary deficit should be a priority for the government, and the Fraser Institute advocated strong fiscal discipline once budgetary balance is achieved. According to the Canadian Council of Chief Executives, the Canadian Taxpayers Federation, the Frontier Centre for Public Policy and the Macdonald-Laurier Institute, the government should reduce the level of the federal debt. To encourage debt-reduction efforts, the Canadian Taxpayers Federation proposed that the 2015 federal budget include a schedule for debt repayment. In considering its long-term projection – for 2017 and beyond – of Canadian economic growth of 2% annually, the Conference Board of Canada suggested that economic growth be the core theme of future federal budgets. The Canadian Taxpayers Federation and the Frontier Centre for Public Policy encouraged the government to reduce taxes. The Conference Board of Canada proposed that the government prioritize debt reduction over tax reductions. Regarding ways in which federal spending could be reduced, the Macdonald-Laurier Institute urged the government to undertake a comprehensive review of public-sector compensation, including pensions. With a view to reducing the size of the public sector and enhancing its effectiveness, the Frontier Centre for Public Policy advocated the adoption of measures that have been implemented in other countries, such as embedded performance management and improved accounting systems. As a means of managing the growing cost of health care and the pressure it exerts on Canadian fiscal sustainability, the University of Ottawa's Kevin Page encouraged a national dialogue on health care policy and finance that would involve all stakeholders. The Frontier Centre for Public Policy proposed that federal involvement in areas of provincial responsibility end, and that federal taxing powers – particularly in relation to the Goods and Services Tax (GST) and the federal excise tax on gasoline – be transferred to the provinces to offset reduced federal spending in these areas. As well, in commenting that equalization transfers can lead the public sectors in recipient provinces to be large and inefficient, it called for changes to the equalization program that would occur concurrently with the proposed transfer of federal taxing powers. Mr. Page suggested that options to reform federal transfers to the provinces/territories be examined. 2. Balanced Budget LegislationThe Canadian Taxpayers Federation supported the enactment of federal balanced budget legislation, and suggested that the statute be integrated into the Constitution Act, 1867. While he recognized that balanced budget legislation can provide a strong signal that the government has a specific fiscal target, Mr. Page indicated that other countries’ experience with such legislation should be analyzed to help identify best practices and measures that would mitigate any potential negative impacts. In his view, if balanced budget legislation is adopted, it should be designed in a manner that would not limit investments in infrastructure. 3. Fiscal ReportingIn noting the practice of governments in some other OECD countries, Mr. Page urged the federal government to publish annual fiscal sustainability reports that would provide analysis of the fiscal situation of federal, provincial/territorial and municipal governments. In addition, he proposed that the government prepare five-year spending plans for each department and agency that would outline spending reductions and corresponding changes to service levels, as these changes may lead to future spending pressures on governments. C. Changes Proposed by Witnesses Invited to Address Topics Other Than “Balancing the Federal Budget to Ensure Fiscal Sustainability and Economic Growth”The Committee’s witnesses were invited to speak about a particular topic. When they appeared, they often made comments about one of the other five topics selected by the Committee, as indicated below. 1. “Supporting Families and Helping Vulnerable Canadians by Focusing on Health, Education and Training” WitnessesYWCA Canada proposed that the government implement gender-based analysis at the earliest possible stage of the process for developing the federal budget. 2. “Increasing the Competitiveness of Canadian Businesses Through Research, Development, Innovation and Commercialization” WitnessesThe Confédération des syndicats nationaux urged the federal and provincial governments to work together with a view to resolving the fiscal imbalance. It also asked the federal government to revise the equalization formula, and to improve the Canada Health Transfer and the Canada Social Transfer. 3. “Ensuring Prosperous and Secure Communities, Including Through Support for Infrastructure” WitnessesIn speaking about the equalization program, Marcelin Joanis – who is with Polytechnique Montréal and appeared as an individual – indicated that the program’s redistributive capacity is limited. He commented on a properly functioning federation, and questioned the appropriateness of federal insulation from the effects of fluctuating equalization payments. 4. “Improving Canada’s Taxation and Regulatory Regimes” WitnessesIn commenting on federal budgetary balance, the Canadian Centre for Policy Alternatives proposed that tax reductions be considered as a third or fourth option to achieve balance. The Canadian Bankers Association and the Chartered Professional Accountants of Canada supported the goal of federal budgetary balance while maintaining a competitive tax environment. In speaking about the flow of capital, Tax Executives Institute, Inc. suggested that any federal commitment to budgetary balance be considered in the context of the need to ensure Canada’s corporate tax competitiveness and appropriate levels of foreign investment. 5. “Maximizing the Number and Types of Jobs for Canadians” WitnessesScott Clark – who is with C.S. Clark Consulting and appeared as an individual – suggested that future federal budgetary surpluses be used to stimulate economic growth and create jobs, mainly through infrastructure spending; measures in these areas should be financed through debt rather than through higher taxes or reduced program spending in other areas. The Quebec Employers’ Council requested that future federal budgetary surpluses be used strategically and in a balanced manner; particular mention was made of corporate and personal tax reductions, and investments in programs that influence productivity, innovation, marketing, environmental conservation and infrastructure development. |