PACP Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

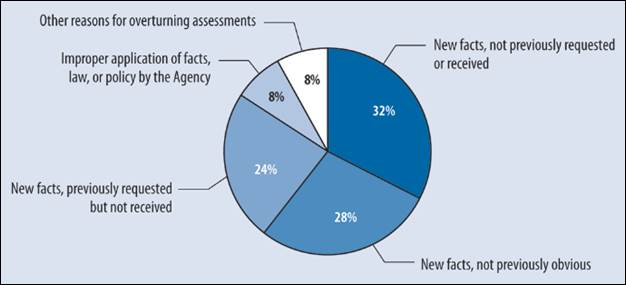

“REPORT 2—INCOME TAX OBJECTIONS—CANADA REVENUE AGENCY,” FALL 2016 REPORTS OF THE AUDITOR GENERAL OF CANADAINTRODUCTIONA. Objection ProcessAccording to the Office of the Auditor General of Canada (OAG), Canadian taxation is based on a system in which taxpayers prepare their own tax returns. This system is guided by fiscal laws, including the Income Tax Act. After taxpayers file their tax returns, the Canada Revenue Agency [CRA or the Agency] assesses the returns and may make changes to them. The Agency may also reassess them later for various reasons. For example, a reassessment may follow the Agency’s finding that employment income was not reported on the tax return, or a reassessment may result from a tax return audit. In addition, the Agency may issue determinations on such matters as a taxpayer’s eligibility for the disability tax credit.[1] Taxpayers who disagree with CRA’s assessment of their tax returns can contact the Agency to provide additional information or ask for a further review of their assessments; they also have the right to file objections.[2] The Agency manages the objection process through its Appeals Branch and “decisions on objections are based on impartial reviews of the particular facts and applicable laws.”[3] “If taxpayers do not agree with the Agency’s decisions, they may appeal to the Tax Court of Canada, then to the Federal Court of Appeal, and finally, to the Supreme Court of Canada.”[4] B. Roles and ResponsibilitiesCRA “is responsible for the application of laws and regulations related to income taxes. Its mandate is to administer tax, benefits, and related programs and to ensure that taxpayers comply with the Income Tax Act and related legislation on behalf of governments across Canada.”[5] According to the OAG: Section 165(3) of the Income Tax Act states that on receiving an objection, “the Minister shall, with all due dispatch, reconsider the assessment and vacate, confirm or vary the assessment or reassess, and shall thereupon notify the taxpayer in writing of the Minister’s action.”[6] When taxpayers are not satisfied with the Agency’s decisions on their objections and decide to appeal to the courts, the Department of Justice Canada is responsible for defending the Agency’s assessments therein.[7] According to the OAG, if a court decision raises potential tax policy issues or has significant revenue implications, the Agency, in collaboration with the Department of Finance Canada, determines whether the court decision will be appealed. If applicable, the Agency indicates to the Department of Finance Canada whether legislative modifications should be considered. The Department of Finance Canada is responsible for proposing changes to the Income Tax Act.[8] In the fall of 2016, the OAG released a performance audit whose objective was to determine whether CRA “was efficiently managing income tax objections.”[9] On 20 March 2017, the House of Commons Standing Committee on Public Accounts (the Committee) held a hearing on this audit.[10] From the OAG, the Committee met with Nancy Cheng, Assistant Auditor General, and Jean Goulet, Principal. CRA was represented by Bob Hamilton, Commissioner of Revenue and Chief Executive Officer, and Mireille Laroche, Assistant Commissioner, Appeals Branch.[11] FINDINGS AND RECOMMENDATIONSNancy Cheng, Assistant Auditor General, OAG, informed the Committee that, as of 31 March 2016, CRA “had close to 172,000 objections outstanding, worth over $18 billion in income taxes.”[12] Bob Hamilton, Commissioner of Revenue and Chief Executive Officer, CRA, pointed out that only 0.1% of the 66 million files assessed each year are the subject of an objection. “Of those objections, 8% involve an alleged misapplication of laws, facts, or policies by the CRA.”[13] A. Processing ObjectionsThe OAG “examined whether the objection process led to timely resolutions of income tax objections.”[14] a. Communication of Expected DelaysAccording to the OAG, When the Agency receives a notice of objection, it records data such as key dates and the complexity of the objection into an information system. The Agency then informs the taxpayer in writing that it has received the notice of objection, adds the file to the inventory of objections, and waits for an appeals officer to become available to review the file.[15] The OAG found that although “the acknowledgement letter provided the taxpayer with an estimated waiting period for the first contact by an appeals officer, it did not provide an estimate of the waiting period to resolve the objection, and this information was not publicly available.”[16] As a result, the “taxpayer remained unaware at the time of filing how long, on average, it could take the Agency to resolve the objection.”[17] Thus, the OAG recommended that CRA “provide taxpayers with the time frames in which it expects to resolve their objections,” and that time frames should be based on an objection’s level of complexity.[18] In response to this recommendation, CRA stated that it “currently provides estimated timeframes to contact the taxpayer and begin work on the objection through an acknowledgement letter.”[19] This information “will be improved to provide a more accurate estimate of time to receive a final response on their objection,” and expected and actual “timeframes related to complexity will begin to be shared with the general public on the CRA’s website” by 31 March 2017.[20] Lastly, CRA will clarify, on its external website, the steps to resolving taxpayer disputes, including the requirement to provide any relevant information.”[21] According to CRA’s action plan, these measures will be completed by 31 December 2017.[22] Thus, the Committee recommends: RECOMMENDATION 1 That, by 30 April 2018, the Canada Revenue Agency confirm in writing to the House of Commons Standing Committee on Public Accounts that it has published a service standard for the resolution of low and medium-complexity objections on its website, and provide the information on high-complexity objections that is available. b. Management of Growing InventoryCRA’s Appeals Branch “had experienced steady growth in the number of taxpayer objections. Agency officials told [the OAG] that the growth was the result of both the taxpayers’ actions and the Agency’s own efforts to identify and reassess taxpayers who were not paying their fair share of income tax.”[23] The OAG “found that the rate of growth in the number of new objections far outpaced the increase in resources the Agency dedicated to managing them:” the inventory of outstanding income tax objections increased by 171%, while the number of employees dedicated to resolving these objections increased by only 14%.[24] According to the OAG, “this large increase in the number of outstanding objections challenged the Agency’s ability to process the objections in a timely manner.”[25] Therefore, OAG recommended that the CRA “develop and implement an action plan with defined timelines and targets to reduce the inventory of outstanding objections to a reasonable level.”[26] CRA responded that it “has identified some areas of delay within the objections process and will develop a strategy for reducing the backlog of unresolved objections that optimizes its processes and its available resources in order to respond to taxpayers in a more timely fashion.”[27] In its action plan, CRA explained that, by 31 March 2018, the inventory of outstanding non-group objections will be reduced “as a result of increased efficiencies and innovation, through the efficient use of available resources.”[28] CRA will also reduce the “intake of invalid objections as a result of improved external communication through CRA correspondence and website information.”[29] Mr. Hamilton acknowledged that reducing the inventory of outstanding objections is very important as CRA tries to address how it can provide better services to Canadians because, at the moment, each new objection is added onto the inventory.[30] He further explained that group files represent 55% of CRA’s inventory, and that these files divert resources from regular objections because they can take years: Once a decision is made, the CRA uses a streamlined process to resolve group objections, but we must divert some of our resources from the regular objections workload to do so. This has had an adverse effect on our overall performance. The CRA is prioritizing the reduction of regular objections inventory, which is composed of varying complexities and issues. As we develop our action plans, we are consulting government departments and other tax administrations that have faced similar inventory challenges, and are trying to incorporate their best practices.[31] In light of this testimony, the Committee recommends: RECOMMENDATION 2 That, by 1 September 2017, the Canada Revenue Agency provide the House of Commons Standing Committee on Public Accounts with a clear target for the planned reduction of its inventory of outstanding objections over the period of 31 March 2016 to 31 March 2018, and report the actual reduction achieved by 30 April 2018. c. Processing Times and Reasons for DelayAgency officials explained to the OAG “that processing was often delayed because notices of objection sent by taxpayers were often missing information required to resolve the objection.”[32] According to the OAG: In most cases, the appeals officer was the first to identify that information was missing and to request it from the taxpayer. However, most objections were not assigned to appeals officers until months after the Agency had received them, which caused delays in requesting the information.[33] When it considered all resolved files, the OAG found that “approximately 79,000 objections, 76,000 of which were group files, took the Agency 5 or more years to resolve. […] Moreover, 7,800 of these objections, 7,400 of which were group files, took the Agency 10 or more years to resolve.”[34] In light of these findings, the OAG is of the opinion that the “Agency did not meet its mandate to provide a timely review of income tax objections.”[35] For this reason, the OAG recommended that CRA “conduct a complete review of the objection process to identify and implement modifications to improve the timely resolution of objections.”[36] In response to this recommendation, CRA stated that, beginning in Fall 2016, “it will conduct a review of the objections process, taking into consideration on-going planned enhancements and suggestions received from appeals officers in 2015-2016, to identify and resolve delays in the process, while taking into account its available resources.”[37] Additionally, beginning in 2017-2018, “as part of the initial step when objections are received and screened, when needed, taxpayers will be contacted to provide any missing information to ensure that the file is complete when assigned for resolution.”[38] According to CRA’s action plan, these measures will be completed by 30 April 2018.[39] Mr. Hamilton also informed the Committee that, under CRA’s new process, “taxpayers or their representatives will be contacted within 30 days of filing an objection to solicit any missing information.”[40] He further added that this “will result in a more timely resolution process” because files will be “complete and ready to be worked on once assigned to an officer.”[41] Therefore, the Committee recommends: RECOMMENDATION 3 That, by 30 April 2018, the Canada Revenue Agency provide the House of Commons Standing Committee on Public Accounts with the key results of its review of the objection process, and clearly explain how it has used these results to improve the timely resolution of objections. B. Measuring TimelinessThe OAG “examined whether the Agency’s performance indicators and related targets were consistent and complete, and whether the results provided an accurate depiction of the average length of time taxpayers wait for decisions on their objections.”[42] The OAG also “examined whether these indicators provided sufficient information to taxpayers and Parliament about the Agency’s performance.”[43] a. Definition of “Timely”The OAG found that the Agency “did not determine what would be considered a reasonable amount of time for resolving objections.”[44] “In the absence of a concrete definition of ‘timely,’ [the OAG] compared the Agency’s performance with that of similar tax administrations in other countries to determine whether processing timelines were comparable and reasonable,”[45] and found the following: In an [international benchmarking study reported in 2011] by the United Kingdom’s tax authority (HM Revenue and Customs), data from 2009 showed that among seven countries studied, Canada took the longest time to resolve objections. Canada took an average of 276 days compared with an average of 70 days for the other six countries [Australia, France, the Netherlands, New Zealand, South Africa and the United Kingdom].[46] Thus, the OAG recommended that CRA “define what it considers the timely resolution of an objection. It may look to other comparable organizations to help it determine what is reasonable.”[47] CRA responded that it will publicly report a standard for the resolution of low-complexity objections (60% of yearly objection intake) to respond to taxpayers on low-complexity objections within 180 days, 80% of the time.[48] As processes are changed and efficiencies are gained, CRA also committed to improve on this service standard, based on available resources.[49] In addition, CRA will establish a measurement for the timely resolution of medium-complexity objections (35% of yearly objection intake) by the end of 2016-2017 and publish this measurement in 2017‑2018.[50] Lastly, CRA “continue to monitor high-complexity files in order to ensure the time for their resolution is commensurate with the complexity of the objection.”[51] When questioned about Canada’s poor performance in the United Kingdom’s tax authority’s 2011 international benchmarking study on the time required to resolve tax objections, Mr. Hamilton responded that the six other selected countries probably have a better process for resolving tax objections than Canada but suggested, without providing any specific examples, that there could also be flaws in the way this study measures the timeliness of each country’s process for resolving tax objections.[52] In light of this testimony, the Committee recommends: RECOMMENDATION 4 That, by 30 April 2018, the Canada Revenue Agency explain to the House of Commons Standing Committee on Public Accounts the rationale for its definition of the timely resolution of an objection based on the level of complexity, and how this definition compares with that of similar tax administration in other countries. b. External ReportingThe OAG found that the Agency’s “external reports did not provide sufficient information to allow an assessment of its performance. Although the Agency had indicators and targets for the number of days in which to resolve objections, it did not measure all the steps of the process.”[53] Ms. Cheng stressed that without “complete and accurate information on the time the agency takes to process an objection, taxpayers have no way of knowing how long they will have to wait for a decision. Furthermore, the agency has no way of knowing if it is getting better or worse at meeting its mandate for timely review of objections.”[54] Therefore, the OAG recommended that CRA: [Modify] its performance indicators so that it can accurately measure and report on whether it is meeting its mandate to provide a timely review. These indicators should include all steps in the process from the time the objection is provided by the taxpayer, and they should be consistent year over year so that the Agency can identify trends and assess performance over time. The Agency should also report these indicators, related targets, and results to Parliament and communicate them to taxpayers.[55] In response to this recommendation, CRA stated that it “is currently introducing new indicators for the timely review of objections,” which will be included in the Agency Departmental Performance Report.[56] CRA will also “publish a description of the complexity of objections on its website by the end” of 2016.[57] Lastly, CRA “will review and amend its internal procedures ensuring that the entire time the objection is within the CRA’s control is measured to provide a more complete depiction to taxpayers of the time it takes to resolve an objection, through its website by the end of 2016-2017.”[58] Mr. Hamilton reassured the Committee that CRA’s updated performance indicators “will better reflect the actual time it takes to review taxpayers’ objections.”[59] In order to ensure that CRA implements its new performance indicators as promised, the Committee recommends: RECOMMENDATION 5 That, by 1 September 2017, the Canada Revenue Agency confirm in writing to the House of Commons Standing Committee on Public Accounts that it has published its updated performance indicators that take into account the entire time an objection is within the Agency’s control in its Departmental Results Report. c. Data ErrorsThe OAG “found that the Agency’s information system did not have sufficient controls in place to ensure data integrity. For example, it was possible to enter a date for completing an objection that preceded the date for receipt of the objection, and in such cases, the error was not flagged by the system. For some objections, the date recorded for receipt of the notice of objection followed the date of assignment to an appeals officer.”[60] Agency officials also informed the OAG “that there were coding errors and data inconsistencies for referrals to headquarters and litigation;” as such, the OAG was “unable to determine how many files required appeals officers to seek guidance from headquarters or legal advice.”[61] The OAG thus recommended that CRA “add appropriate controls to its objection process and its information systems to ensure the integrity of its data.”[62] In response to this recommendation, CRA stated that it is [Committed] to ensuring enhancements that are required to data integrity within its information system are identified and built into regular system maintenance process. New data validities will be incorporated in the current system in upcoming release cycles in the Fall of 2016, May 2017 and ongoing. As well, improvements to detailed instructions to officers on data entry will be issued and monitored.[63] CRA also noted that it “is currently developing a systems modernization proposal which will address identified gaps in data needs and validities as well as link to other CRA systems, thereby reducing the need for manual entry requirements and improving overall data integrity.”[64] Lastly, CRA will “ensure that existing procedural controls are clearly communicated to Appeals officers, identify any additional controls that may be necessary, and monitor the effectiveness of these controls.”[65] When questioned about CRA’s data errors, Mireille Laroche responded that some non-mandatory fields were left blank because the system allowed employees to do that and still process the file: I think if an appeals officer or any officer wants to expedite the process, they don't consider that as being mandatory; therefore, it's allowed. It's true that it impedes our ability to do some analysis and performance reporting in that regard. We had some data reporting activities before. We had reports. I would say that they were not truly effective in how we dealt with them, so we revamped them in December. We are already seeing marked results because we're making our officers accountable for these mistakes, and they're changing them, as the Commissioner has said. From one month to the other, we saw a 41% decrease in our data integrity issues. We're also working on the systems because one of the points that the OAG mentioned is that it's a system issue in terms of it allowing the dates to be non-sequenced, not in order. We started to fix that in the fall, and we have another release coming up that will help mitigate and lower these incidents.[66] In order to verify whether CRA’s objections systems and processes have appropriate controls in place to ensure accuracy of data, the Committee therefore recommends: RECOMMENDATION 6 That, by 30 April 2018, the Canada Revenue Agency provide the House of Commons Standing Committee on Public Accounts with a report outlining the controls that it has added to its objections systems and processes, and the detailed instructions that it has provided to officers on data entry to ensure the accuracy of data. This report should also explain how the Agency will regularly monitor the effectiveness of these measures. C. Reasons for Decisions in Favour of the TaxpayerThe OAG examined “the reasons decisions about objections favoured the taxpayers.”[67] The OAG found that 65% of the “objections reviewed resulted in decisions that favoured taxpayers in full or in part.”[68] The OAG found that “in many cases, the objections were allowed in full or in part because the taxpayer provided additional information that supported the objection.”[69] Figure 1 below shows a “breakdown of the reasons for overturned assessments in the five-year period ending 31 March 2016.”[70] Figure 1 – Breakdown of the Reasons for Overturned Assessments in the Five-Year Period Ending 31 March 2016

Source: Office of the Auditor General of Canada, “Report 2–Income Tax Objections–Canada Revenue Agency,” Fall 2016 Reports of the Auditor General of Canada, Exhibit 2.5 Mr. Hamilton explained that overturned assessments could be reduced by a combination of two factors: The first is the taxpayer offering up the information at the right point in time rather than at the appeals. Second, it's us knowing that we need that information and asking the question earlier, or realizing that the information exists somewhere. If you look at the numbers, 32% is new facts that were not previously requested or received. That's a big percentage. Then there's another percentage, almost 30%, that was not previously obvious. So what's that exactly? We're going to do some work on that. New facts previously requested but not received, that's about a quarter. That's a pretty big chunk. Then you get to about 8% where the appeals officer felt that the auditor had misapplied the law. That's 8%, it's still a positive number, but I think there's enough in the first three categories that we should be able to find a better way to get the right information at the right time. I'm quite hopeful on that.[71] Ms. Cheng drew the Committee’s attention to the fact that, when taxpayers pay up front and CRA takes a long time to rule in their favour, costs are incurred not just for the taxpayers involved, but also for the economy as a whole.[72] She then suggested that assessment “decisions that are overturned either by the agency’s objection process or by the court’s own appeal may signal issues with either the original assessment or the agency’s subsequent reviews.”[73] In light of these findings, the OAG recommended that CRA “review the reasons objections are decided in favour of taxpayers so that it can identify opportunities to resolve issues before objections are filed.”[74] In response to this recommendation, CRA stated that it “remains committed to analyzing the reasons why assessments are overturned to identify opportunities to improve service to Canadians.”[75] CRA “has formalized its feedback loop process introduced following the 2012 evaluation, in collaboration with assessing and audit areas. Quarterly reporting, containing reasons for objections decisions, will be issued to audit and assessing areas starting in Q3 of 2016-2017.”[76] According to CRA, the formalized process will identify opportunities for improvements in processes, required documentation and training as well as service to taxpayers through clear communications or correspondence.”[77] Thus, the Committee recommends: RECOMMENDATION 7 That, by 30 April 2018, the Canada Revenue Agency provide the House of Commons Standing Committee on Public Accounts with a report outlining the opportunities to resolve issues before an objection is filed that the Agency has identified through its review of the reasons for which objections are decided in favour of taxpayers. This report should also explain how the Agency took full advantage of each of these opportunities to improve services to Canadians. D. Sharing Information with Agency StakeholdersThe OAG examined “whether the CRA adequately shared information with Agency stakeholders involved in the income tax assessment and objection process.”[78] The OAG found that CRA “provided limited information about objection decisions to previous assessors of taxpayers’ files.”[79] According to the OAG, this “lack of information sharing resulted in missed opportunities for previous assessors to learn and improve their practices.”[80] The OAG therefore recommended that CRA “ensure that decisions on objections and appeals are shared within the Agency in such a way that those performing assessments can use that information to improve future assessments.”[81] In response to this recommendation, CRA stated that, at the beginning of 2016-2017, it [Formalized] the feedback loop process and continues to strengthen ongoing collaboration between the audit and assessing branches, the regions and the Appeals Branch in the analysis of objections and appeals results. This collaboration uses a variety of mechanisms such as regular reporting and analysis, structured discussions on issues and implementation of action plans to address the identified areas for improvement.[82] Additionally the Agency stated that it is [Taking] steps to strengthen its practice of sharing business intelligence from the objections and appeals processes. This will enhance the monitoring of trends leading to potential resolution of policy, legislation and procedural issues in both the Appeals Branch and audit and assessing areas, thus improving service to taxpayers.[83] Lastly, Mr. Hamilton reported that CRA “had successful results from the feedback loop related to the disability tax credit that led to a significant decrease in objections in 2016-17 and an increase in the percentage of assessments confirmed.”[84] Therefore, the Committee recommends: RECOMMENDATION 8 That, by 30 April 2018, the Canada Revenue Agency provide the House of Commons Standing Committee on Public Accounts with a report outlining the concrete measures that it has implemented to ensure that decisions on objections and appeals are shared within the Agency in such a way that those performing assessments can use that information to improve future assessments. IMPROVING SERVICE DELIVERY AND CUSTOMER EXPERIENCEWhen questioned about CRA’s poor service delivery and taxpayers’ experience, Mr. Hamilton responded that the Minister of National Revenue “has received a pretty clear mandate from the Prime Minister to improve service at the agency, the service that we provide to Canadians.”[85] He then acknowledged that although the 40,000 employees of the Agency are really trying to serve Canadians as best they can, there is definitely room for improvement.[86] For example, Mr. Hamilton mentioned that CRA will measure how long it takes to deal with an objection from the taxpayer’s perspective, require additional information when necessary, and write its correspondence in plain and simple language.[87] That is, going forward, CRA will “think more about what works for the taxpayer, not just what works” for itself.[88] When questioned about the content of some letters from constituents who were unhappy with CRA’s services and customer experience, Mr. Hamilton acknowledged that although he cannot respond to every individual case, most of the letters from taxpayers that he has received tend to be more negative than positive.[89] He then explained the following: We are trying to make sure that, where we have a piece of information from a taxpayer, we use it. There certainly have been examples in the past where in one part of the organization somebody had information, but somebody else was dealing with the taxpayer and didn't have access to that information. We're trying to fix that. We're trying to think of the agency more as an integrated whole and connecting the silos together. […] The second thing is that when we correspond with the taxpayer, making sure that it's respectful correspondence and in some ways helping to educate why we're doing what we're doing. Hopefully, we won't make mistakes. However, if we do, they could be uncovered in a way that's constructive and productive. We are trying to look at our correspondence, look at how we train people. […] We can do a better job, and that is part of the service mandate we are trying to push for our minister. We can try to minimize the number of mistakes that we make. In a big organization, with all of the returns that we process, there will probably always be some cases, unfortunately. But we are actively trying to improve the service we provide, using the best tools we can, intelligence and technology, and being sensitive in how we communicate.[90] When asked what percentage of CRA’s employees is aware of the Taxpayer Bill of Rights, Mr. Hamilton responded that, according to his knowledge, all employees are aware of it and understand that it is a part of CRA’s responsibilities.[91] Asked whether CRA could do a better job at educating Canadians on illegal tax schemes, Ms. Laroche responded that, over the years, the Agency “has published and issued a number of communiqués to try to educate taxpayers;” specifically: One of the things that the taxpayers' ombudsman did in 2014 was examine what we've done and provide some recommendations of how we can discourage promoters from using these arrangements, from selling them; but also from a taxpayer's perspective, how we can discourage them so they can actually recognize when it's too good to be true and not get involved. Since then there have been efforts to try to improve this, but as the commissioner said, there's probably more that can be done. There have been legislative changes that have changed the incentives for promoters, whereby when you are involved in such a scheme, even when you are in the objection phase, you still have to pay 50% of what you owe. That was one thing that discouraged people from participating, so that helped from the other side of the equation in terms of how they are promoted and sold to Canadians.[92] When asked to comment on Mr. Hamilton’s testimony, Ms. Cheng responded with the following: I'm very encouraged with what the commissioner has provided in his opening statement. Those seem to be the areas that we are concerned with. The communication aspect is very important because a lot of taxpayers are waiting for answers. The uncertainty doesn't help with the dynamics or the trust factor. The element of managing the inventory is absolutely critical. We had a graph that shows the overall change in inventory, but we also split it out into the intake and the ability to resolve cases. Those lines were converging, which suggests that you might be looking at another spike. The fact that the commissioner and the agency are going to try to deal with that is important.[93] The Committee examined CRA’s Departmental Plan 2017-18 to verify whether the agency had a performance indicator that measured Canadians’ overall level of satisfaction with its services and customer experience, and it found that none of CRA’s 11 performance indicators[94] measured this important metric. Since the Committee strongly believes that having a performance indicator that measures Canadians’ overall level of satisfaction with the Agency’s services and customer experience would help CRA to effectively monitor and report its progress towards becoming a more client-focused organization, the Committee recommends: RECOMMENDATION 9 That, by 30 April 2018, the Canada Revenue Agency develop a performance indicator that scientifically measures Canadians’ overall level of satisfaction with its services and customer experience, and report annually the results in its Departmental Results Report. CONCLUSIONThe OAG concluded that CRA “did not process income tax objections in a timely manner,”[95] and had “no indicator or target for the time that taxpayers should wait for decisions on their objections.”[96] The OAG also concluded that CRA “did not adequately analyze or review decisions on income tax objections and appeals, and there was insufficient sharing of the results of these objections and court decisions within the Agency.”[97] In this report, the Committee made eight recommendations to ensure that CRA addresses each of the issues identified in the OAG’s audit, and one recommendation that seeks to help the Agency monitor and report its progress towards becoming a more client-focused organization. Canadians deserve good, timely services delivered in a respectful way, and the Committee is determined to do everything within its mandate to ensure that this is exactly what CRA provides them. SUMMARY OF RECOMMENDED ACTIONS AND ASSOCIATED DEADLINESTable 1 – Summary of Recommended Actions and Associated Deadlines

[1] Office of the Auditor General of Canada (OAG), “Report 2–Income Tax Objections–Canada Revenue Agency,” Fall 2016 Reports of the Auditor General of Canada, para. 2.1. [2] Ibid., para. 2.2. [3] Ibid., para. 2.3. [4] Ibid. [5] Ibid., para. 2.5. [6] Ibid., para. 2.6. [7] Ibid., para. 2.7. [8] Ibid. [9] Ibid., para. 2.8. [10] House of Commons Standing Committee on Public Accounts, Evidence, 1st Session, 42nd Parliament, 20 March 2017, Meeting 49, 1530. [11] OAG, “Report 2–Income Tax Objections–Canada Revenue Agency,” Fall 2016 Reports of the Auditor General of Canada, para. 2.8. [12] House of Commons Standing Committee on Public Accounts, Evidence, 1st Session, 42nd Parliament, 20 March 2017, Meeting 49, 1530. [13] Ibid., 1535. [14] OAG, “Report 2–Income Tax Objections–Canada Revenue Agency,” Fall 2016 Reports of the Auditor General of Canada, para. 2.27. [15] Ibid., para. 2.28. [16] Ibid., para. 2.30. [17] Ibid. [18] Ibid., para. 2.31. [19] Ibid. [20] Ibid. [21] Ibid. [22] Canada Revenue Agency, Canada Revenue Agency Detailed Action Plan, p. 1. [23] OAG, “Report 2–Income Tax Objections–Canada Revenue Agency,” Fall 2016 Reports of the Auditor General of Canada, para. 2.32. [24] Ibid., para. 2.33. [25] Ibid. [26] Ibid., para. 2.34. [27] Ibid. [28] Canada Revenue Agency, Canada Revenue Agency Detailed Action Plan, p. 1. [29] Ibid. [30] House of Commons Standing Committee on Public Accounts, Evidence, 1st Session, 42nd Parliament, 20 March 2017, Meeting 49, 1540. [31] Ibid. [32] OAG, “Report 2–Income Tax Objections–Canada Revenue Agency,” Fall 2016 Reports of the Auditor General of Canada, para. 2.35. [33] Ibid., para. 2.36. [34] Ibid., para. 2.38. [35] Ibid. [36] Ibid., para. 2.39. [37] Ibid. [38] Ibid. [39] Canada Revenue Agency, Canada Revenue Agency Detailed Action Plan, p. 2. [40] House of Commons Standing Committee on Public Accounts, Evidence, 1st Session, 42nd Parliament, 20 March 2017, Meeting 49, 1540. [41] Ibid. [42] OAG, “Report 2–Income Tax Objections–Canada Revenue Agency,” Fall 2016 Reports of the Auditor General of Canada, para. 2.47. [43] Ibid. [44] Ibid., para. 2.48. [45] Ibid., para. 2.49. [46] Ibid. [47] Ibid., para. 2.50. [48] Ibid. [49] Ibid. [50] Ibid. [51] Ibid. [52] House of Commons Standing Committee on Public Accounts, Evidence, 1st Session, 42nd Parliament, 20 March 2017, Meeting 49, 1645. [53] OAG, “Report 2–Income Tax Objections–Canada Revenue Agency,” Fall 2016 Reports of the Auditor General of Canada, para. 2.55. [54] House of Commons Standing Committee on Public Accounts, Evidence, 1st Session, 42nd Parliament, 20 March 2017, Meeting 49, 1535. [55] OAG, “Report 2–Income Tax Objections–Canada Revenue Agency,” Fall 2016 Reports of the Auditor General of Canada, para. 2.57. [56] Ibid. The Government of Canada recently changed the name of these reports to Departmental Results Reports. [57] Ibid. [58] Ibid. [59] House of Commons Standing Committee on Public Accounts, Evidence, 1st Session, 42nd Parliament, 20 March 2017, Meeting 49, 1545. [60] OAG, “Report 2–Income Tax Objections–Canada Revenue Agency,” Fall 2016 Reports of the Auditor General of Canada, para. 2.59. [61] Ibid., para. 2.61. [62] Ibid., para. 2.62. [63] Ibid. [64] Ibid. [65] Ibid. [66] House of Commons Standing Committee on Public Accounts, Evidence, 1st Session, 42nd Parliament, 20 March 2017, Meeting 49, 1610. [67] OAG, “Report 2–Income Tax Objections–Canada Revenue Agency,” Fall 2016 Reports of the Auditor General of Canada, para. 2.71. [68] Ibid., para. 2.72. An objection that is allowed in full is one for which the appeals officer found sufficient evidence to support the taxpayer’s claim and granted the full deduction, whereas an objection that is allowed in part is one for which the appeals officer found evidence that the taxpayer incurred fewer expenses than claimed and granted part of the deduction. For more details, see para. 2.66. [69] Ibid., para. 2.74. [70] Ibid. [71] House of Commons Standing Committee on Public Accounts, Evidence, 1st Session, 42nd Parliament, 20 March 2017, Meeting 49, 1705. [72] Ibid., 1530. [73] Ibid., 1535. [74] OAG, “Report 2–Income Tax Objections–Canada Revenue Agency,” Fall 2016 Reports of the Auditor General of Canada, para. 2.77. [75] Ibid. [76] Ibid. [77] Ibid. [78] Ibid., para. 2.82. [79] Ibid., para. 2.78. [80] Ibid. [81] Ibid., para. 2.95. [82] Ibid. [83] Ibid. [84] House of Commons Standing Committee on Public Accounts, Evidence, 1st Session, 42nd Parliament, 20 March 2017, Meeting 49, 1545. [85] Ibid., 1550. [86] Ibid. [87] Ibid. [88] Ibid. [89] Ibid., 1555. [90] Ibid., 1555. [91] Ibid., 1620. [92] Ibid., 1640. [93] Ibid., 1655. [94] The Agency’s 11 performance indicators are the following: 1) the percentage of individuals who paid their taxes on time, 2) the dollar value of payments the CRA processed, 3) the dollar value of benefit and credit payments to recipients, 4) the percentage of electronic filing rates for businesses, 5) the percentage of electronic individual income tax returns processed within an average of two weeks (45 days for corporate income tax returns), 6) the percentage of individual taxpayers (businesses) with My Account (My Business Account) either directly or through their tax representative, 7) the dollar value of identified non-compliance, 8) tax debt as a percentage of gross revenues, 9) caller accessibility, 10) percentage of service complaints resolved in 30 working days, and 11) the percentage change in appeals (closing) inventory. For more details, see CRA, Departmental Plan 2017-18. [95] OAG, “Report 2–Income Tax Objections–Canada Revenue Agency,” Fall 2016 Reports of the Auditor General of Canada, para. 2.96. [96] Ibid., para. 2.97. [97] Ibid., para. 2.98. |