FINA Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

Introduction

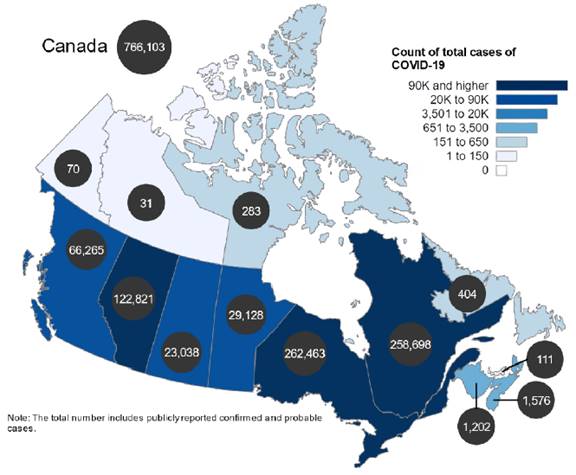

The COVID-19 pandemic has had a profound impact on Canada’s economy and society, as well as the health of Canadians. As shown in Figure 1, as of 28 January 2021 more than 766,000 Canadians have been diagnosed with, or are considered probable cases of, COVID-19. Nearly 20,000 Canadians have died as a result of this disease as of that date.

Figure 1—Number of Cases of COVID-19, by Province/Territory, Canada, 28 January 2021

Source: Health Canada, Interactive data visualizations of COVID-19.

It was within this context that – between 2 April 2020 and 7 July 2020 – the House of Commons Standing Committee on Finance (the Committee) held 26 meetings on the government’s response to the COVID‑19 pandemic. During these meetings, witnesses provided many suggestions as to how the federal government could address the pandemic and what steps could be taken to ensure an effective economic recovery. In light of the relevance of this evidence, on 19 November 2020, the Committee agreed to include its study on the government’s response to the COVID‑19 pandemic in its pre‑budget consultations in advance of the 2021 federal budget.

In preparation for undertaking its pre-budget consultations, the Committee invited Canadians to share their budgetary proposals, with a particular focus on the “measures the federal government could take to restart the Canadian economy, as it recovers from the COVID‑19 pandemic.” Nearly 800 individuals and organizations responded by providing the committee with their ideas, as catalogued within Appendix B of this report.

From 1–11 December 2020, the Committee heard presentations from over 50 witnesses who appeared virtually during its pre‑budget meetings. These meetings were held in a “hybrid” format, with members attending either virtually or in-person, under strict health and safety protocols.

In consideration of the meetings held and evidence received, the committee presents its recommendations for the 2021 federal budget and a summary of the testimony it received. As well, the committee encourages the government to consider the recommendations it made in its report on the pre-budget consultations in advance of the 2020 federal budget, which are presented in Appendix F.

The Committee’s Recommendations

People

The COVID-19 pandemic has changed the way Canadians socialize, entertain, work, study and shop. Canadians have been challenged economically, socially, physically and mentally. However, Canadians have shown solidarity in making the individual and collective sacrifices needed to guarantee the health and safety of all Canadians, especially the most vulnerable. Federal programs and services will have to effectively support Canadians as they emerge from these challenging times.

The House of Commons Standing Committee on Finance recommends that the Government of Canada, in accordance with the powers of each jurisdiction:

Health Care and Research

Recommendation 1

Develop and implement a long-term mental health COVID-19 recovery plan to ensure all Canadians – especially the most vulnerable – can access the care they need, no matter where they live.

Recommendation 2

Address gaps in the ability to monitor and manage public health risks at Canada’s ports of entry, as well as in the procurement of medical equipment (such as testing and contact tracing equipment), supplies, vaccinations and personal protective equipment through domestic production – where possible – or through more diversified international sourcing and stockpiling where needed.

Recommendation 3

Rejuvenate the National Emergency Strategic Stockpile and collaborate with provincial, territorial and regional authorities on asset management.

Recommendation 4

Set national standards for long-term care facilities and make investments in both long-term care and in-home, including home, community, and institutional settings, that will allow provinces to achieve a standard of care that will provide dignity for seniors requiring such care in Canada, with proper accountability measures.

Recommendation 5

Make targeted investments in health care that will improve access to primary care, mental health supports, and virtual care in provincial health care systems.

Recommendation 6

Implement strategies that increase the resiliency and address inequalities of the health-care system to safeguard Canada’s social and economic security.

Recommendation 7

Work in collaboration with the provinces and territories to assist those jurisdictions in accelerating the deployment of technology and ensure the availability of health human resources with appropriate training in culturally competent virtual care.

Recommendation 8

Provide $2.5 million per year for three years ($7.5 million total) to sustain, scale, and spread national reporting on cardiovascular care quality, as well as inform care delivery and management during and following the COVID-19 pandemic.

Recommendation 9

Work with provinces to adequately fund palliative care.

Recommendation 10

Make home care and palliative care more available across the country.

Recommendation 11

Move forward on its commitment to implement an equitable, national and universal pharmacare program, beginning with the development of a preliminary common formulary of essential medicines by January 2022 that would be comprehensively expanded by 2027.

Recommendation 12

Ensure that the Patented Medicine Prices Review Board changes do not create barriers for new medicines for Canadians.

Recommendation 13

Support the establishment of the Vaccine and Infectious Disease Organization (VIDO) as a National Centre for Pandemic Research, and support VIDO’s role as a National Centre for Pandemic Research – expanding Canada’s capacity for research on emerging pathogens – by providing infrastructure support for animal housing and containment level 3 and 4 research at this centre.

Recommendation 14

Provide a one-time 25% increase in investment in the Canadian Institutes of Health Research (CIHR), the Natural Sciences and Engineering Research Council and the Social Sciences and Humanities Research Council for research restart and recovery from the setback of the COVID-19 pandemic to research laboratories in Canada.

Recommendation 15

Honour next year’s centenary of the discovery of insulin through a renewed investment of $15 million in the JDRF-CIHR Partnership to Diabetes to be matched by JDRF and its partners, as well as investing $150 million in funding over seven years to support the implementation of a new nationwide diabetes strategy – based on the Diabetes 360˚ framework – which should facilitate the creation of Indigenous-specific strategic approaches led and owned by Indigenous groups.

Recommendation 16

Commit to paying 5% of the global funding needed for vaccine research, production and deployment. Earmark $2 billion in the 2021 federal budget for that purpose.

Children, Families and Social Policy

Recommendation 17

Establish national standards for child care, create a nationalized child-care system or increase funding for child care.

Recommendation 18

In partnership with provincial, territorial and Indigenous governments, implement a National Early Learning and Child Care System, including at least 2 billion in the 2021 federal budget, to address the early childhood educator labour shortage, and provide funding to increase access to childcare spaces as well as supports to ensure new childcare services are affordable for families.

Recommendation 19

Provide financial supports to prevent COVID-19 outbreaks in sexual assault centres, the current support for which is inadequate and excludes essential agencies, as COVID-19 has made the life of women who are sexually abused or trafficked much more dangerous.

Recommendation 20

Provide financial support for victims of domestic abuse and social housing, as many women who are victims of domestic abuse are unemployed, with little prospects of employment, and may not have access to child benefits. Social housing during the pandemic is very rare.

Recommendation 21

Adopt a series of targeted personal income supports for groups in need, including Canadians living with disabilities, youth aging out of care, women fleeing violence, those who have lost income, who cannot work because they are sick and are ineligible for employment insurance (EI) sickness benefits, or are able and willing to work but are unable to secure employment.

Recommendation 22

Reform the registered disability savings plan system to make it easier to access.

Recommendation 23

Uncouple the eligibility for the disability tax credit (DTC) and a registered disability savings plan (RDSP) so that individuals who are denied the DTC do not have their RDSP government co-contributions clawed back.

Recommendation 24

Make the disability tax credit refundable.

Recommendation 25

Invest $45 million over three years to strengthen Canada’s Anti-Racism Strategy and provide more capacity for community-led projects to combat racism.

Recommendation 26

Extend Old Age Security payments to the surviving spouse of a deceased individual to three months.

Recommendation 27

Protect the pension funds of workers as privileged creditors by amending the Bankruptcy and Insolvency Act and the Companies’ Creditors Arrangement Act.

Indigenous Peoples

Recommendation 28

Support Indigenous peoples, communities and businesses dealing with the COVID-19 pandemic by:

- increasing financial assistance and support for Indigenous peoples living in urban and off-reserve environments;

- developing public policies which take into consideration the needs of Indigenous peoples living in urban and off-reserve environments;

- addressing the disparities faced by Indigenous peoples in the areas of housing, access to clean drinking water, access to personal protective equipment, food insecurity, health, and medevac transportation;

- supporting Indigenous businesses by ensuring continued access to government financing programs such as the Canada Emergency Wage Subsidy;

- implementing health protocols for Indigenous communities who are unable to conduct screening tests for COVID-19; and

- providing financial support to Indigenous communities who rely on tourism and have suffered from the effects of the pandemic.

Recommendation 29

Address the ongoing priorities of Indigenous communities by:

- increasing financial support for programs earmarked for Indigenous government activities (e.g. the Band Support Funding Program);

- including all Indigenous groups in decision-making processes concerning the future allocation and distribution of government resources, as well as in the development of public policy;

- immediately allocating substantial government funding to Indigenous communities to combat child poverty and improve health-care services;

- addressing the public security needs of Indigenous communities who do not have access to policing services; and

- ensuring there is sufficient affordable housing units for Indigenous peoples, such as providing an additional 10,000 units for Indigenous communities in Quebec.

Recommendation 30

Immediately ensure a supply of “tap” drinking water for all Indigenous nations in Canada.

Recommendation 31

Expand Indigenous fiscal powers to include sales, resources, tobacco, cannabis, excise and income, or taksis.

Recommendation 32

Commit to Indigenous-led conservation by expanding support for existing and new Indigenous Guardians initiatives and Indigenous Protected and Conserved Areas.

Recommendation 33

Implement the Truth and Reconciliation Commission’s Call to Action No. 21 by providing “sustainable funding for existing and new Aboriginal healing centres to address the physical, mental, emotional, and spiritual harms caused by residential schools, and to ensure that the funding of healing centres in Nunavut and the Northwest Territories is a priority.”

Recommendation 34

Invest $50 million to implement the Truth and Reconciliation Commission’s Call to Action No. 23 by increasing recruitment and retention of Indigenous health professionals and providing cultural competency training for health-care professionals.

Recommendation 35

Provide funding for Indigenous-led mental health care to continue closing gaps in health outcomes between Indigenous and non-Indigenous communities.

Recommendation 36

Provide substantial, long-term funding towards the operations and infrastructure of Friendship Centres.

Recommendation 37

Implement a “For Indigenous, By Indigenous” housing strategy that properly addresses the unique needs of urban, rural, and northern Indigenous communities.

Recommendation 38

Follow the example of Northwest Territories Housing, Nunavut Housing, B.C. Housing and the Vancouver Affordable Housing Agency and use innovative, sustainable and climate adaptive Canadian foundation solutions for buildings on unstable soils – permafrost, floodplains and brownfields – in support of affordable and aboriginal housing needs.

Recommendation 39

Address the backlog of land claim and self-government negotiations with Indigenous organizations by increasing the staffing levels of federal negotiators.

Employment and Labour

Recommendation 40

Adjust its economic immigration program to meet Canada’s current and future labour and skill market needs that cannot be met by Canadians; and that future immigration selection take into consideration all occupations and all skill levels listed in the ten sectors identified in the National Strategy for Critical Infrastructure.

Recommendation 41

Fund Statistics Canada to collect data on regional and local skills and labour.

Recommendation 42

Extend income support programs such as EI and the Canada Emergency Wage Subsidy, and consider the implementation of a universal basic income program.

Recommendation 43

Establish a legal definition of self-employment status to end discrimination between these workers, employees and different types of businesses.

Recommendation 44

Reorient employment supports and develop a training system that supports green jobs.

Recommendation 45

Adopt Bill C-395, the Opportunity for People with Disabilities Act, which was introduced in the 42nd Parliament, to ensure people are always better off from working.

Recommendation 46

Reform tax and benefit programs to allow low-income workers to keep more of their wages to be the primary beneficiaries.

Education and Skills Training

Recommendation 47

Establish a fund directed towards expanding post-secondary education infrastructure.

Recommendation 48

Invest in skills training for young Canadians that will enable more of them to gain the skills they need to secure good paying jobs in the post-COVID economy.

Recommendation 49

Work with the provinces on a national strategy to upskill and educate Canadian workers to fill in-demand jobs across the Canadian economy. The strategy should support and extend post-secondary opportunities to traditionally marginalized communities, those most harmed by the pandemic, and to Indigenous peoples.

Communities

Canadian communities are on the front line of efforts to stave off the effects of the pandemic. Given the current social distancing measures in place, communities are required to find new ways to deliver and sustain the services needed to assist vulnerable Canadians. The challenges facing communities are multidimensional and often require support from multiple levels of governments, charitable organizations and Canadians themselves.

The House of Commons Standing Committee on Finance recommends that the Government of Canada, in accordance with the powers of each jurisdiction:

Arts, Culture, Tourism and Hospitality

Recommendation 50

Provide targeted funding to support art museums and public art galleries throughout the reopening and recovery phase following the COVID-19 pandemic.

Recommendation 51

Expand funding programs that support the creation of digital content by art museums and public art galleries, to allow for increased public participation online.

Recommendation 52

Amend the Endowment Incentives component of Canadian Heritage’s Canada Cultural Investment Fund (CCIF) to make art museums and public art galleries eligible and increase the total annual budget of the CCIF to $25.5 million to reflect that change.

Recommendation 53

Complete the review of the Copyright Act during the year by making the necessary amendments to the Act to ensure that rights holders receive fair compensation for the use of their works.

Recommendation 54

Establish a tax credit for the restoration and preservation of buildings listed in the Canadian Register of Historic Places.

Recommendation 55

Support the cultural, tourism and hospitality sectors by:

- providing additional financial support to these sectors until COVID‑19-related restrictions can be safely lifted;

- introducing a new program modelled after the Marquee Tourism Events Program with funding of $225 million over three years;

- expanding the eligibility criteria of the Communities at Risk: Security Infrastructure Program to allow festivals and events to apply; and

- supporting the planning of safe live and digital activities and events.

Charities and Non-Profit Organizations

Recommendation 56

Eliminate the capital gains tax on donations of shares in private corporations or real property to charities.

Recommendation 57

Establish a fund to provide bridge operating grants for up to 12 months to essential community service organizations. Funding should be flexible to allow organizations to maintain operations and respond to emerging needs. This support should be made available for a three to six-month period as organizations recover from the impacts of COVID-19. Applications should outline need or financial duress, and what other programs have been accessed (or are unavailable), such as wage and rent relief. Support could be differentiated by subsector or relevant need – as immediate humanitarian support may be gauged differently than longer-term institutional goals that can be addressed at a later time.

Recommendation 58

Review existing tax measures available to both individual and corporate donors and make appropriate amendments to encourage giving to, and supporting the recovery of, the health charities sector.

Housing

Recommendation 59

Improve the National Housing Co-investment Fund by providing greater resources, making the fund more transparent, and making the application process simpler and timelier.

Recommendation 60

Continue and enhance funding for the Rapid Housing Initiative by allocating $7 billion for no less than 50,000 supportive housing units. The funding should be allocated directly to municipalities.

Recommendation 61

Deliver necessary funding to develop shovel-ready affordable housing projects which will also stimulate the economy and create jobs.

Recommendation 62

Simplify access and implementation of Canada Mortgage and Housing Corporation funds for housing.

Infrastructure

Recommendation 63

Support Canadian municipalities by:

- providing enhanced funding to maintain municipal assets in a state of good repair and committing to invest in infrastructure at the level that was planned prior to the COVID-19 crisis as well as consider maximizing any investments given the current pandemic;

- reinstating the National Guide to Sustainable Municipal Infrastructure; and

- developing more opportunities to partner with municipalities directly through programs, including scaling up proven federal programs that support municipalities.

Recommendation 64

Accelerate the repair of ports, wharves and other federal infrastructure.

Recommendation 65

Invest directly in long-term care infrastructure by allowing the provinces to use their shares of federal infrastructure money for long-term care.

Recommendation 66

As part of the economic recovery, accelerate investments in infrastructure for fighting climate change, particularly investments in public transportation.

Recommendation 67

Expand the Public Transit Infrastructure Fund.

Recommendation 68

Launch VIA Rail’s High Frequency Rail project, as it represents a key infrastructure initiative that will contribute to a more sustainable economic recovery for Canada.

Recommendation 69

Invest in infrastructure, particularly into those that promote walking and cycling.

Recommendation 70

Provide financial support for regional and municipal airport development plans.

Recommendation 71

Support Canadian airports by providing:

- immediate financial support through a moratorium on ground lease rents and interest‐free loans (or equivalent operational support) in order to cover operating costs and alleviate the need for rate increases during the recovery; and

- short-term operating grants for airports to strengthen and maintain financial liquidity.

Rural, Remote and Northern Regions

Recommendation 72

In consultation with Northerners, design programs to address the Northern infrastructure gap in areas like housing, telecommunications, transportation, energy, and climate change preparedness.

Recommendation 73

Appropriately fund the implementation of Canada's Arctic and Northern Policy Framework.

Recommendation 74

Ensure every person in Canada has access to reliable, high-speed internet by 2025, including those living in rural, remote, northern, and Indigenous communities.

Businesses

Canadian businesses have faced significant challenges during the COVID-19 pandemic, such as mandatory closures, limits placed on their physical spaces and customer numbers, as well as additional personal protective equipment (PPE) and social distancing costs. Businesses employ the majority of Canadians, and Figure 2 illustrates how employment in certain sectors of the economy have been disproportionately affected by the pandemic.

Figure 2—Variation in Employment, by Sector, Canada, February 2020 to December 2020 (%)

Note: Other services include the following services: repair and maintenance; personal and laundry services; religious, grant-making, civic, and professional and similar organizations; and services to private households.

Source: Figure prepared by the authors using seasonally adjusted data obtained from Statistics Canada, Table 14‑10-0355-01, “Employment by industry, monthly, seasonally adjusted and unadjusted, and trend‑cycle, last 5 months (x 1,000),” accessed 13 January 2021.

The government has taken several measures to support Canadian businesses, such as the Canada Emergency Wage Subsidy (CEWS), the Canada Emergency Business Account (CEBA), the Canada Emergency Rent Subsidy (CERS) and other measures that target specific groups or sectors.

The House of Commons Standing Committee on Finance recommends that the Government of Canada, in accordance with the powers of each jurisdiction:

Innovation, Research and Development

Recommendation 75

Reform the Scientific Research and Experimental Development (SR&ED) Program to help foster R&D in Canada by:

- increasing the base rate from 20% to 25% while introducing new complementarity measures similar to the tax incentive system for patents;

- eliminating or substantially raising the upper limit for taxable capital phase-out range from the current $50 million;

- reinstating capital expenditure eligibility that was phased out beginning 1 January 2013;

- eliminating the 20% disallowance on arm’s-length consulting payments;

- updating definitions for eligible costs and R&D; and

- reducing the amount of documentation to be completed for businesses filing SR&ED claims.

Recommendation 76

Extend and enhance R&D incentive programs such as the Accelerated Capital Cost Allowance program and the Innovation Assistance Program while providing direct funding for R&D to universities, hospitals, laboratories and other research facilities.

Recommendation 77

Recapitalize the Strategic Innovation Fund to support projects that will bring transformational employers to Canada and create jobs in Canadian communities.

Recommendation 78

Lead a national innovation agenda with significant new investments in research and knowledge mobilization, with an emphasis on helping domestic companies grow and compete globally.

Recommendation 79

Financially support the establishment of a quantum computing research institute in the Toronto area, similar to the Vector Institute, to build upon the world-class cluster of quantum research expertise in the city.

Recommendation 80

Establish a dedicated funding program to support early-mover proponents in the Small Modular Reactor (SMR) sector as part of its SMR Action Plan.

Start-Ups and Small and Medium-Sized Businesses

Recommendation 81

Implement personal and market-driven tax incentives to attract equity capital and private investment for new business formation as well as the expansion of existing small and medium-sized businesses (SME).

Recommendation 82

Invest $35 million into Green Centre Canada’s ADVANCE Network Project to accelerate start-ups and the development of chemical and materials cleantech companies.

Recommendation 83

Create a National Intellectual Property Strategy and help Canadian start-ups navigate complex intellectual property management, assisting with patent filings, invention disclosures, fundraising, partnering and investment.

Recommendation 84

Allow small businesses access to the 30-day protection from creditors afforded to companies with debts over $5 million under the Companies’ Creditors Arrangement Act to help small businesses restructure in case of insolvency and survive the COVID-19 pandemic, preserve jobs and limit the number of bankruptcies.

Recommendation 85

Financially support the shift to digital among SMEs.

Recommendation 86

Provide funding, through the recovery program for Canadian SMEs, for the trademark protection strategy to cover the costs associated with trademark searches and trademark applications.

Recommendation 87

Ensure that government programs are better suited to cooperatives and self-employed workers, especially those registered in Canada’s COVID-19 Economic Response Plan.

COVID-19 Response Programs

Recommendation 88

Prevent companies from increasing dividend payments or conducting share buybacks to enrich shareholders or paying executive bonuses while they are receiving 75% of their payroll from the federal government.

Recommendation 89

Ensure that wage subsidies should only be used to pay employees and not be used for executive bonuses or dividends.

Recommendation 90

Require the companies receiving the Large Employer Emergency Financing Facility to prove that their business plans are in line with the Paris Agreement target to limit temperature increase to 1.5 degrees.

Recommendation 91

Implement transparency and accountability mechanisms to ensure that the total amounts available to the oil and gas sector and the transactions made by Export Development Canada and the Business Development Bank of Canada, and through the Large Employer Emergency Financing Facility are made public, including the new loan required for the Trans Mountain pipeline expansion.

Recommendation 92

Ensure independent advisors (contractors) qualify for wage support.

Agriculture and Fisheries

Recommendation 93

Work with industry to develop a labour action plan for Canada’s agri-food sector.

Recommendation 94

Improve the Business Risk Management Program and AgriStability be reinstated at 85% of reference margins.

Recommendation 95

Invest $450 million over 5 years according to the Deans Council - Agriculture, Food and Veterinary Medicine proposal for the following:

- addressing current and emerging public health risks from zoonotic disease and pandemic threats by supporting the establishment of the Canadian One Health Network; and

- establishing a coordinated Federal, Provincial, and Territorial

investment strategy for Sustainable Agriculture and Food Systems:

- to support research and development, innovation, and skills training;

- for co-location sharing of renewed basic or foundational infrastructure between universities, governments, and industry.

Recommendation 96

Create and fund a new AgriResilience program to help farmers transition to lower-carbon agriculture practices, thereby reducing the growing climate risk in this sector. An AgriResilience program would reward innovation and the adoption of new, more resilient farming practices, thereby helping to reduce climate risk.

Recommendation 97

Create a limited statutory deemed trust, similar to the U.S. Perishable Agricultural Commodities Act, to support needed liquidity and protect produce sellers during bankruptcy in Canada.

Recommendation 98

Increase funding for marine biology research to properly assess the status of stocks of various fishery resources.

Recommendation 99

Comply with bi-lateral treaties with the United States regarding the Great Lakes and honour these commitments by funding the Great Lakes Fishery Commission at a rate of $19.44 million in fiscal year 2021-2022 and every year thereafter.

Natural Resources

Recommendation 100

Invest in the processing of natural resources and environmental development, particularly in the following sectors:

- renewable energy;

- forestry;

- innovative technologies;

- wastewater management; and

- research and development.

Recommendation 101

Diversify markets and opportunities for Canadian forestry products on export markets by increasing the budget for Natural Resources Canada’s market development program.

Recommendation 102

Increase support in the transition of the forestry sector, particularly in research and development of forest biomass supply chains and bioenergy production, by supporting a Canadian strategic transition plan.

Recommendation 103

Introduce a registered savings plan for the forestry industry to allow private logging income, under certain conditions, to be tax-sheltered and that its use for forest management purposes remains non-taxable.

Recommendation 104

Introduce a logging income averaging regime for private loggers to divide occasional felling income over several years and prevent forest management costs over the years from being higher than the net income generated in the logging year.

Recommendation 105

Subsidize plant modernization and research to develop innovative secondary and tertiary processing products in the forestry sector.

Recommendation 106

Develop the Canadian Minerals and Metals Plan to improve Canadian resilience and develop an export strategy that helps Canada feed into the recovery packages of other nations, especially as they pursue mineral-intensive green infrastructure and energy projects.

Aerospace

Recommendation 107

Develop a national aerospace industry strategy involving:

- predictable support for research and development, including refundable tax credits;

- risk-sharing investments that will help protect the entire supply chain;

- support for companies in the implementation of practices and technologies that promote productivity (automation and digital technologies in the production process);

- the creation an investment fund dedicated to aerospace to strengthen companies by promoting "grouping strategies;"

- the redesign of the current Industrial and Technological Benefits Policy in order to foster national leadership and maximize local benefits;

- structuring benefits for the sector in government contracts;

- the development of a low-interest financial assistance program specific to the aerospace industry to help companies through this pandemic; and

- the renewal and expansion of the funding commitments for aerospace training programs at the provincial and federal levels.

Recommendation 108

Provide direct funding to Canada’s aerospace manufacturing sector, especially SMEs operating in this industry facing bankruptcy or those that are targets of foreign acquisition.

Recommendation 109

Require airlines to reimburse their customers whose flights are cancelled.

Sector-Specific Initiatives

Recommendation 110

Develop industrial strategies to expand critical domestic manufacturing capacity and supply chain infrastructure for Canadian manufacturing, auto, aerospace, shipbuilding, pharmaceuticals and PPE production.

Recommendation 111

Develop comprehensive industrial strategies and make investments designed both to strengthen core infrastructure that supports business incubation activities and the expansion of critical domestic manufacturing capacity, as well as to ensure an adequate quality and quantity of supply chain infrastructure. In developing these strategies and making these investments, the Government’s focus should include: auto, rail, clean water, aerospace, shipbuilding, construction materials, pharmaceuticals and personal protective equipment, as well as such service and creative sectors as telecommunications and media. Finally, while taking these actions, the Government should accelerate the delivery of funding to core projects that it approved for support prior to the COVID-19 pandemic.

Recommendation 112

Establish an Economic Strategy Table on Creative Industries to ensure sector growth and global competitiveness.

Fiscal Policy, Regulatory Framework and Trade

When the economy enters the recovery phase, fiscal policy will have to balance the short-term goal of stimulating the economy back to its full capacity with the long-term goal of keeping federal finances on a sustainable path. Furthermore, the federal regulatory framework will have to effectively protect the health, safety, security, social and economic well-being of Canadians, as well as the environment in a post-pandemic world.

Figure 3—Accumulated Deficit ($ millions) and Percentage of Accumulated Deficit to Gross Domestic Product, Canada, Fiscal Year Ending 31 March 1971 to Fiscal Year Ending 31 March 2021

Note: a. Data for fiscal year 2020 presents actual values taken from the Fall Economic Statement 2020.

b. Data for fiscal year 2021 presents projected values taken from the Fall Economic Statement 2020, which do not include planned stimulus of $70-to-$100 billion over three years.

Source: Department of Finance, Fiscal Reference Tables September 2019: Part 1 of 9; and Government of Canada, Fall Economic Statement: Supporting Canadians and Fighting COVID-19, 30 November 2020, p. 126.

The House of Commons Standing Committee on Finance recommends that the Government of Canada, in accordance with the powers of each jurisdiction:

Tax-Related Issues

Recommendation 113

Eliminate the excise tax on the first 10,000 hectolitres of brewed beer to fund craft brewers so they can hire more people, purchase more raw materials and speed up their economic recovery.

Recommendation 114

Replace the Excise Duty Exemption on wine made from 100% Canadian-grown grapes with a program that encourages the purchase of locally grown grapes.

Recommendation 115

Exempt credit card interchange fees from GST at the point of sale.

Recommendation 116

Grant the seller the same tax benefits when a farm or small business is sold from a parent to a child in the form of corporate shares as if it were sold to an unrelated person.

Recommendation 117

Amend the Income Tax Act to clearly define that income earned by private campgrounds who employ fewer than five full-time employees year-round be considered as “active business income” for the purpose of determining their eligibility for the small business deduction.

Recommendation 118

Review the rules defining passive and active business income, including the five‑employee rule for small businesses.

Recommendation 119

Implement an annual cost recovery fee on the tobacco industry to recover the cost of the federal government’s tobacco control strategy.

Recommendation 120

Implement a levy or annual licensing fee on tobacco manufacturers and introduce a 20% value-added tax to be levied on vaping products.

Recommendation 121

Create a legally enforceable duty of care from Canada Revenue Agency to taxpayers.

Federal Finances

Recommendation 122

Increase funding for the Office of the Auditor General of Canada.

Recommendation 123

Withdraw from the Asian Infrastructure Investment Bank.

Recommendation 124

Publish, in the 2021 federal budget, a roadmap to eliminate ineffective fossil fuel subsidies by 2025 to respect Canada’s G20 commitment in this area.

Recommendation 125

Ensure that Canada’s R&D efforts are sufficient to support a resilient, competitive and knowledge-based economy and society by bringing research and development investments to 2% of GDP by 2026.

Recommendation 126

Eliminate targeted corporate welfare programs. Examples include: $50 million to Mastercard, $40 million to Blackberry, and $12 million to Loblaws, etc.

Regulatory Framework

Recommendation 127

Invest in a rigorous privacy policy to stop fraudulent claims for government benefits.

Recommendation 128

Implement a digital identity system that empowers Canadians to control their data that is held by the federal government.

Recommendation 129

Create a national data strategy.

Recommendation 130

Consult with stakeholders and consider compliance costs before changing product labelling requirements.

Trade

Recommendation 131

Announce mitigation measures for the market access concessions granted in the Canada–United States–Mexico Agreement.

Recommendation 132

Provide the Canada Border Services Agency and the Canadian Food Inspection Agency (CFIA) with the resources and training needed to thoroughly and effectively enforce regulations and standards for the import of dairy products at the Canadian border and ensure that CFIA has the resources to conduct inspections of dairy processing facilities seeking to export into Canada.

Recommendation 133

Work with the provinces and territories to remove interprovincial trade barriers to achieve a stronger internal economic union in Canada.

Environment and Climate Change

Despite business closures resulting from the COVID-19 pandemic, the World Meteorological Organization has found that global concentrations of greenhouse gases (CO2, CH4, and N2O) continued to increase from 2019 to 2020, and that the past six years – including 2020 – are predicted to be the six warmest years on record.

The government has recently announced it is working on a plan to achieve net‑zero emissions by 2050, joining announcements from other countries such as Japan, the United States and South Korea.

The House of Commons Standing Committee on Finance recommends that the Government of Canada, in accordance with the powers of each jurisdiction:

Environmental Policy

Recommendation 134

Prioritize exports of clean-burning Canadian natural gas and natural gas technology to coal-intensive countries to reduce global greenhouse gas emissions.

Recommendation 135

Remain committed to achieving the goal of 90% non-emitting electricity by 2030, as well as commit to achieving 100% non-emitting electricity before 2050 by setting legally binding five-year emissions-reduction milestones in order to achieve economy-wide net‑zero emissions by 2050.

Recommendation 136

Continue to make the investments necessary to support other levels of government and industry to grow demand for clean electricity by: expanding electrification of public transit and light-duty vehicles; planning for transmission grid expansion to displace coal and diesel; and demonstrating innovative green hydrogen production and utilization projects.

Recommendation 137

Encourage broad adoption of smaller GHG reduction projects through a sliding scale national incentive program for projects $10 thousand to $100 thousand.

Recommendation 138

Make investments in projects that will improve the renewable capacity of Canada’s energy grids, such as the Atlantic Loop, and eliminate Canada’s reliance on coal by 2030.

Recommendation 139

Implement the Clean Fuel Standard.

Recommendation 140

Enshrine the Paris Agreement targets, as written in the text of the agreement, into legislation.

Electric Vehicles

Recommendation 141

Provide targeted incentives for the research and development of heavy and commercial electric vehicles, including the development of electric ambulances.

Recommendation 142

Provide incentives toward the purchase of new and used zero-emission vehicles (ZEV) for individuals and corporations, such as through a four-year federal guarantee for ZEV purchase related loans.

Recommendation 143

Significantly increase the electrification of federal government and Crown vehicle fleets.

Recommendation 144

Support ZEV growth in Canada – to reach 100% ZEV sales by 2040 – through a national ZEV standard and a National Auto Strategy that include:

- building charging infrastructure and setting higher 1 and 5-year targets for electric vehicles charging station deployment;

- establishing targeted industry support programs;

- expanding funding for ZEV training programs;

- committing to Canada’s ZEV targets with regulatory measures; and

- developing a national strategy on low-carbon commercial transport in urban areas.

Recommendation 145

Aim to incentivize the purchasing of ZEVs by increasing the base Manufacturer’s Suggested Retail Price (MSRP) cut-off for the iZEV program for eligible light-duty vehicles pickup trucks and SUVs/minivans from the current $45,000 (with a $54,999 ceiling for higher priced trims) to $60,000 with a $69,999 ceiling to support the arrival of electric pickup trucks and SUVs, which will have a higher MSRP than smaller light-duty vehicles (sedan threshold to remain at current levels). This will help increase regional equity and access for persons who require these larger vehicles for their work and/or local context.

Conclusion

Since the committee’s last pre-budget consultations in February 2020, Canadians, businesses and communities have all been deeply affected by the COVID-19 pandemic. A large number of Canadians contracted the disease, had to care for a sick relative or mourned the loss of a relative, and an even larger number of Canadians found themselves without work, temporarily or indefinitely.

The committee’s recommendations, which focus on measures to provide ongoing assistance to Canadians during the COVID-19 pandemic and support the recovery of the Canadian economy, will contribute to the government’s deliberations for the 2021 federal budget. The committee is grateful to all those who shared their views and priorities regarding the upcoming federal budget, which were invaluable in the elaboration of these recommendations.

Summary of Evidence

Meetings Held on the Pre-Budget Consultations in Advance of the 2021 Budget

Meeting of 1 December 2020

Canadian Nurses Association

The Canadian Nurses Association spoke about:

- Improving

health outcomes for vulnerable populations – the government should

implement strategies that increase the resiliency and address inequalities of

the health-care system to safeguard Canada’s social and economic security by:

- investing $50 million to implement the Truth and Reconciliation Commission’s Call to Action No. 23 by increasing recruitment and retention of Indigenous health professionals and providing cultural competency training for health‐care professionals;

- increasing funding under Canada’s national housing strategy to provide more low‐income rental housing;

- investing $45 million over three years to strengthen Canada’s national anti‑racism strategy and provide more capacity for community‐led projects to combat racism;

- lead the development of pan‐Canadian standards for the long‐term care sector, including home, community, and institutional settings, with proper accountability measures.

- Services for seniors – the government should lead the development of national standards for institutional long-term care and invest $13.6 billion over five years in a demographic top‐up transfer to the provinces.

- Enhancing

pandemic preparedness – the government should invest

$10 billion in 2021‐22 to enhance pandemic preparedness by:

- maintaining a consistent and reliable availability of PPE and large‑scale capacity to conduct viral testing and contact tracing;

- ensuring equitable distribution of and access to COVID‐19 treatments and vaccines, when available, especially for health‐care professionals and vulnerable populations;

- providing adequate resources to better assess, manage, and monitor public health risks at Canada’s ports of entry.

- The Office of the Federal Chief Nursing Officer – the government should invest $750,000 per year to re‐establish the office of the federal chief nursing officer reporting to the deputy health minister to provide strategic and technical health policy advice.

- Mental health support services – the government should invest $60 million over two years and work with the provinces and territories to determine implementation needs for no‐cost mental health support services tailored for health‐care workers.

- Nursing workforce demographics – the government should work in collaboration with the provinces and territories to invest in a national unique nursing identifier to provide accurate and reliable nursing workforce data collection to support projections and planning.

- Expanding virtual care – the government should invest $200 million over five years to assist jurisdictions to accelerate the deployment of technology and ensure the availability of health human resources with appropriate training in culturally competent virtual care.

- Access to high-speed internet – the government should ensure every person in Canada has access to reliable, high‐speed internet by 2025, including those living in rural, remote, northern, and Indigenous communities.

Community Food Centres Canada

Community Food Centres Canada spoke about:

- A refundable disability tax credit – making the disability tax credit refundable would provide low-income Canadians with severe and prolonged disabilities with up to $1,300 per year. The Canadian Centre for Policy Alternatives estimated it would cost $370 million a year to make the credit refundable for those who are currently receiving it.

- A tax credit for working adults – poverty has increased for single adults. Single adults make up 48.1% of all food bank clients. Working age adults are increasingly being trapped in poverty by low-wage jobs and insufficient social assistance rates. Two thirds of food insecure households earn most of their income through salaries and wages.

Skills Canada

Skills Canada spoke about:

- Promotion of skilled and technology occupations – as the government should draw its attention to the promotion and orientation of skilled trade and technology-based occupations targeting underrepresented youth and people in career transition, including women, indigenous peoples, persons with a disability, those from underserved communities and those who are part of the LGBTQS+ community.

- National awareness initiatives on apprenticeship training system – the government should implement initiatives aimed at engaging parents on how the apprenticeship training system in Canada works, on the importance of the Essential Skills and on recognizing the Red Seal Endorsement (RSE) acronym as a standard of Red Seal completion in the skilled trades.

- The integration of emerging technologies in apprenticeship training – in order to support the work required to identify current and emerging technologies and how such technologies are and will be applied in apprenticeship and technology-based occupation training models.

- The creation and development of multisectoral skills strategy – to support the creation of a multisectoral skills strategy that links the previous suggestions into an overall skills promotion and skills development approach linked to the skills required now and in the future.

WaterPower Canada

WaterPower Canada spoke about:

- Decarbonizing

the electricity supply – the government should design and

implement the following measures for the decarbonization of Canada’s

electricity supply:

- remain committed to striving toward 90% non-emitting electricity by 2030; and commit to achieving 100% non-emitting electricity before 2050;

- set legally binding five-year emissions-reduction milestones towards economy-wide net-zero emissions by 2050; and

- continue to support provincial and territorial discussions that can accelerate the adoption of waterpower projects of all types to help decarbonize emission-intensive regions.

- Measures

for electrification in transport, industry and buildings –

the government should design and implement the following measures for

transitioning from fossil fuels to clean and renewable electricity in

transport, industry and buildings:

- create an electrification strategy for electricity to become Canada’s single largest energy source by 2050;

- implement the Clean Fuel Standard; and

- implement a legislated zero-emission vehicles mandate; and maintain incentives for the adoption of electric vehicles, and funding for electric vehicle charging infrastructure.

- Reducing

the regulatory burden – the government should ensure that the

implementation of federal legislation does not introduce any undue or overly

burdensome constraints on waterpower producers so that the regulatory

environment does not impede investments in existing or new projects. To that

end, the government should:

- develop and/or amend as necessary, regulations and policies under the recently modified Fisheries Act and Canadian Navigable Waters Act to ensure that all existing waterpower facilities can continue to operate without undue constraints that were not foreseeable at the time of construction, and so that they can be maintained or refurbished in a timely and cost-effective manner; and

- ensure that departments that are responsible for the implementation of the Fisheries Act, the Canadian Navigable Waters Act, and the Impact Assessment Act are provided with the human and financial resources necessary to promptly and efficiently deal with all applications for project reviews, authorizations and permits.

Canadian Produce Marketing Association

The Canadian Produce Marketing Association spoke about:

- Implementing a Canadian limited statutory deemed trust – the government should protect produce sellers during buyer bankruptcy in Canada. In the case of an insolvent buyer, the current super priority provision for farmers fails to protect effectively the sector, as the terms of payment for fresh produce sales regularly extend beyond the 15 days between delivery and buyer bankruptcy as prescribed in the Bankruptcy and Insolvency Act.

- Employment benefits related to COVID-19 – current and future employment benefits related to the pandemic should be adjusted to provide Canadians requiring support the opportunity to work beyond existing program limitations.

- Changes to the CEWS – the program should be continued until the Public Health Agency of Canada has declared that the pandemic has ended. As well, the CEWS should be adjusted to allow companies and organizations to apply retroactively based on an assessment of a full year’s financial impacts and support essential businesses, such as those in the fresh produce supply chain, that have been impacted by a significant rise in operational costs due to the pandemic by providing an option to apply for the CEWS based on reductions in net income.

- Labour standards – the government should work to improve service standards and processing times for applications under the Seasonal Agricultural Worker Program and the Agricultural Stream of the Temporary Foreign Worker Program, including by working with source countries and implementing measures to further streamline the collection of biometrics and visa and work permit application processes.

- A PPE tax credit – the government should implement a PPE tax credit to support the industry in procuring the equipment.

- Extending customs duty relief – the government should extend customs duty relief for PPE beyond the end of 2020 and making customs duty relief retroactive prior to its announcement on 6 May 2020.

- Sustainability

in the food system – the government should:

- provide ongoing financial support to achieve the targets of the Food Policy for Canada to promote long-term social, environmental and economic sustainability of the Canadian food system;

- work closely with the industry to find solutions to reduce the use of plastics, while considering the food safety and food security implications of reducing the use of plastics for fresh produce; and

- commit funds and resources to support the reduction of food waste across the supply chain.

- Innovation

and infrastructure in produce supply chain – the government should

provide:

- innovation funding specific for the fresh produce supply chain;

- dedicated funding to support the rapid expansion of high-speed internet infrastructure and cell phone service coverage; and

- dedicated funding to invest in rural infrastructure, including roads, energy, and service infrastructure, such as waste management.

- An agriculture and agri-food data strategy – the government should establish a data working group between Agriculture and Agri-Food Canada, Innovation, Science and Economic Development Canada and other relevant departments and agencies.

- Produce sector recovery – the government should commit funds to support a full analysis of impacts to the produce sector due to the pandemic and ongoing efforts of the Canadian Food Policy Advisory Council to support industry requirements for recovery.

Festivals and Major Events Canada

Festivals and Major Events (FAME) Canada spoke about:

- Additional liquidity support – the government should provide additional financial support to the culture and tourism industry. FAME estimated that the cumulative losses suffered due to the pandemic by its members is $150 to $200 million.

- Improving income support programs – the government should extend the CEWS and the Canada Emergency Response Benefit (CERB), or establish similar programs tailored to the culture and tourism sectors.

- Funding for marquee events to improve operations – the government should introduce a new program, modelled on the Marquee Tourism Events Program, and provide it with $225 million over three years.

- Renewing investments in programs that benefit festivals and major events – the government should make permanent the investments announced in 2019 in the two main programs benefiting more than 1,300 festivals and events, namely the Canada Arts Presentation Fund (+$8 million/year) and the Building Communities Through Arts and Heritage program (+$7 million/year).

- Security Infrastructure Program – the government should expand the criteria of the Security Infrastructure Program to enable festivals and events to apply.

- Creation of a green and digital transition fund – the government should support the planning of safe events and shows that are live and digital.

Food and Beverage Canada

Food and Beverage Canada spoke about:

- Resolving agri-food’s labour problems – the government should work with industry to develop a labour action plan for Canada’s food and beverage manufacturing sector and the entire agri-food sector.

- Rebalancing relationships across the supply chain – the working group between the federal, provincial and territorial agriculture ministers should prioritize and commit to having a grocery code of conduct in place by the end of 2021. There are multiple steps in the food system between the farmer and the end point of food. Any break in that system can have a financial impact on farmers.

- Ensuring that front-line food workers are protected – the government should reinforce front-line food workers, recognize the essential nature of this type of work and consider the importance of front-line food workers in any rapid testing and vaccination programs.

Canadian Arts Coalition

The Canadian Arts Coalition spoke about:

- Recovery supports – the government should provide dedicated infrastructure funding for arts venues to enable them to contribute to a sustainable recovery. Funds are also needed to cover the increased costs associated with implementing practices to minimize the risk of transmission of infection among attendees, performers and production crew. This includes the purchase of personal and protective equipment and other safety items.

- Addressing systemic issues in arts funding – the government should address some of the systemic issues, particularly issues around systemic racism in the arts funding, by providing funds to ensure enhanced interim ongoing operational project funding for indigenous, racialized, the deaf and disabled and community-based arts organizations.

- Extending income support programs – the government should extend income support programs such as employment insurance (EI) and the CEWS, and consider the implementation of a universal basic income program.

- Investing in innovations for digital creation – the government should invest funds in the technologies, training and supports required to develop accessible digital arts experiences that fairly compensate the creators.

- Increasing the charitable tax credit – the government should provide an incentive to the private sector to participate in the charitable sector.

Meeting of 3 December 2020

Amyotrophic Lateral Sclerosis Society of Canada

The Amyotrophic Lateral Sclerosis Society of Canada spoke about:

- Capture ALS – which is the culmination of decades of investment into Canadian ALS research and clinical infrastructure. It will provide meaningful data that will strengthen policy development and position Canada as a first choice for pharmaceutical investment and clinical trials. The organization requests $35 million over five years towards funding the project.

Fairness Alberta

Fairness Alberta spoke about:

- The Clean Fuel Standard – which is estimated to result in 30,000 job losses and a $22 billion reduction in Canadian capital investment. It would make Canada the only country with a natural gas-related fuel standard.

- Pandemic spending – and allowing Albertan exports to maximize their revenue making potential in order to help with Canadian recovery from the COVID-19 pandemic.

- Federal transfer payments – and while there was a modest improvement to the cap on fiscal stabilization announced, it did not reflect the wishes of the 13 premiers. Action on fiscal transfers should be taken by the federal government for the sake of fairness and national unity.

National Ethnic Press and Media Council of Canada

The National Ethnic Press and Media Council of Canada spoke about:

- Ethnic media – which for many Canadians is their only form of information. It has been transitioning to digital delivery and new revenue streams, but it requires federal assistance so that it can complete this transition and survive into the future.

- The 2018 federal budget – allocated $600,000 per year to the ethnic press out of $10 million in media supports, which only satisfied the needs of 53 outlets out of a total of 900 ethnic press outlets in Canada. Ethnic media should instead receive a $1.5-2 million share of the $10 million in media supports.

- The COVID-19 pandemic – which is estimated to cause 51% of ethnic press outlets to close within the next six months. Without significant intervention, 62% of outlets indicated that they would close within a year. Accordingly, they request $7 million in federal funding.

- A non-profit advertisement cooperative – the creation of which would approach major advertising firms to encourage third-language advertising.

- Carriage licenses for third language news – which should be created by the Canadian Radio-television and Telecommunications Commission to avoid certain systemic racism in journalism.

- A new request for proposals – for ethnic media to be treated fairly in government advertising campaigns in third language media.

Oxfam Canada

Oxfam Canada spoke about:

- The care sector – for which federal investments will create more and better care places for children, the sick and the elderly, and will mean that women currently caring for family members will be able to enter the workforce. Oxfam welcomes the federal commitment to building a publicly funded national child-care system, and call on the government to allocate $2 billion for early learning and child care in the 2021 federal budget, as well as an increase of $2 billion each year thereafter to publicly fund a child care system in partnerships with the provinces, territories and indigenous governments.

- The social protection and working conditions of women – where Oxfam calls on the government to expand women’s access to EI by modernizing key gaps in the existing EI system.

- International assistance – where Canada should invest an additional $2 billion in COVID-19 interventions that focus on feminist programming, supporting sexual and reproductive health and rights, combatting gender-based violence, investing in the care sector and supporting the women’s and feminist movement. Additionally, doubling Canada’s international assistance envelope from $6.2 billion to $12.4 billion over five years.

Jeffrey Booth (as an individual)

Jeffrey Booth, Entrepreneur and Author, spoke about:

- Inflation – and that economic policy that requires inflation is incompatible with exponential advancing technology, as they are opposite forces. The consequences of “national monetary manipulation” are far more severe than the monetary theorist policy-makers seem to realize. The government should investigate this issue.

Jack Mintz (as an individual)

Jack Mintz, President's Fellow, School of Public Policy, University of Calgary, spoke about:

- Structural unemployment – in which many workers will not be able to go back to their original employers in certain sectors post-pandemic, reflecting – in part – long-term changes in consumer and business behaviour. This issue must be addressed by the federal government.

- Labour productivity – which has been nearly flat since 2015, and is affected by investment, under which non-residential, public and private capital formation in Canada has declined by 12% from 2014 to 2019. The federal government should have a greater focus on regulatory reform to spur investment.

- Pandemic response – where tax deferrals and enhanced tax losses provide a more neutral support to the start-up companies compared to the established companies.

- Interprovincial trade – where the government should be taking a stronger leadership role in achieving an internal economic union in Canada.

- Social policies – which should not increase marginal tax rates on the working poor due to income-tested programs, as this discourages work, education and training, even if the resulting income is taxed more heavily.

4 Pillars Consulting Group Inc.

4 Pillars Consulting Group Inc. spoke about:

- The Bankruptcy and Insolvency Act – in light of an expected increase in pandemic related bankruptcies, the government should undertake a thorough review of the Bankruptcy and Insolvency Act from the viewpoint of the debtors. The current system is preferentially weighted towards the creditor, does not promote the ability of those in debt to make informed choices, and we do not collect the data that allows for the understanding of the various root causes of excessive debt.

Macdonald-Laurier Institute

The Macdonald-Laurier Institute spoke about:

- The Fall Economic Statement – which recognizes that the pandemic lowers Canada’s potential gross domestic product (GDP) by $50 billion by 2025 but ignores the effects of an extended period of low interest rates on our financial and pension systems. The government’s focus on monetary and fiscal short-term stimulus to the economy should not overshadow considerations of negative long-term impacts on potential growth.

Meeting of 7 December 2020

Aéro Montréal

Aéro Montréal spoke about:

- Supporting the aerospace industry – for the aerospace industry to remain a national champion, the federal government must do what other nations around the world are doing: becoming a strategic partner and putting in place the tools to support the sector. The manufacturers of the aerospace industry have received no help from the federal government. Small and medium sized enterprises (SMEs) will eventually go bankrupt and the risk is that companies will become acquisition targets for foreign investors.

- Protecting the Canadian supply chain – the government should support the establishment of a consolidation fund that will protect the entire Canadian supply chain, especially SMEs that are more at risk because they are not currently receiving orders. Businesses in the commercial sector are operating at between 40% and 50% of their capacity. Defence companies are doing better because governments continue to buy from them to meet their defence and security needs.

- Delays in obtaining export permits – since the aerospace industry exports 80% of its products, delays in obtaining export permits is a serious problem that causes the industry to miss business opportunities. It can take up to six months to obtain a permit and despite representations to the federal government, things are not moving fast enough, and the problem has been exacerbated with the COVID-19 pandemic.

Chemistry Industry Association of Canada

The Chemistry Industry Association of Canada spoke about:

- Extending the Accelerated Capital Cost Allowance – in 2018, the federal government introduced the 100% Accelerated Capital Cost Allowance (ACCA) for major capital projects over a 10-year period. To ensure that capital projects interrupted by the COVID-19 pandemic are not jeopardized, the federal government should extend the 100% ACCA until at least 2030 and consider making it permanent to provide long-term certainty to capital-intensive investors.

- Ending the taxation of investment support programs – investment support programs are critical to attracting global-scale investments that will increase the capacity of Canada’s chemical industry. However, investment supports are often subject to federal and provincial corporate income tax, which can decrease the value of these supports by up to 30% in some provinces. The federal government should work with the provinces to end taxation of investment support programs to encourage new investment.

- Reforming

the Scientific Research and Experimental Development (SR&ED) program –

to reinvigorate private-sector research and development in Canada, the program

should be modified by:

- raising the investment tax credit from 15% to 20%;

- eliminating or substantially raising the upper limit for the taxable capital phase-out range;

- reinstating the capital expenditure eligibility; and

- eliminating the 20% disallowance on arm’s-length consulting payments.

Environmental Defence Canada

Environmental Defence Canada spoke about:

- Phasing out fossil fuel subsidies – eliminating fossil fuel subsidies is a critical step to ensure a climate-safe future and transition to a low-carbon economy. Canada has a long-standing commitment to phase out inefficient fossil fuel subsidies under the G20. Despite these commitments and strong public support for phasing out subsidies, Canada remains the largest provider of subsidies to oil and gas production per unit of GDP in the G7 and the second-largest provider of public finance to oil and gas in the G20.

- Export Development Canada (EDC) – which already supports oil and gas companies and provides nearly $14 billion in support to oil and gas companies each year. It should ensure that its new climate change policy aligns with Canada’s international climate commitments.

- Protecting the Great Lakes and the St. Lawrence River – the federal government should invest $1.2 billion over five years to implement the recommendations in the Great Lakes–St. Lawrence Action Plan 2020–2030.

Fédération des producteurs forestiers du Québec

The Fédération des producteurs forestiers du Québec spoke about:

- Creating a silviculture savings and investment plan – low profit margins for forest management projects discourage most woodlot owners from making new silvicultural investments. The federal government should create a personal silviculture savings and investment plan to ensure woodlot owners could put aside part of their forest income to be used for future investments to manage their woodlots.

- A Canadian program for reforestation and forest management – the government’s commitment to planting 2 billion trees across the country is a step in the right direction, as it should ensure that more owners can develop their woodlots. However, it is critical for the funding to go to protecting forest stands.

Ian Lee (as an individual)

Ian Lee, Associate Professor, Sprott School of Business, Carleton University, spoke about:

- Targeted assistance programs – Canada has roughly 1 million more unemployed people now than before the COVID-19 pandemic. To help these people, the government should tailor its assistance programs to the industries that really need it, such as the oil and gas, airline, accommodation and entertainment industries.

- The CERB – various employers have found that the CERB discourages people from returning to work. The government should add incentives to encourage people to return to work.

- Reducing poverty – contrary to popular belief, poverty has been on the decline in Canada for decades. The number of Canadians living below the poverty line has decreased from 25% in the 1960s to less than 10% today.

African Leadership Force

African Leadership Force spoke about:

- A

program to support recovery in African countries – the government

should participate in introducing a special program to support recovery in

African countries:

- by assisting them in establishing their own sovereign funds; and

- by supporting SMEs, which constitute 90% of African businesses.

- Improving the well-being and health of seniors – the government should take steps to improve the health and well-being of seniors in cooperation with the provinces.

- Safety of seasonal farm workers – the government should take the necessary steps to ensure the safety of seasonal agriculture workers entering Canada to work on farms.

- Fighting racism – the organization expressed appreciation for federal programs to fight discrimination, such as the Black Entrepreneurship Program. However, the government should set clear objectives and measures to fight systemic racism, similar to the commitment made in July 2020 as part of the BlackNorth Initiative.

- Police brutality – the government should work with Canadian provinces and cities to take steps to end police brutality against Indigenous and Black people.

- Canada Investment Fund for Africa – the government should fund the creation of a Canada Investment Fund for Africa, with $1 billion in capital, to improve capital availability and to finance business and investment projects in Africa, particularly in the areas of infrastructure and technology.

- Promoting Canada–Africa business relations – the government should fund African diaspora organizations in Canada that promote Canada–Africa business relationships.

- Reducing interest rates on loans and credit cards – the government should encourage banks and federal institutions to extend interest rate reductions on loans and credit cards to the end of 2021.

Centre for Sexuality

The Centre for Sexuality spoke about:

- Preventing and addressing gender-based violence – in Alberta, domestic abuse rates are at a 10-year peak. The COVID-19 pandemic has amplified existing problems and stretched already-limited resources to the breaking point. The government should invest new resources in the National Strategy to Prevent and Address Gender-Based Violence.

- Preventing sexually transmitted infections and blood-borne infections – Canada was already experiencing an epidemic of sexually transmitted infections and blood-borne infections, and the COVID-19 pandemic has exacerbated the situation. The government should increase its funding by $50 million a year to address this public health crisis.

- The Gender-Based Violence Strategy – this program should be renewed quickly, with a stronger focus on prevention.

Moodys Tax Law LLP

Moodys Tax Law LLP spoke about:

- Federal budget – the fall economic statement left many questions unanswered, and the government must develop and table a budget quickly to share its spending plans.

- Employment – in the short term, the government should focus on programs that help business owners so they can continue to employ Canadians.

- Tax reform – a representative group of tax experts, economists, academics and public policy experts should conduct a thorough review of Canada’s tax system and make recommendations to Parliament.

- The CEWS and the CERS – the government should simplify these assistance programs, as many people do not understand them and do not want to use them in case they are audited by the government.

Meeting of 8 December 2020

Minister of Finance and Departmental Officials

The Minister of Finance spoke about:

- Bill C-14 – which follows the fall economic statement and would provide families who are entitled to the Canada Child Benefit with additional support of up to $1,200 for each child under the age of six in 2021, as well as eliminate – for one year – the interest on the repayment of the federal portion of the Canada student loans and Canada apprentice loans. It also provides funding of up to $505.7 million in 2021 to help long-term care facilities and almost $400 million in additional funding for a variety of measures, including mental health, addictions, testing for COVID-19 and support for telemedicine.

- The 2021 federal budget – which plans to invest 3–4% of Canada’s GDP over three years into job creation for Canadians.

- Pandemic response – Canadian COVID-19 support programs will be time limited and targeted. The government will track economic progress against several related indicators, such as the employment rate, total hours worked, and the level of unemployment in the economy.

Meeting of 10 December 2020

Canadian Association of Oilwell Drilling Contractors

The Canadian Association of Oilwell Drilling Contractors spoke about:

- Investment in clean technology – as Canada’s oil and gas industry generally forms the foundation for other domestic energy industries, Canada must enable investment in natural gas and oil to support the innovation needed for successful long-term emissions reductions and environmental performance improvements.

- Corporate liquidity – could be supported through the Business Development Bank of Canada (BDC) and EDC using unsecured and subordinate financial instruments, particularly for the Canadian drilling and service rig industry.

- Grant programs – to support the Canadian drilling rig sector in the form of a nonrepayable grant administered by Natural Resources Canada.

City of Yellowknife

The City of Yellowknife spoke about:

- Gas tax funding – which should be doubled for communities during the next three years, as a measure to restart the Canadian economy.

- Aboriginal healing centres – could be aided by providing sustainable funding for existing and new centres to address the physical, mental, emotional, and spiritual harms caused by residential schools.

- Land claims – where the government should address the backlog of claims and self-government negotiations with Indigenous organizations by increasing the staffing levels of federal negotiators.

- Northern infrastructure gap – where investments should be made to significantly reduce the gap in order to address the transportation, connectivity, energy, and climate-based challenges Northerners face.

- A safe restart agreement – which must include funding support for municipal operations through 2021 to protect essential municipal services.

- Rapid housing initiative – which should be scaled up by allocating seven billion for 24,000 additional affordable housing units over the national strategy’s seven remaining years.

- Canada’s Arctic and northern policy framework – which should be funded.

Electric Mobility Canada

Electric Mobility Canada spoke about: