Based on the economic narrative examined in Chapter 2, the

arguments in favour of removing foreign ownership restrictions appear

compelling. Indeed, to the extent that removing foreign restrictions could help

increase competitive pressure in the wireless market, and potentially improve

some of the market features, such a change in policy would likely be beneficial

to the economic welfare of Canadians. This is the economic case. However, there

are also important social and equity dimensions to the foreign ownership

question. This section examines the elements related to those aspects.

Public Mobile, a new entrant in the wireless market that appeared

before the Committee, suggested that the extremely low level of cellular mobile

penetration is indicative of the fact that the large incumbents are not

interested in servicing markets that are considered less lucrative (rural,

low-density, or lower-income individuals). Public Mobile has made no secret

that it is going after the markets that are underserved by the large incumbents:

Public Mobile, unlike some of the other new

entrants, is actually not competing head to head with some of the incumbents.

We aren’t going upmarket. We aren’t offering BlackBerrys and smart phones. We’re

actually aimed directly at what we refer to as “the unserved market”. We’re

going after the working-class Canadians who require predictability in their

bill. If you did the research and really looked into why working-class Canadians,

that one third of Canadians, don’t have cell phones, it’s because they’re

value-conscious. They live paycheque to paycheque.

The Committee does not have any evidence to substantiate the claim

that the large incumbents are more interested in going after the high-end

market segments, but notes that the low level of cellular mobile penetration in

Canada relative to other countries does indicate that a large swath of the

Canadian population is not using wireless phones at this time. Of course,

reasons for this underutilisation could be multi-fold. For example, since

wireline and wireless are sometimes considered substitutes, a reasonably priced

and well served wire line market would act as a deterrent to an increase in

cellular phone penetration. A poor wire line infrastructure has in fact been an

important catalyst to increasing cellular phone penetration in some countries.

Moreover, cultural differences could play a role in the lower Canadian

utilisation levels as well. Nonetheless, the difference is so important in

mobile cellular penetration between the Canadian market and other OECD markets

that the Committee is of the view that pricing in the Canadian wireless market

segment must be playing a role to some extent. In particular, the two studies

surveyed in Chapter 2 would suggest that Canada is not a low-price country in

terms of mobile phone service.

Consequently, some portion of the Canadian population may decide

not to own a wireless phone because of pricing concerns. This creates an

“equity” issue whereby “working class” Canadians could be priced out of the

market. As relayed to the Committee by Alek Krstajic, CEO of Public Mobile,

this constitutes an argument against maintaining the status quo on foreign

ownership rules to the extent that the current rules do not favour an increase

in competitive pressure in the wireless market, which could lead to a decrease

in consumer prices and an increase in market penetration.

Officials from Industry Canada indicated to the Committee that the

removal of foreign ownership restrictions is under consideration for telecommunications

industries only, not for broadcasting industries. Since broadcasting

distribution undertakings (BDU) are regulated under the Broadcasting Act,

a number of witnesses (e.g., MTS Allstream, Shaw, Rogers, Bell, Telus) that are

integrated market players (i.e., that are both telecommunications common

carriers and BDUs) informed the Committee that they strongly oppose the

potential differential treatment of telecommunications carriers and

broadcasting distributors with respect to the liberalisation of foreign

ownership rules. They indicated that technological convergence has resulted in

corporate convergence, and that creating an artificial difference between the

two types of businesses from a regulatory standpoint would put them at a

competitive disadvantage.

Before the advent of the Internet age, telecommunications carriage

and broadcasting distribution were clearly separate undertakings from a

technological and corporate standpoint; one was dealing with phone service, the

other with television. Technological convergence has changed this reality. In

the broadcasting distribution segment, firms that used to be strictly

considered phone companies (e.g., Bell) are now going after the market share of

what used to be the sole preserve of established BDUs (e.g., Rogers, Shaw, and

Videotron). Conversely, these established BDUs are now trying to take a share

of the home phone market away from the traditional phone companies. Both types

of businesses are competing head to head in the Internet broadband market segment.

In the wireless segment, two of the dominant players (Bell and Telus) have

their origins in the traditional wireline phone segment and one (Rogers) has

its roots in the traditional broadcasting distribution segment. Given this

reality, it could be argued that the integrated players (Bell, Telus, Rogers,

Videotron, Shaw, MTS Allstream) are direct competitors in the fixed phone, Internet

broadband and cable distribution segments. Moreover, as a result of the latest

spectrum auction, two new entrants in the wireless market are from the

traditional broadcasting distribution segment (Videotron and Shaw). Therefore,

wireless telephony constitutes an additional market segment where major

integrated players will compete against each other.

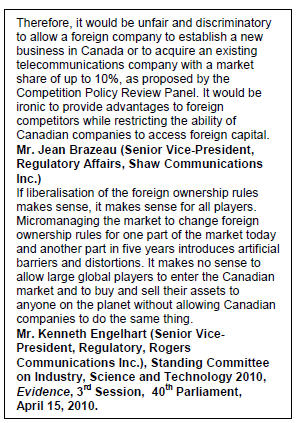

In this context, it is not surprising to see why these integrated

players (Telus, Rogers, Shaw and MTS Allstream) are in favour of removing the

ownership restrictions if applied equally to both telecommunications common

carriers and BDUs. If foreign ownership restrictions are removed under the Telecommunications

Act only, it would expose the integrated players (i.e., those that are both

telecommunications common carriers and BDUs) to the competitive threat of

non-integrated players (pure-play telecommunication common carriers) that would

have unlimited access to foreign capital.

This competitive threat would perhaps force the integrated players

to spin off their telecommunications carriage businesses (i.e., create separate

telecommunications carriage subsidiaries) in order to make them eligible to

receive unlimited foreign capital investment. Such changes could, however,

affect their “integrated offerings” (whereby television, Internet, phone

services are bundled in a single package) since phone and Internet services

would now be offered by different subsidiaries. Therefore, removing foreign

ownerships restrictions for telecommunications common carriers only could be

considered inequitable from the integrated players’ perspective.

It should be noted that the Telecommunications Review Panel was

acutely aware of this issue in its 2006 report. Although it recommended partial

removal of foreign ownership restrictions starting with the telecommunications

carriage segment as a first step, it also recommended that the federal government

undertake a complete review as to how these changes could apply to BDUs without

affecting broadcasting content.

Both

the 2006 Telecommunications Review Panel and the 2008 Competition Policy Review

Panel proposed a phased-in approach to the removal of foreign ownership

restrictions. In the first phase, the federal cabinet would be granted

authority to waive foreign ownership restrictions for telecommunications common

carriers when a foreign investment is deemed in the public interest. According

to both panels, a presumption would be made that foreign investments in any

start-up telecommunications common carrier or one with less than 10 % of

the total revenues generated in any telecommunications service are in the

public interest. The second phase, which would take place only after a complete

review of broadcasting policy, would consist of greater liberalisation of

foreign investment rules to players of all sizes and would extend this

liberalisation to broadcasting distribution undertakings (but not to

broadcasters). Large established market players that appeared before the

Committee typically opposed a phased–in approach on the ground that it provides

an unfair competitive advantage to smaller players or new entrants.

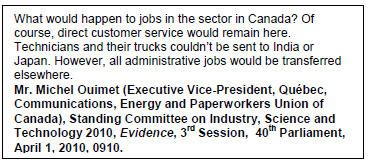

Telecommunications

carriage and broadcasting distribution cannot be considered in the same manner

as a plant producing goods; moving all equipment into another country to take

advantage of lower costs is not an option. From this perspective, foreign

ownership could appear to be less of a threat to employment levels than is the

case in other industries. However, witnesses on both sides of the foreign

ownership debate indicated that a decrease in head office jobs (including

research and development) in Canada could result from the removal of foreign

ownership restrictions. To use a specific example, if Verizon Corporation, a

major U.S. telecommunications company, were to acquire the telecommunications

carriage and broadcasting distribution activities of Bell Canada, this would

likely result in a decrease in the number of head office jobs in Canada. Professor

Globerman of Western Washington University offered a dissenting view on this

issue. He suggested that global value chains are making location a very

fungible item in the elaboration of corporate strategy and that companies are

moving activities to where it’s efficient to do those activities. In this

light, according to the Professor, it could be the case that by saying no to

foreigners, Canada is denying itself the opportunity to do more research and

development.

Telecommunications

carriage and broadcasting distribution cannot be considered in the same manner

as a plant producing goods; moving all equipment into another country to take

advantage of lower costs is not an option. From this perspective, foreign

ownership could appear to be less of a threat to employment levels than is the

case in other industries. However, witnesses on both sides of the foreign

ownership debate indicated that a decrease in head office jobs (including

research and development) in Canada could result from the removal of foreign

ownership restrictions. To use a specific example, if Verizon Corporation, a

major U.S. telecommunications company, were to acquire the telecommunications

carriage and broadcasting distribution activities of Bell Canada, this would

likely result in a decrease in the number of head office jobs in Canada. Professor

Globerman of Western Washington University offered a dissenting view on this

issue. He suggested that global value chains are making location a very

fungible item in the elaboration of corporate strategy and that companies are

moving activities to where it’s efficient to do those activities. In this

light, according to the Professor, it could be the case that by saying no to

foreigners, Canada is denying itself the opportunity to do more research and

development.

Notwithstanding this last argument, loss of head office employment

is a possible undesirable by-product of removing foreign ownership

restrictions. This undesirable impact has to be weighed against the possible

advantages of this policy change described earlier.

It was made clear to the Committee that the first stop on the road

to more competition in the wireless segment lies in urban areas. Given higher

population density, urban areas are much more profitable than rural areas for

telecommunications common carriers. New independent players in the wireless

segment (e.g., Public Mobile and Globalive) made no secret that they intend to

target urban areas first. They further pointed out that as urban markets become

saturated, competition would naturally move to rural areas. According to them,

rural areas will eventually reap the benefits of allowing foreign ownership,

but with a time lag relative to urban areas. Incumbent wireless operator Rogers

Communications made reference to the approach of their new competitors:

Globalive isn’t going to do anything for the rural

areas. They are honest about the fact that they are going to only provide

service in the major urban areas. None of the new entrants will go to the rural

areas. We’re already doing a huge amount. This revolution in wireless broadband

is something that I would urge this committee to take note of.

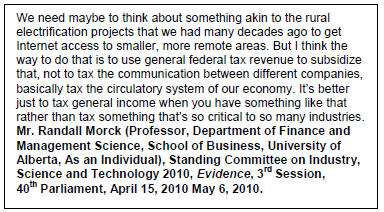

The equity issue embodied by the rural-urban divide would perhaps

not be a major problem if removal of foreign ownership restrictions led to

increased competition and lower prices in urban areas while also benefiting—or

at least not harming—consumers in rural and remote areas. A scenario where

prices in rural areas increase as a result of increasing competition in urban

centers cannot, however, be completely ruled out. Cross-subsidising between

profitable and non-profitable business segments is a well known practice in the

telecommunications industry. This raises the spectre of cut-throat competition

in urban centres leading to higher prices in rural and remote areas through

geographical cross-subsidisation practices from major market players in the

wireless segment.

Some

witnesses who appeared before the Committee pointed out that the best way to

deal with urban-rural divide issues is through a government direct subsidy

program (funded from general revenues). This last option is the one that is

typically favoured by economists since it is considered the least market

distorting and the most efficient. This option was also recommended by the 2006

Telecommunications Review Panel to fund broadband expansion in areas that are

considered less profitable to commercial operators.

Some

witnesses who appeared before the Committee pointed out that the best way to

deal with urban-rural divide issues is through a government direct subsidy

program (funded from general revenues). This last option is the one that is

typically favoured by economists since it is considered the least market

distorting and the most efficient. This option was also recommended by the 2006

Telecommunications Review Panel to fund broadband expansion in areas that are

considered less profitable to commercial operators.

Also mentioned in the urban-rural divide debate is the fact that

the goal of a business, whether Canadian or foreign-owned, is ultimately to

maximise profit, not to achieve a given societal objective. From this

perspective, there is not much difference between a Canadian telecommunications

company and a foreign-owned one; neither will invest in a project for the sole

purpose of providing services to rural and remote areas if the project is not

commercially viable. Only government policy could ensure that such investments

are undertaken.

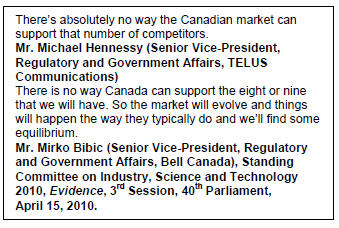

As

shown in Chapter 2, most OECD countries have three wireless operators that hold

the vast majority of the domestic market share. From this perspective, Canada’s

situation is not much different than that in other countries. Witnesses

indicated that in the long run, the Canadian market cannot possibly sustain

eight or nine players in the wireless segment. Therefore, by removing foreign

ownership restrictions, Canada could run the risk of having the worst of both

worlds: end up with the same number of operators as is the case currently (or

even a lower number) and have those few operators be foreign-owned. In such a

scenario, the increase in the level of competition resulting from the removal

of foreign ownership restrictions could be a temporary phenomenon tantamount to

a “hit-and-run”, with operating margins and prices being driven down in the

short-term by the increase in the number of operators and

the removal of foreign ownership restrictions. This would ultimately encourage

consolidation through buy-outs or bankruptcies of the weaker elements. The end

picture could be an increase in market concentration, a lower level of

competition and perhaps even higher prices.

As

shown in Chapter 2, most OECD countries have three wireless operators that hold

the vast majority of the domestic market share. From this perspective, Canada’s

situation is not much different than that in other countries. Witnesses

indicated that in the long run, the Canadian market cannot possibly sustain

eight or nine players in the wireless segment. Therefore, by removing foreign

ownership restrictions, Canada could run the risk of having the worst of both

worlds: end up with the same number of operators as is the case currently (or

even a lower number) and have those few operators be foreign-owned. In such a

scenario, the increase in the level of competition resulting from the removal

of foreign ownership restrictions could be a temporary phenomenon tantamount to

a “hit-and-run”, with operating margins and prices being driven down in the

short-term by the increase in the number of operators and

the removal of foreign ownership restrictions. This would ultimately encourage

consolidation through buy-outs or bankruptcies of the weaker elements. The end

picture could be an increase in market concentration, a lower level of

competition and perhaps even higher prices.

Professor Globerman from Western Washington University indicated

that it should be precisely the role of the Competition Bureau to protect and

promote competitive markets and prevent this scenario from happening. In

contrast, Peter Murdoch (from Media, Communications, Energy and Paperworkers

Union of Canada) took issue with relying on the on the Competition Bureau:

[Y]ou heard that Canada’s

Competition Act will prevent large foreign companies from buying up

Canadian telecommunications firms and acquiring market dominance. But even

domestically this legislation has not worked well. It certainly has not stopped

Canada’s cable systems from buying up their competitors so that five companies

now set the prices for 90% of all cable subscribers in Canada.