Biotechnology Innovation: A submission to the House of Commons Standing Committee on Finance to create sustainable long-term economic growth inCanada

EXECUTIVE SUMMARY:

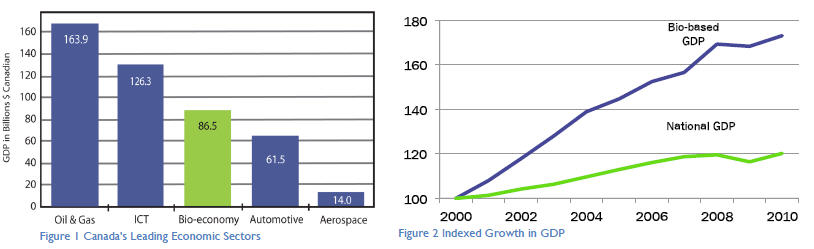

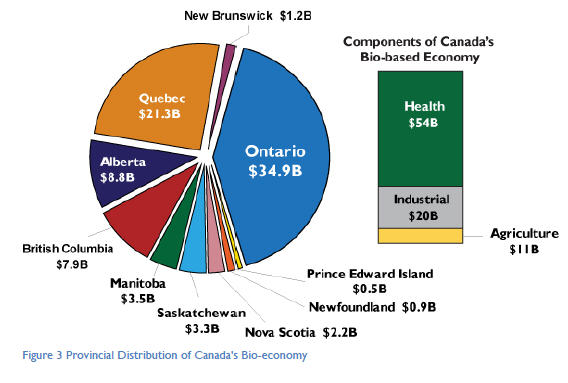

The bio-economy in Canada represents an employment network of more than 1 million jobs in Canada. The bioeconomy comprises $87 billion of our nation’s gross domestic product (GDP) and has a tangible footprint in every province throughout the country. The bio-economy brings increased economic growth, high skilled jobs, more effective health care spending, improved productivity, and globally competitive leadership in research commercialization. This proposal will show how Canada can take 3 steps to further build prosperity through the bio-economy by helping to generate capital for Canadian operations, balancing incentives for investments and investing in measures to save health care spending.

3-step action plan to keep growing the bio-economy in Canada:- Enable Risk Capital Formation for Domestic Spending: Expand the flow-through shares program to junior biotechnology companies in Canada.

- Improve Global Competitiveness for All

Domestic R&D Jobs: Remove the Canadian-controlled

private company (CCPC) restriction from the Scientific Research and Experimental &ED) tax credit program. - Sustain Federal Vaccine Funding for Healthcare Savings: Invest in new vaccines that provide world-class care and save costs in our health care system.

The biological sciences in

Canada are adding value to a host of products, services and industries,

establishing the “the

bio-economy.” From resource management to new manufacturing technologies, from

new medicines to healthier foods, from renewable energy sources to cleaner

chemical production, biotechnology is driving vast levels of innovation into all

elements of the Canadian economy. New vaccines, bio-diesel and engine oils made from

oilseed crops, biological therapies for Alzheimer’s and cancer, ethanol (1

million litres per day), new

plastic

composites from agricultural sources, trans fat-free cooking oil, renewable

biomass energy sources — all showcase the vast range of applications

biotechnology offers the job creation demands of today and for years to come. As shown below, the bio-economy is material

and growing.

If Canada embraces its full bio-economy potential, we can become the world’s leading bio-economy within the next decade. Achieving the US’s level of 8.1% of GDP would see an additional 280,000 jobs in Canada.

BIOTECHNOLOGY COMPANIES DEPEND ON ACCESS TO RISK CAPITAL

Canadian biotech companies need to attract one to 1.5 billion dollars of new investment annually to sustain products and processes currently in development, according to global industry experts.[1]

With almost 600 innovative biotechnology companies located here in Canada feeding a national network of discovery and development, the Canadian biotechnology industry is a catalyst for our long-term economic health in all regions of the country. The figure below show cases the activity across the country which is poised for renewed growth - with the recommended aforementioned 3 action steps.

The biotech industry accounts for 11 percent of all business expenditures on research and development (BERD) in Canada.[2] We estimate Canada’s biotech industry represents a BERD/GDP value of 2.2%, more than twice the aggregate BERD/GDP value of Canada’s overall economy.[3]

Access to capital remains the number one challenge this industry faces as it seeks to bring new technologies into the global marketplace. The unique length and depth of the development process for biotechnology products stands out amongst dozens of other innovative technologies. On average, these technologies take 7- 10 years to develop and work through initial regulatory paths. Combined with length of development time, the high level of risk involved with scientific discovery, and the better incentives to invest in other areas like hy away from this industry. Moreover, given the lack of venture capital funds in Canada, companies look to the global marketplace for investment or out-licensing opportunities.

The recent PricewaterhouseCoopers Life Sciences Forecast tells us companies on average are seeking over $10 million in their next round of financing.[4]

STEP 1: Enable Risk Capital Formation for Domestic Spending:

Expand the flow-through shares program to junior biotechnology companies in Canada.

Since its introduction more than 50 years ago, the flow-through shares (FTS) program has consistently delivered positive returns for the Government of Canada, our national economy, and our way of life. Simply put, this program has positioned Canada as the number one destination in the world for:

- the exploration, development, and commercialization of mineral products; exports of mineral commodities and related products to the world;

- resource equity financing; and

- attracting the top resource management talent.

The FTS program is a market-based incentive that levers the capital markets to create new risk capital for high- risk resource projects that have the potential to deliver outstanding positive returns. As evidenced by the government in their 2010 federal budget whereby the program was expanded to certain areas of the renewable energy biotech sector, it can lever private-sector investment into all biotech driven enterprises to the benefit of Canada. Due to the many similarities with the junior mining sector in terms of business and development risk, the junior biotech sector is the primary candidate for flow-through share

Permitting junior biotechnology companies to issue FTS would stimulate more research investment, jobs, and commercialization of high-tech goods and services in Canada. As a preliminary estimate, expanding the FTS program to Canada’s biotechnology industry is expected to generate nearly $1 billion in gross output and create nearly 8,000 new high-value jobs in the immediate short-term.

STEP 2: Improve Global Competitiveness for All Domestic R&D Jobs:

Remove the Canadian-controlled private company (CCPC) restriction from the Scientific Research and Experimental Development (SR&ED) tax credit program.

The SR&ED tax credit program remains the sole tax incentive for companies in our industry to keep investing in R&D jobs here. Moreover, the refundable credits of the federal SR&ED program are only available to CCPCs many companies do not qualify or benefit from refundable credits. The vast majority of companies in Canada’s biotechnology industry are small, pre-commercial companies with little to no cash flow - these companies rely on risk capital to bring their first technologies to market. In today’s competitive global technology market, small biotech companies are not only seeking their next round of financing from domestic private markets, but also from public markets and foreign investors. However, the CCPC restriction on SR&ED refundable tax credits discourages small companies in our industry from seeking capital from these two vital sources of capital and, subsequently, creates a distinct competitive disadvantage for innovative companies operating in Canada. The value of the SR&ED program has been proven in numerous government, industry, and academic reports - the Department of Finance itself has calculated that for every dollar spent on the program, a gross economic gain of $1.11 is created. Refundable credits provide the important financing to sustain research jobs and help companies grow in Canada. These refundable credits need to be available to all SME’s irrespective of ownership in Canada.

As other nations reframed their economic incentives in response to the recent economic recession beginning in 2008, many countries sharpened their capacity to compete for investment via their respective R&D tax credit programs - see below. Canada has lost it’s ‘best-in-world’ status for research credits as it applies to emerging research companies.

It is important to note we are

not recommending increases to the taxable capital and taxable income limits to

SR&ED.

Removing the CCPC restriction will not affect large commercial enterprises. Our

recommendation is

based on

the premise that small, non-CCPC Canadian technology companies are at a

tremendous

disadvantage

simply because of their ownership structure, even though they can and should

invest in R&D in Canada.

STEP 3: Sustain Federal Vaccine Funding for Healthcare Savings:

Invest in new vaccines that provide world-class care and save costs in our health care system.

Over the last 50 years, immunization has saved more lives in Canada than any other health intervention and is widely recognized as one of the best investments in health. In 2008, vaccines represented less than 0.3% of national health care expenditures.

New innovative vaccines approved by Health Canada and recommended by the National Advisory Committee on Immunization are not reaching Canadians. Without sustained federal funding, these vaccines, and the dozens of others in the development pipeline will not reach Canadians as they are not yet part of publiclyfunded immunization programs. A real risk of reverting back to the late 1990s exists; wherein disparities across jurisdictions resulted in inequitable access to vaccine-preventable diseases. This created additional spending for our healthcare system money and is an inherent threat to repeating itself.

The availability of federal financing for vaccines positively affects immunization rates; consistent financing also enhances the stability of provincial support and encourages innovation in new vaccine technologies. It is our recommendation to renew the National Immunization Trust Fund by creating a permanent fund for newly recommended vaccines. New, exciting vaccines on the market and the near-term horizon include vaccines that protect against: meningitis, pneumonia, rotavirus-caused diarrhea, herpes, Hepatitis C, malaria, AIDS, pulmonary tuberculosis, cancers, and degenerative diseases (Alzheimer's). Investments in new vaccines represent smart public policy - vaccines are a solution to meeting increased health demands and improved health

Step 3 Estimated Cost: In 2003 the federal government launched the National Immunization Strategy (NIS) which has since contributed $600 million to immunization programs (roughly $100 million per year leveraging additional provincial spending)

Submitted by BIOTECanada

August 12, 2011

[1]Burrill & Company.

[2]OECD SCIENCE, TECHNOLOGY AND INDUSTRY SCOREBOARD 2009.

[3] BIOTEDCanada Research Services.

[4] Canadian Life Sciences Industry Forecast 2011. PricewaterhouseCooper LLP.

[5] Economic Impact of Flow-Through Shares in Canada’s Biotechnology Industry. PricewaterhouseCoopers LLP. 14 septembre 2010